Exam 6: Inventories

Exam 1: Accounting in Action276 Questions

Exam 2: The Recording Process223 Questions

Exam 3: Adjusting the Accounts303 Questions

Exam 4: Completing the Accounting Cycle262 Questions

Exam 5: Accounting for Merchandising Operations244 Questions

Exam 6: Inventories257 Questions

Exam 7: Fraud, Internal Control, and Cash238 Questions

Exam 8: Accounting for Receivables269 Questions

Exam 9: Plant Assets, Natural Resources, and Intangible Assets339 Questions

Exam 10: Liabilities317 Questions

Exam 12: Investments227 Questions

Exam 13: Statement of Cash Flows213 Questions

Exam 14: Financial Statement Analysis231 Questions

Exam 15: Accounting and Financial Reporting for Contingent Liabilities and Leases281 Questions

Select questions type

Purdy Company is in the electronics industry and the price it pays for inventory is decreasing.

Instructions

Indicate which inventory method will:

a. provide the lowest ending inventory.

b. provide the highest cost of goods sold.

c. result in the highest net income.

d. result in the lowest income tax expense.

e. produce the most stable earnings over several years.

(Essay)

4.8/5  (38)

(38)

At December 31, 2014, the following information was available for Fife Company: ending inventory $22,600; beginning inventory $21,400; cost of goods sold $198,000; and sales revenue $330,000.

Calculate the inventory turnover ratio and days in inventory for Fife.

(Essay)

4.8/5  (47)

(47)

Transactions that affect inventories on hand have an effect on both the statement of financial position and the income statement.

(True/False)

4.8/5  (42)

(42)

Widner Company understated its inventory by $10,000 at December 31, 2013. It did not correct the error in 2013 or 2014. As a result, Widner's equity was:

(Multiple Choice)

4.8/5  (35)

(35)

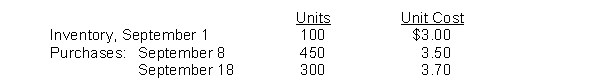

Hoyt Company's inventory records show the following data for the month of September:  A physical inventory on September 30 shows 200 units on hand. Calculate the value of ending inventory and cost of goods sold if the company uses LIFO inventory costing and a periodic inventory system.

A physical inventory on September 30 shows 200 units on hand. Calculate the value of ending inventory and cost of goods sold if the company uses LIFO inventory costing and a periodic inventory system.

(Essay)

4.8/5  (37)

(37)

In a period of rising prices, if a company uses the FIFO cost flow assumption, income tax expense will be lower than if they used average-costing.

(True/False)

4.8/5  (35)

(35)

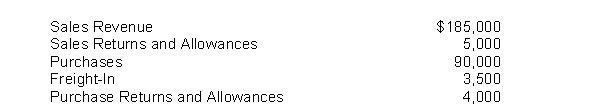

The inventory of Pedigo Company was destroyed by fire on April 1. From an examination of the accounting records, the following data for the first three months of the year are obtained:  Instructions

Determine the merchandise lost by fire, assuming a beginning inventory of $60,000 and a gross profit rate of 40% on net sales.

Instructions

Determine the merchandise lost by fire, assuming a beginning inventory of $60,000 and a gross profit rate of 40% on net sales.

(Essay)

4.9/5  (31)

(31)

If the unit cost of inventory has continuously increased, the ______________, first-out inventory valuation method will result in a higher valued ending inventory than if the ______________, first-out method had been used.

(Not Answered)

This question doesn't have any answer yet

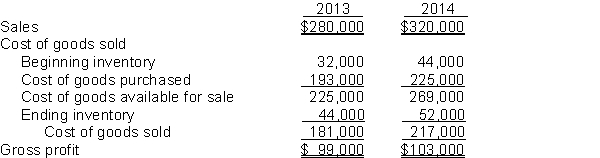

Linden Watch Company reported the following income statement data for a 2-year period.  Linden uses a periodic inventory system. The inventories at January 1, 2013, and December 31, 2014, are correct. However, the ending inventory at December 31, 2013, was overstated $5,000.

Instructions

(a) Prepare correct income statement data for the 2 years.

(b) What is the cumulative effect of the inventory error on total gross profit for the 2 years?

Linden uses a periodic inventory system. The inventories at January 1, 2013, and December 31, 2014, are correct. However, the ending inventory at December 31, 2013, was overstated $5,000.

Instructions

(a) Prepare correct income statement data for the 2 years.

(b) What is the cumulative effect of the inventory error on total gross profit for the 2 years?

(Essay)

4.9/5  (32)

(32)

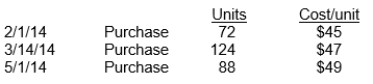

Lee Industries had the following inventory transactions occur during 2014:  The company sold 204 units at $63 each and has a tax rate of 30%. Assuming that a periodic inventory system is used, what is the company's gross profit using FIFO? (rounded to whole dollars)

The company sold 204 units at $63 each and has a tax rate of 30%. Assuming that a periodic inventory system is used, what is the company's gross profit using FIFO? (rounded to whole dollars)

(Multiple Choice)

4.8/5  (34)

(34)

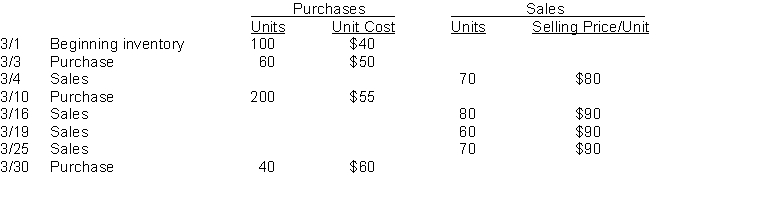

Kegin Company sells many products. Whamo is one of its popular items. Below is an analysis of the inventory purchases and sales of Whamo for the month of March. Kegin Company uses the periodic inventory system.  Instructions

(a) Using the FIFO assumption, calculate the amount charged to cost of goods sold for March. (Show computations)

(b) Using the weighted average method, calculate the amount assigned to the inventory on hand on March 31. (Show computations)

(c) Using the LIFO assumption, calculate the amount assigned to the inventory on hand on March 31. (Show computations)

Instructions

(a) Using the FIFO assumption, calculate the amount charged to cost of goods sold for March. (Show computations)

(b) Using the weighted average method, calculate the amount assigned to the inventory on hand on March 31. (Show computations)

(c) Using the LIFO assumption, calculate the amount assigned to the inventory on hand on March 31. (Show computations)

(Essay)

4.9/5  (36)

(36)

For the current month, the beginning inventory of Elipresse Inc. consisted of 3 units that cost CHF5,500 each. During the month, the company made two purchases: 4 units at CHF5,800 each and 1 units at CHF5,750. Elipresse sold 5 units during the month. If Elipresse uses specific identification and wishes to maximize net income, the units costs allocated to cost of goods sold will be:

(Multiple Choice)

4.8/5  (40)

(40)

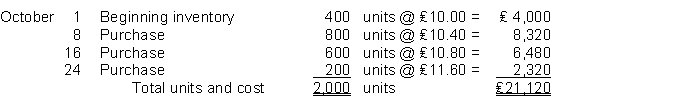

Toso Company uses the periodic inventory system to account for inventories. Information related to Toso Company's inventory at October 31 is given below:  Instructions

1. Show computations to value the ending inventory using the FIFO cost assumption if 550 units remain on hand at October 31.

2. Show computations to value the ending inventory using the weighted-average cost method if 550 units remain on hand at October 31.

3. Show computations to value the ending inventory using the LIFO cost assumption if 550 units remain on hand at October 31.

Instructions

1. Show computations to value the ending inventory using the FIFO cost assumption if 550 units remain on hand at October 31.

2. Show computations to value the ending inventory using the weighted-average cost method if 550 units remain on hand at October 31.

3. Show computations to value the ending inventory using the LIFO cost assumption if 550 units remain on hand at October 31.

(Essay)

4.9/5  (36)

(36)

Under the LCNRV approach, the net realizable value is defined as

(Multiple Choice)

4.9/5  (48)

(48)

Accounting for inventories under IFRS is very similar to accounting under GAAP.

(True/False)

4.7/5  (39)

(39)

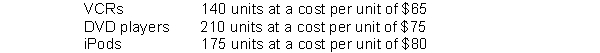

Boyer Company applied FIFO to its inventory and got the following results for its ending inventory.  The cost of purchasing units at year-end was VCRs $71, DVD players $72, and iPods $78.

Instructions

Determine the amount of ending inventory at lower-of-cost-or-net realizable value.

The cost of purchasing units at year-end was VCRs $71, DVD players $72, and iPods $78.

Instructions

Determine the amount of ending inventory at lower-of-cost-or-net realizable value.

(Essay)

4.8/5  (36)

(36)

The lower-of-cost-or-net realizable value basis of valuing inventories is an example of

(Multiple Choice)

4.8/5  (30)

(30)

In a period of falling prices, which inventory method would result in the lowest tax burden?

(Multiple Choice)

4.9/5  (31)

(31)

Showing 81 - 100 of 257

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)