Exam 4: Completing the Accounting Cycle

Exam 1: Accounting in Action282 Questions

Exam 2: The Recording Process224 Questions

Exam 3: Adjusting the Accounts309 Questions

Exam 4: Completing the Accounting Cycle264 Questions

Exam 5: Accounting for Merchandising Operations245 Questions

Exam 6: Inventories258 Questions

Exam 7: Fraud, Internal Control, and Cash247 Questions

Exam 8: Accounting for Receivables270 Questions

Exam 9: Plant Assets, Natural Resources, and Intangible Assets342 Questions

Exam 10: Liabilities318 Questions

Exam 12: Investments228 Questions

Exam 13: Statement of Cash Flows217 Questions

Exam 14: Financial Statement Analysis235 Questions

Exam 15: Accounting Principles and Contingent Liabilities in Business Operations251 Questions

Select questions type

At Westglow Company, the following errors were discovered after the transactions had been journalized and posted. Prepare the necessary correcting entry for each of the following.

a. A collection on account of ₤500 was debited to Cash €500 and credited to Service Revenue ₤500.

b. The purchase of supplies on account for ₤1,270 was recorded as a debit to Supplies for ₤1,720 and a credit to Accounts Payable for ₤1,720.

(Essay)

4.8/5  (25)

(25)

Which one of the following statements concerning the accounting cycle is incorrect?

(Multiple Choice)

4.9/5  (40)

(40)

A liability is classified as a current liability if the company is to pay it within the forthcoming year.

(True/False)

4.8/5  (39)

(39)

The following items (in thousands) are taken from the financial statements of Huang Company for the year ending December 31, 20114:  What are total non-current liabilities at December 31, 20114?

What are total non-current liabilities at December 31, 20114?

(Multiple Choice)

5.0/5  (38)

(38)

Journalizing and posting closing entries is a required step in the accounting cycle. Discuss why it is necessary to close the books at the end of an accounting period. If closing entries were not made, how would the preparation of financial statements be affected?

(Essay)

4.9/5  (31)

(31)

The last 2 columns on a worksheet prepared under IFRS contains data for the Retained Earnings Statements.

(True/False)

4.7/5  (33)

(33)

Identify which of the following accounts would have balances on a post-closing trial balance.

(1) Service Revenue

(2) Income Summary

(3) Notes Payable

(4) Interest Expense

(5) Cash

(Short Answer)

4.7/5  (38)

(38)

Match the accounts found on balance sheets to the classification scheme for a statement of financial position .

Correct Answer:

Premises:

Responses:

(Matching)

4.8/5  (39)

(39)

The preparation of a Statement of Financial Position is a required step in the accounting cycle.

(True/False)

4.8/5  (42)

(42)

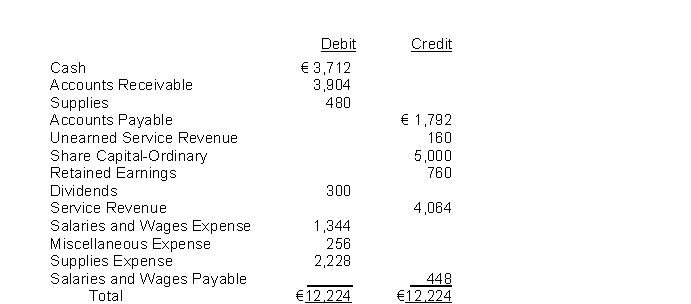

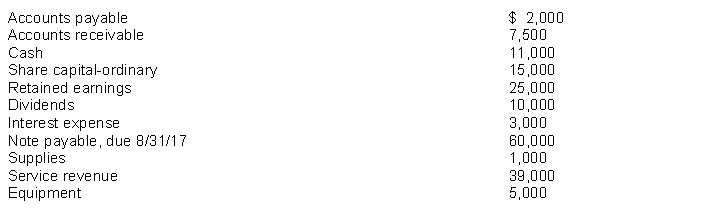

Use the following data, taken from the adjusted trial balance, for 70 and 71.  -Which of the following accounts is least likely to have its balance change on the worksheet?

-Which of the following accounts is least likely to have its balance change on the worksheet?

(Multiple Choice)

4.8/5  (44)

(44)

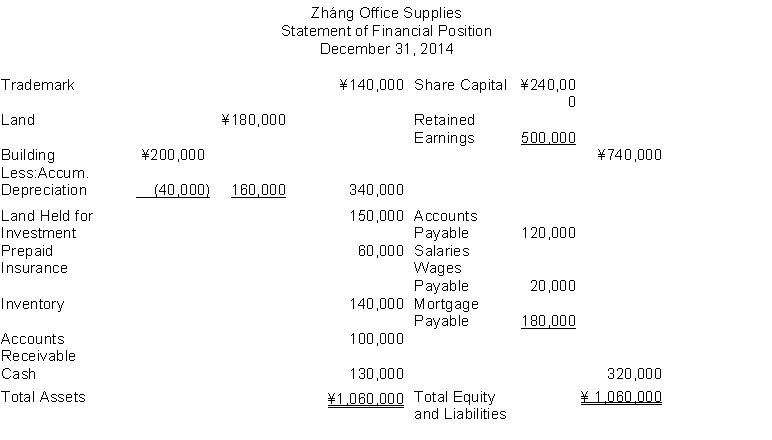

The following information (in thousands) is for Zháng Office Supplies:  The total amount of liabilities to be classified as current liabilities is

The total amount of liabilities to be classified as current liabilities is

(Multiple Choice)

4.9/5  (36)

(36)

Closing entries are unnecessary if the business plans to continue operating in the future and issue financial statements each year.

(True/False)

4.7/5  (41)

(41)

After closing entries are posted, the balance in the retained earnings account in the ledger will be equal to

(Multiple Choice)

5.0/5  (47)

(47)

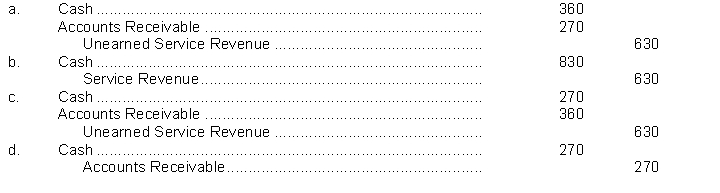

A lawyer collected $630 of legal fees in advance. He erroneously debited Cash for $360 and credited Accounts Receivable for $360. The correcting entry is

(Short Answer)

4.9/5  (41)

(41)

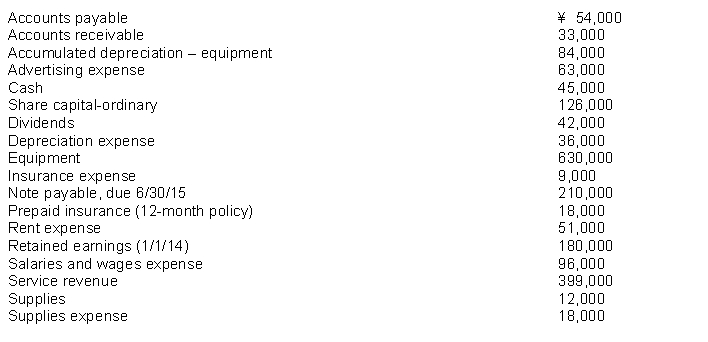

The following accounts were included on Haircut 101's adjusted trial balance at December 31, 2014:  (a) What are total current assets?

(b) What are total current liabilities?

(a) What are total current assets?

(b) What are total current liabilities?

(Essay)

4.7/5  (36)

(36)

Closing entries may be prepared from all but which one of the following sources?

(Multiple Choice)

4.9/5  (39)

(39)

Showing 161 - 180 of 264

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)