Exam 15: Accounting Principles and Contingent Liabilities in Business Operations

Exam 1: Accounting in Action282 Questions

Exam 2: The Recording Process224 Questions

Exam 3: Adjusting the Accounts309 Questions

Exam 4: Completing the Accounting Cycle264 Questions

Exam 5: Accounting for Merchandising Operations245 Questions

Exam 6: Inventories258 Questions

Exam 7: Fraud, Internal Control, and Cash247 Questions

Exam 8: Accounting for Receivables270 Questions

Exam 9: Plant Assets, Natural Resources, and Intangible Assets342 Questions

Exam 10: Liabilities318 Questions

Exam 12: Investments228 Questions

Exam 13: Statement of Cash Flows217 Questions

Exam 14: Financial Statement Analysis235 Questions

Exam 15: Accounting Principles and Contingent Liabilities in Business Operations251 Questions

Select questions type

Internal control over payroll is not necessary because employees will complain if they do not receive the correct amount on their payroll checks.

Free

(True/False)

4.9/5  (33)

(33)

Correct Answer:

False

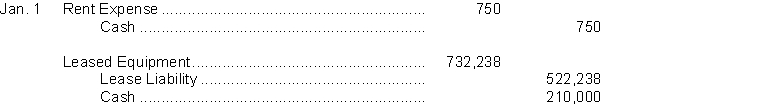

Ryan Corporation entered into the following transactions:

1. Hewitt Car Rental leased a car to Ryan Corporation for one year. Terms of the operating lease call for monthly payments of $750.

2. On January 1, 2014, Ryan Corporation entered into an agreement to lease 20 machines from Meeks Corporation. The terms of the lease agreement require an initial payment of $210,000 and then three annual rental payments of $210,000 beginning on December 31, 2014. The present value of the three rental payments is $522,238. The lease is a finance lease.

Instructions

Prepare the appropriate journal entries to be made by Ryan Corporation in January related to the lease transactions.

Free

(Essay)

4.8/5  (44)

(44)

Correct Answer:

2014

If $30,000 is deposited in a savings account at the end of each year and the account pays interest of 5% compounded annually, what will be the balance of the account at the end of 10 years?

Free

(Multiple Choice)

4.9/5  (42)

(42)

Correct Answer:

C

The entries in the Accounts Receivable Credit column of the cash receipts journal must be posted _______________ to the accounts in the accounts receivable subsidiary ledger and in _______________ to the control account in the general ledger.

(Not Answered)

This question doesn't have any answer yet

Match the statements below with the appropriate item

Correct Answer:

Premises:

Responses:

(Matching)

4.8/5  (33)

(33)

Which of the following statements concerning leases is true?

(Multiple Choice)

4.8/5  (30)

(30)

The accounts receivable _____________ provides detailed information about customer accounts which is summarized in one ______________ account in the general ledger.

(Not Answered)

This question doesn't have any answer yet

The journal entry to record the payroll for a period will include a credit to Salaries and Wages Payable for the gross

(Multiple Choice)

4.8/5  (39)

(39)

An employee's time card is used to record the number of exemptions claimed by the employee for income tax withholding purposes.

(True/False)

4.8/5  (31)

(31)

If Sloane Joyner invests $10,514.81 now and she will receive $30,000 at the end of 11 years, what annual rate of interest will she be earning on her investment?

(Multiple Choice)

4.9/5  (44)

(44)

Which of the following would not be an appropriate heading for a column in the cash receipts journal?

(Multiple Choice)

4.9/5  (38)

(38)

The decision to make long-term capital investments is best evaluated using discounting techniques that recognize the time value of money.

(True/False)

4.9/5  (42)

(42)

The one characteristic that all entries recorded in a multiple-column purchases journal have in common is a

(Multiple Choice)

4.7/5  (36)

(36)

Many companies calculate the future value of the cash flows involved in an investment in evaluating long-term capital investments.

(True/False)

4.8/5  (37)

(37)

Lucie Ball's regular rate of pay is $15 per hour with one and one-half times her regular rate for any hours which exceed 40 hours per week. She worked 48 hours last week. Therefore, her gross wages were

(Multiple Choice)

4.8/5  (41)

(41)

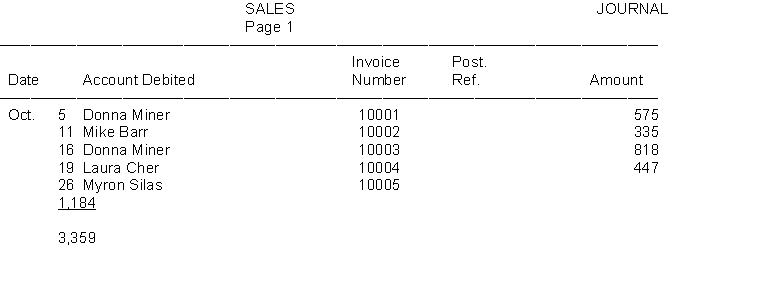

Easton Company began business on October 1. The sales journal, as it appeared at the end of the month, follows:  1. Open general ledger T-accounts for Accounts Receivable (No. 112) and Sales Revenue (No. 401) and an accounts receivable subsidiary T-account ledger with an account for each customer. Make the appropriate postings from the sales journal. Fill in the appropriate posting references in the sales journal above.

2. Prove the accounts receivable subsidiary ledger by preparing a schedule of accounts receivable.

1. Open general ledger T-accounts for Accounts Receivable (No. 112) and Sales Revenue (No. 401) and an accounts receivable subsidiary T-account ledger with an account for each customer. Make the appropriate postings from the sales journal. Fill in the appropriate posting references in the sales journal above.

2. Prove the accounts receivable subsidiary ledger by preparing a schedule of accounts receivable.

(Essay)

4.8/5  (40)

(40)

A cash payments journal should not be used to record transactions which require payment by check.

(True/False)

4.9/5  (28)

(28)

A subsidiary ledger provides up-to-date information on specific account balances.

(True/False)

4.9/5  (37)

(37)

Showing 1 - 20 of 251

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)