Exam 6: Inventories

Exam 1: Accounting in Action276 Questions

Exam 2: The Recording Process223 Questions

Exam 3: Adjusting the Accounts303 Questions

Exam 4: Completing the Accounting Cycle262 Questions

Exam 5: Accounting for Merchandising Operations244 Questions

Exam 6: Inventories257 Questions

Exam 7: Fraud, Internal Control, and Cash238 Questions

Exam 8: Accounting for Receivables269 Questions

Exam 9: Plant Assets, Natural Resources, and Intangible Assets339 Questions

Exam 10: Liabilities317 Questions

Exam 12: Investments227 Questions

Exam 13: Statement of Cash Flows213 Questions

Exam 14: Financial Statement Analysis231 Questions

Exam 15: Accounting and Financial Reporting for Contingent Liabilities and Leases281 Questions

Select questions type

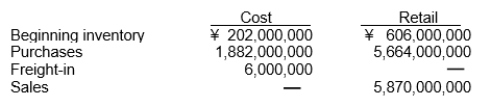

Mishu Inc. uses the retail inventory method to value its merchandise inventory. The following information is available for 2014:  What is Mishu's estimated ending inventory at cost?

What is Mishu's estimated ending inventory at cost?

(Multiple Choice)

4.8/5  (40)

(40)

______________ is calculated as cost of goods sold divided by average inventory.

(Not Answered)

This question doesn't have any answer yet

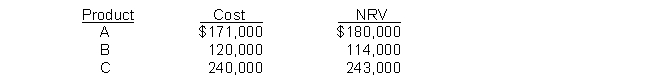

Never Company developed the following information about its inventories in applying the lower-of-cost-or-net realizable value (LCNRV) basis in valuing inventories:  If Never applies the LCNRV basis, the value of the inventory reported on the statement of financial position would be

If Never applies the LCNRV basis, the value of the inventory reported on the statement of financial position would be

(Multiple Choice)

4.8/5  (43)

(43)

All inventories are reported as current assets on the statement of financial position.

(True/False)

4.8/5  (38)

(38)

Companies have the choice of physically counting inventory on hand at the end of the year or using the gross profit method to estimate the ending inventory.

(True/False)

4.9/5  (35)

(35)

Whitmore Company identifies the following items for possible inclusion in the physical inventory. Indicate whether each item should be included or excluded from the inventory taking.

1. Goods shipped on consignment by Whitmore to another company.

2. Goods in transit from a supplier shipped FOB destination.

3. Goods shipped via common carrier to a customer with terms FOB shipping point.

4. Goods held on consignment from another company.

(Essay)

4.8/5  (36)

(36)

The lower-of-cost-or-net realizable value basis of accounting for inventories should be applied when the ______________ cost of the goods is lower than its cost.

(Short Answer)

4.7/5  (35)

(35)

Chang Company took a physical inventory at December 31, 2013 and determined that ¥3,950,000 of goods were on hand. Included in the count was inventory of ¥700,000 on consignment from Keiko Company. On December 30, Chang sold and shipped F.o.b. destination ¥820,000 worth of inventory. These goods arrived at the buyer's place of business on January 2, 2014. What amount should Chang report for inventory on its December 31, 2013 statement of financial position?

(Multiple Choice)

4.9/5  (46)

(46)

Beginning inventory plus the cost of goods purchased equals

(Multiple Choice)

4.8/5  (30)

(30)

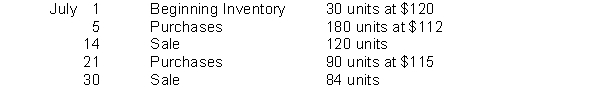

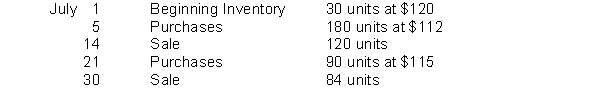

Neighborly Industries has the following inventory information.  Assuming that a periodic inventory system is used, what is the amount allocated to ending inventory on a LIFO basis?

Assuming that a periodic inventory system is used, what is the amount allocated to ending inventory on a LIFO basis?

(Multiple Choice)

4.8/5  (29)

(29)

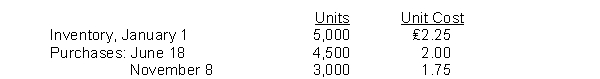

Holliday Company's inventory records show the following data:  A physical inventory on December 31 shows 2,000 units on hand. Holliday sells the units for ₤3 each. The company has an effective tax rate of 20%. Holliday uses the periodic inventory method. What is the cost of goods available for sale?

A physical inventory on December 31 shows 2,000 units on hand. Holliday sells the units for ₤3 each. The company has an effective tax rate of 20%. Holliday uses the periodic inventory method. What is the cost of goods available for sale?

(Multiple Choice)

4.9/5  (43)

(43)

The LIFO inventory method assumes that the cost of the latest units purchased are

(Multiple Choice)

4.7/5  (28)

(28)

Of the following companies, which one would not likely employ the specific identification method for inventory costing?

(Multiple Choice)

4.8/5  (42)

(42)

FIFO and average-cost are the two most common cost flow assumptions made in costing inventories. The amounts assigned to the same inventory items on hand may be different under each cost flow assumption. If a company has no beginning inventory, explain the difference in ending inventory values under the FIFO and average-cost cost bases when the price of inventory items purchased during the period have been (1) increasing, (2) decreasing, and (3) remained constant.

(Essay)

4.8/5  (37)

(37)

If a company uses the FIFO cost assumption, the cost of goods sold for the period will be the same under a perpetual or periodic inventory system.

(True/False)

4.8/5  (35)

(35)

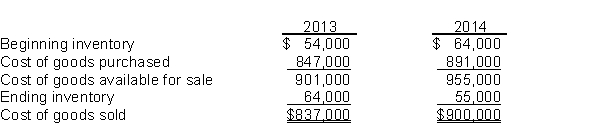

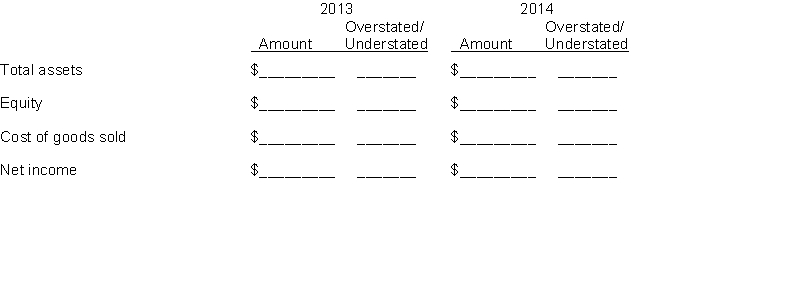

Graves Pharmacy reported cost of goods sold as follows:  Hill, the bookkeeper, made two errors:

(1) 2013 ending inventory was overstated by $4,000.

(2) 2014 ending inventory was understated by $10,000.

Instructions

Assuming the errors had not been corrected, indicate the dollar effect that the errors had on the items appearing on the financial statements listed below. Also indicate if the amounts are overstated (O) or understated (U).

Hill, the bookkeeper, made two errors:

(1) 2013 ending inventory was overstated by $4,000.

(2) 2014 ending inventory was understated by $10,000.

Instructions

Assuming the errors had not been corrected, indicate the dollar effect that the errors had on the items appearing on the financial statements listed below. Also indicate if the amounts are overstated (O) or understated (U).

(Essay)

4.8/5  (41)

(41)

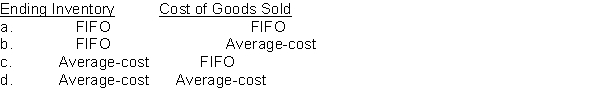

Which inventory costing method most closely approximates current cost for each of the following?

(Short Answer)

4.8/5  (29)

(29)

The inventory turnover ratio is computed by dividing cost of goods sold by

(Multiple Choice)

4.9/5  (30)

(30)

Neighborly Industries has the following inventory information.  Assuming that a periodic inventory system is used, what is the amount allocated to ending inventory on a FIFO basis?

Assuming that a periodic inventory system is used, what is the amount allocated to ending inventory on a FIFO basis?

(Multiple Choice)

4.8/5  (35)

(35)

Management may choose any inventory costing method it desires as long as the cost flow assumption chosen is consistent with the physical movement of goods in the company.

(True/False)

4.8/5  (40)

(40)

Showing 181 - 200 of 257

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)