Exam 7: Fraud, Internal Control, and Cash

Exam 1: Accounting in Action276 Questions

Exam 2: The Recording Process223 Questions

Exam 3: Adjusting the Accounts303 Questions

Exam 4: Completing the Accounting Cycle262 Questions

Exam 5: Accounting for Merchandising Operations244 Questions

Exam 6: Inventories257 Questions

Exam 7: Fraud, Internal Control, and Cash238 Questions

Exam 8: Accounting for Receivables269 Questions

Exam 9: Plant Assets, Natural Resources, and Intangible Assets339 Questions

Exam 10: Liabilities317 Questions

Exam 12: Investments227 Questions

Exam 13: Statement of Cash Flows213 Questions

Exam 14: Financial Statement Analysis231 Questions

Exam 15: Accounting and Financial Reporting for Contingent Liabilities and Leases281 Questions

Select questions type

A company stamps checks received in the mail with the words "For Deposit Only". This endorsement is called a(n)

(Multiple Choice)

4.9/5  (40)

(40)

The cash account shows a balance of $75,000 before reconciliation. The bank statement does not include a deposit of $4,600 made on the last day of the month. The bank statement shows a collection by the bank of $1,880 and a customer's check for $640 was returned because it was NSF. A customer's check for $790 was recorded on the books as $970, and a check written for $159 was recorded as $195. The correct balance in the cash account was

(Multiple Choice)

4.9/5  (44)

(44)

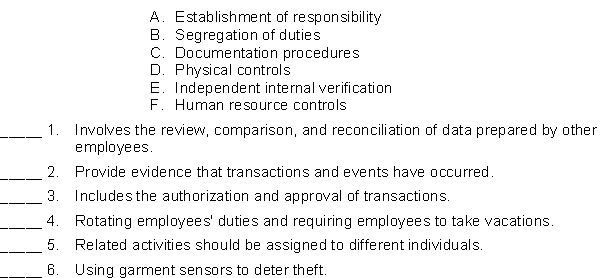

Match each of the following principles of internal control with the appropriate description below.

(Short Answer)

4.8/5  (36)

(36)

When two or more people get together for the purpose of circumventing prescribed controls, it is called

(Multiple Choice)

4.8/5  (38)

(38)

Cash equivalents are highly liquid investments that can be converted into a specific amount of cash.

(True/False)

4.7/5  (35)

(35)

Because cash is the most liquid current asset it is listed first in the current assets section of the statement of financial position.

(True/False)

4.9/5  (32)

(32)

The principle of establishing responsibility does not include

(Multiple Choice)

4.8/5  (40)

(40)

Indicate how each of the following items would be shown on a bank reconciliation.

1. Bank error (The bank charged our account with another company's check)

2. Check printing charge

3. Deposits in transit

4. Note collected by the bank

5. NSF checks

6. Outstanding checks

(Essay)

4.9/5  (27)

(27)

The cash account shows a balance of $55,000 before reconciliation. The bank statement does not include a deposit of $2,300 made on the last day of the month. The bank statement shows a collection by the bank of $940 and a customer's check for $320 was returned because it was NSF. A customer's check for $450 was recorded on the books as $540, and a check written for $79 was recorded as $97. The correct balance in the cash account was

(Multiple Choice)

4.8/5  (42)

(42)

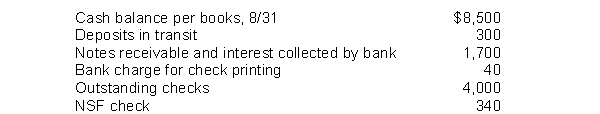

Quayle Company gathered the following reconciling information in preparing its August bank reconciliation:  The adjusted cash balance per books on August 31 is

The adjusted cash balance per books on August 31 is

(Multiple Choice)

4.9/5  (39)

(39)

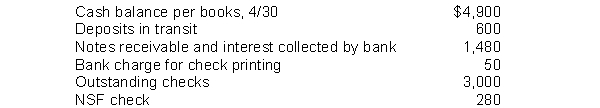

Fairly Company gathered the following reconciling information in preparing its April bank reconciliation:  The adjusted cash balance per books on April 30 is

The adjusted cash balance per books on April 30 is

(Multiple Choice)

4.9/5  (32)

(32)

The preparation of a bank reconciliation is an important cash control procedure. If a company deposits cash receipts daily and makes all cash disbursements by check, explain why the cash balance per books might not agree with the cash balance shown on the bank statement. Identify specific examples that may cause differences between the cash balance per books and the cash balance per bank.

(Essay)

4.8/5  (33)

(33)

Savings accounts are usually classified as cash on the statement of financial position.

(True/False)

4.8/5  (35)

(35)

A segregation of duties among employees eliminates the possibility of collusion.

(True/False)

4.9/5  (38)

(38)

Because cash is the least liquid current asset it is listed last in the current assets section of the statement of financial position.

(True/False)

4.9/5  (37)

(37)

In large companies, the independent internal verification procedure is often assigned to

(Multiple Choice)

4.9/5  (37)

(37)

All of the following would involve a debit memorandum except

(Multiple Choice)

4.8/5  (40)

(40)

Showing 141 - 160 of 238

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)