Exam 5: Reporting and Analyzing Inventory

Exam 1: Introduction to Financial Statements183 Questions

Exam 2: A Further Look at Financial Statements201 Questions

Exam 3: The Accounting Information System226 Questions

Exam 4: Merchandising Operations and the Multiple-Step Income Statement221 Questions

Exam 5: Reporting and Analyzing Inventory201 Questions

Exam 6: Fraud, Internal Control, and Cash209 Questions

Exam 7: Reporting and Analyzing Receivables220 Questions

Exam 8: Reporting and Analyzing Long-Lived Assets227 Questions

Exam 9: Reporting and Analyzing Liabilities245 Questions

Exam 10: Reporting and Analyzing Stockholders Equity215 Questions

Exam 11: Statement of Cash Flows170 Questions

Exam 12: Financial Analysis: The Big Picture211 Questions

Exam 13: Managerial Accounting151 Questions

Exam 14: Job Order Costing150 Questions

Exam 15: Process Costing129 Questions

Exam 16: Activity-Based Costing147 Questions

Exam 17: Cost-Volume-Profit156 Questions

Exam 18: Cost-Volume-Profit Analysis: Additional Issues81 Questions

Exam 19: Incremental Analysis166 Questions

Exam 20: Budgetary Planning158 Questions

Exam 21: Budgetary Control and Responsibility Accounting154 Questions

Exam 22: Standard Costs and Balanced Scorecard161 Questions

Exam 23: Planning for Capital Investments156 Questions

Select questions type

The accountant at Landry Company is figuring out the difference in income taxes the company will pay depending on the choice of either FIFO or LIFO as an inventory costing method. The tax rate is 30% and the FIFO method will result in income before taxes of $17,480. The LIFO method will result in income before taxes of $16,200. What is the difference in tax that would be paid between the two methods?

(Multiple Choice)

4.8/5  (43)

(43)

The LIFO method is rarely used because most companies do not sell the last goods they purchase first.

(True/False)

4.8/5  (33)

(33)

The average cost inventory method relies on a simple average calculation.

(True/False)

4.8/5  (28)

(28)

The First-in, First-out (FIFO) inventory method results in an ending inventory valued at the most recent cost.

(True/False)

4.8/5  (35)

(35)

Redeker Company had the following records: 2017 2016 Ending inventory \ 32,650 \ 30,490 Cost of goods sold 213,600 209,040 What is Redeker's average days in inventory for 2017? (rounded)

(Multiple Choice)

4.7/5  (44)

(44)

Johnson Company has a high inventory turnover that has increased over the last year. All of the following statements are true regarding this situation except Johnson Company:

(Multiple Choice)

4.8/5  (34)

(34)

Which of the following is not a common cost flow assumption used in costing inventory?

(Multiple Choice)

4.8/5  (31)

(31)

Use the following information regarding Black Company and Red Company to answer the question "Which of the following is Red Company's "cost of goods sold" for 2017 (to the closest dollar)?" Year Inventory Turnover Ending Inventory Black Company 2015 \ 26,340 2016 8.7 \ 29,890 2017 8.2 \ 30,100 Red Company 2015 \ 25,860 2016 7.0 \ 24,750 2017 7.5 \ 22,530

(Multiple Choice)

4.9/5  (43)

(43)

Delightful Discs has the following inventory data: Nov. 1 Inventory 30 units @\ 6.00 each 8 Purchase 120 units @\ 6.45 each 17 Purchase 60 units @\ 6.30 each 25 Purchase 90 units @\ 6.60 each A physical count of merchandise inventory on November 30 reveals that there are 100 units on hand. Ending inventory under LIFO is

(Multiple Choice)

4.9/5  (41)

(41)

A major criticism of the FIFO inventory method is that it magnifies the effects of the business cycle on business income.

(True/False)

4.8/5  (40)

(40)

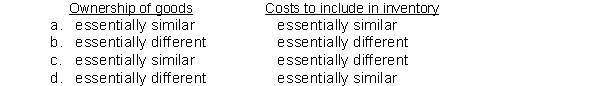

GAAP's provision for ownership of goods (goods-in-transit or consigned goods), as well as which costs to include in inventory, as compared to IFRS are:

(Short Answer)

5.0/5  (41)

(41)

The inventory turnover is calculated by dividing cost of goods sold by

(Multiple Choice)

4.8/5  (40)

(40)

The consistent application of an inventory costing method enhances

(Multiple Choice)

4.7/5  (34)

(34)

Inventory costing methods place primary reliance on assumptions about the flow of

(Multiple Choice)

4.9/5  (33)

(33)

Tidwell Company's goods in transit at December 31 include sales made

(1) FOB destination

(2) FOB shipping point

And purchases made

(3) FOB destination

(4) FOB shipping point.

Which items should be included in Tidwell's inventory at December 31?

(Multiple Choice)

4.8/5  (45)

(45)

Hogan Industries had the following inventory transactions occur during 2017: Units Cost/unit Feb. 1,2017 Purchase 108 \ 45 Mar. 14,2017 Purchase 186 \ 47 May 1,2017 Purchase 132 \ 49 The company sold 306 units at $63 each and has a tax rate of 30%. Assuming that a periodic inventory system is used and operating expenses of $1,800, what is the company's after-tax income using FIFO? (rounded to whole dollars)

(Multiple Choice)

4.8/5  (40)

(40)

The manager of Weiser is given a bonus based on net income before taxes. The net income after taxes is $59,500 for FIFO and $49,000 for LIFO. The tax rate is 30%. The bonus rate is 20%. How much higher is the manager's bonus if FIFO is adopted instead of LIFO?

(Multiple Choice)

4.7/5  (38)

(38)

Alpha First Company just began business and made the following four inventory purchases in June: June 1 150 units \ 1,040 June 10 200 units 1,560 June 15 200 units 1,680 June 28 150 units 1,320 \5 ,600 A physical count of merchandise inventory on June 30 reveals that there are 210 units on hand. Using the LIFO inventory method, the value of the ending inventory on June 30 is

(Multiple Choice)

4.8/5  (38)

(38)

The specific identification method of inventory valuation is desirable when a company sells a large number of low-unit cost items.

(True/False)

4.8/5  (35)

(35)

Automobile Audio has the following inventory data: Nov. 1 Inventory 30 units @\ 6.00 each 8 Purchase 120 units @\ 6.45 each 17 Purchase 60 units @\ 6.30 each 25 Purchase 90 units @\ 6.60 each A physical count of merchandise inventory on November 30 reveals that there are 100 units on hand. Ending inventory under FIFO is

(Multiple Choice)

5.0/5  (41)

(41)

Showing 61 - 80 of 201

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)