Exam 15: Accounting Principles and Contingent Liabilities in Business Operations

Exam 1: Accounting in Action282 Questions

Exam 2: The Recording Process224 Questions

Exam 3: Adjusting the Accounts309 Questions

Exam 4: Completing the Accounting Cycle264 Questions

Exam 5: Accounting for Merchandising Operations245 Questions

Exam 6: Inventories258 Questions

Exam 7: Fraud, Internal Control, and Cash247 Questions

Exam 8: Accounting for Receivables270 Questions

Exam 9: Plant Assets, Natural Resources, and Intangible Assets342 Questions

Exam 10: Liabilities318 Questions

Exam 12: Investments228 Questions

Exam 13: Statement of Cash Flows217 Questions

Exam 14: Financial Statement Analysis235 Questions

Exam 15: Accounting Principles and Contingent Liabilities in Business Operations251 Questions

Select questions type

A $10,000, 6%, 5-year note payable that pays interest quarterly would be discounted back to its present value by using tables that would indicate which one of the following period-interest combinations?

(Multiple Choice)

4.8/5  (42)

(42)

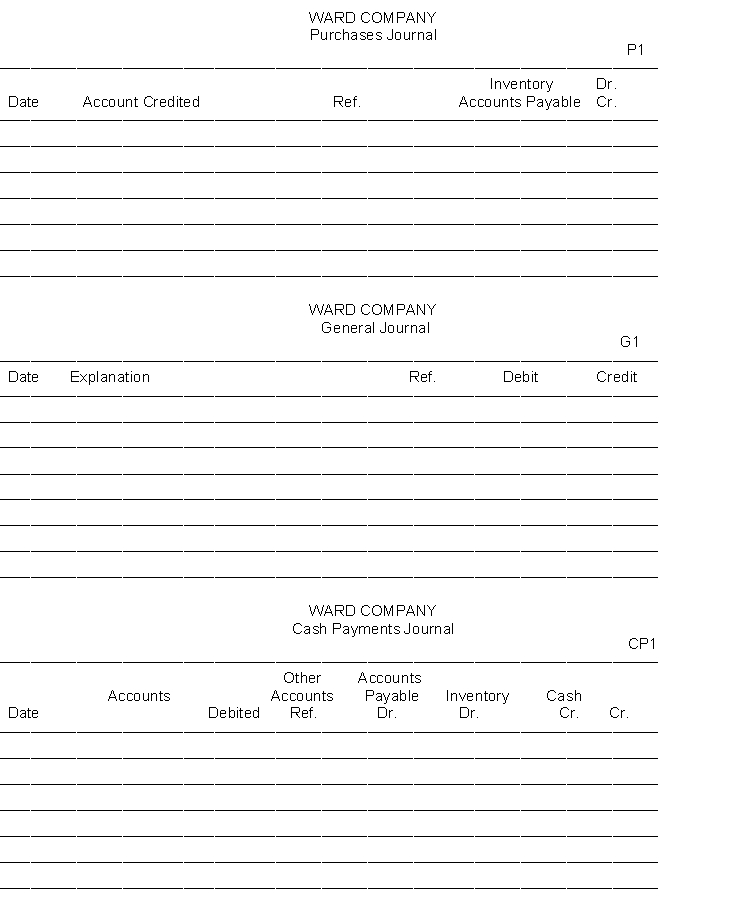

Ward Company uses a single-column purchases journal, a cash payments journal, and a general journal to record transactions with its suppliers and others. Record the following transactions in the appropriate journals.

Transactions

Oct. 5 Purchased merchandise on account for $15,000 from Groton Company. Terms: 2/10, n/30; FOB shipping point.

Oct. 6 Paid $7,200 to Federated Insurance Company for a two-year fire insurance policy.

Oct. 8 Purchased supplies on account for $700 from Flynn Supply Company. Terms: 2/10, n/30.

Oct. 11 Purchased merchandise on account for $14,000 from Buehler Corporation. Terms: 2/10, n/30; FOB shipping point.

Oct. 13 Issued a debit memorandum for $3,000 to Buehler Corporation for merchandise purchased on October 11 and returned because of damage.

Oct. 15 Paid Groton Company for merchandise purchased on October 5, less discount.

Oct. 16 Purchased merchandise for $8,000 cash from Clifford Company.

Oct. 21 Paid Buehler Corporation for merchandise purchased on October 11, less merchandise returned on October 13, less discount.

Oct. 25 Purchased merchandise on account for $22,000 from Dooley Company. Terms: 2/10, n/30; FOB shipping point.

Oct. 31 Purchased office equipment for $30,000 cash from Paten Office Supply Company.

(Essay)

4.7/5  (40)

(40)

Repair costs incurred in honoring warranty contracts should be debited to Warranty Liability.

(True/False)

4.8/5  (32)

(32)

Luis Rodriguez wants to buy a car in 3 years. He will need $3,000 for a down payment. The annual interest rate is 9%. How much money must Luis invest today for the purchase?

(Short Answer)

4.8/5  (31)

(31)

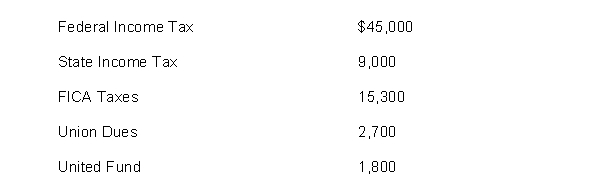

Warren Company's payroll for the week ending January 15 amounted to $200,000 for salaries and wages. None of the employees has reached the earnings limits specified for federal or state employer payroll taxes. The following deductions were withheld from employees' salaries and wages:  Federal unemployment tax (FUTA) rate is 6.2% less a credit equal to the rate paid for state unemployment taxes. The state unemployment tax (SUTA) rate is 5.4%.

Instructions

Prepare the journal entries to record the weekly payroll ending January 15 and the employer's payroll tax expense on the payroll for January 15.

Federal unemployment tax (FUTA) rate is 6.2% less a credit equal to the rate paid for state unemployment taxes. The state unemployment tax (SUTA) rate is 5.4%.

Instructions

Prepare the journal entries to record the weekly payroll ending January 15 and the employer's payroll tax expense on the payroll for January 15.

(Essay)

4.7/5  (34)

(34)

Interest is the difference between the amount borrowed and the principal.

(True/False)

4.8/5  (42)

(42)

A debit column for Sales Returns and Allowances may be found in the cash payments journal.

(True/False)

4.9/5  (39)

(39)

Match the statements below with the appropriate item

Correct Answer:

Premises:

Responses:

(Matching)

4.8/5  (44)

(44)

Posting a sales journal to the accounts in the general ledger requires a

(Multiple Choice)

5.0/5  (32)

(32)

Changes in pay rates during employment should be authorized by the

(Multiple Choice)

4.8/5  (39)

(39)

CVS leases a building for 20 years. The lease requires 20 annual payments of $10,000 each, with the first payment due immediately. The interest rate in the lease is 10%. What is the present value of the cost of leasing the building?

(Not Answered)

This question doesn't have any answer yet

In order to compute the present value of an annuity, it is necessary to know the

(Multiple Choice)

4.8/5  (31)

(31)

A subsidiary ledger is a group of control accounts which provides information to the managers for controlling the operation of the company.

(True/False)

4.9/5  (37)

(37)

Match the to the procedures listed below to the following payroll functions

Correct Answer:

Premises:

Responses:

(Matching)

4.9/5  (39)

(39)

The factor 1.0609 is taken from the 3% column and 2 periods row in certain table. From what table is this factor taken?

(Multiple Choice)

4.7/5  (33)

(33)

Showing 201 - 220 of 251

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)