Exam 4: Completing the Accounting Cycle

Exam 1: Accounting in Action276 Questions

Exam 2: The Recording Process223 Questions

Exam 3: Adjusting the Accounts303 Questions

Exam 4: Completing the Accounting Cycle262 Questions

Exam 5: Accounting for Merchandising Operations244 Questions

Exam 6: Inventories257 Questions

Exam 7: Fraud, Internal Control, and Cash238 Questions

Exam 8: Accounting for Receivables269 Questions

Exam 9: Plant Assets, Natural Resources, and Intangible Assets339 Questions

Exam 10: Liabilities317 Questions

Exam 12: Investments227 Questions

Exam 13: Statement of Cash Flows213 Questions

Exam 14: Financial Statement Analysis231 Questions

Exam 15: Accounting and Financial Reporting for Contingent Liabilities and Leases281 Questions

Select questions type

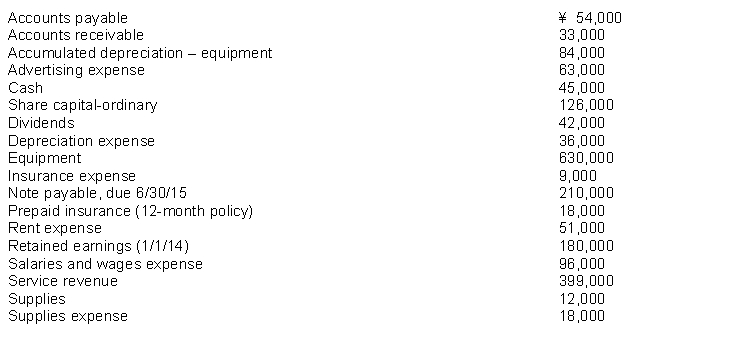

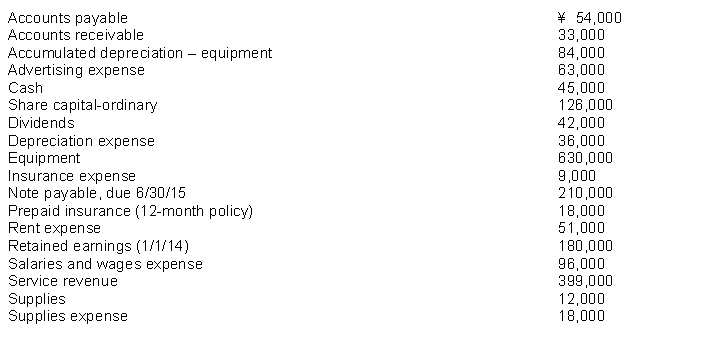

The following items (in thousands) are taken from the financial statements of Huang Company for the year ending December 31, 2014:  What is total equity and liabilities at December 31, 2014?

What is total equity and liabilities at December 31, 2014?

(Multiple Choice)

4.8/5  (33)

(33)

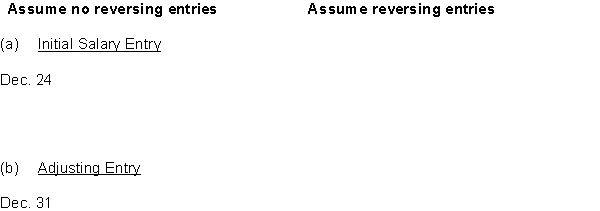

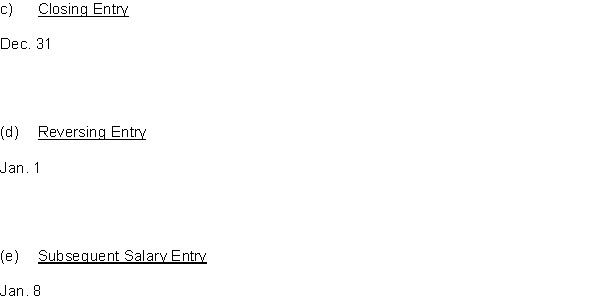

Transaction and adjustment data for Alcortt Company for the calendar year end is as follows:

1. December 24 (initial salary entry): ₤18,000 of salaries and wages earned between December 1 and December 24 are paid.

2. December 31 (adjusting entry): Salaries and wages earned between December 25 and December 31 are ₤3,000. These will be paid in the January 8 payroll.

3. January 8 (subsequent salary entry): Total salary payroll amounting to ₤11,000 was paid.

Instructions

Prepare two sets of journal entries as specified below. The first set of journal entries should assume that the company does not use reversing entries, and the second set should assume that reversing entries are utilized by the company.  (

(

(Essay)

4.9/5  (40)

(40)

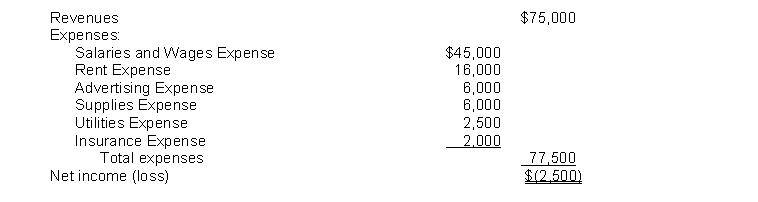

The income statement for the year 2014 of Poole Co. contains the following information:  After all closing entries have been posted, the revenue account will have a balance of

After all closing entries have been posted, the revenue account will have a balance of

(Multiple Choice)

4.9/5  (37)

(37)

The Dividends account is a permanent account whose balance is carried forward to the next accounting period.

(True/False)

4.9/5  (45)

(45)

Correcting entries will never affect statement of financial position accounts.

(True/False)

4.9/5  (48)

(48)

Topeka Bike Company received a $920 check from a customer for the balance due. The transaction was erroneously recorded as a debit to Cash $290 and a credit to Service Revenue $290. The correcting entry is

(Multiple Choice)

4.9/5  (33)

(33)

Correcting entries are made any time an error is discovered even though it may not be at the end of an accounting period.

(True/False)

4.7/5  (38)

(38)

A company has purchased a trust of land and expects to build a production plant on the land in approximately 5 years. During the 5 years before construction, the land will be idle. Under GAAP, the land should be reported as

(Multiple Choice)

4.7/5  (39)

(39)

An examination of the accounts of Freeman Company for the month of October revealed the following errors after the transactions were journalized and posted. Prepare correcting entries for each of the above assuming the erroneous entries are not reversed.

(a) A check for $700 was issued for goods previously purchased on account. The bookkeeper debited Accounts Receivable and credited Cash for $700.

(b) A check for $580 was received as payment on account. The bookkeeper debited Accounts Payable for $850 and credited Accounts Receivable for $850.

(c) When making the entry to record the year's depreciation expense, the bookkeeper debited Accumulated Depreciation for $1,500 and credited Cash for $1,500.

(d) When accruing interest on a note payable, the bookkeeper debited Interest Receivable for $200 and credited Interest Payable for $200.

(Essay)

4.9/5  (42)

(42)

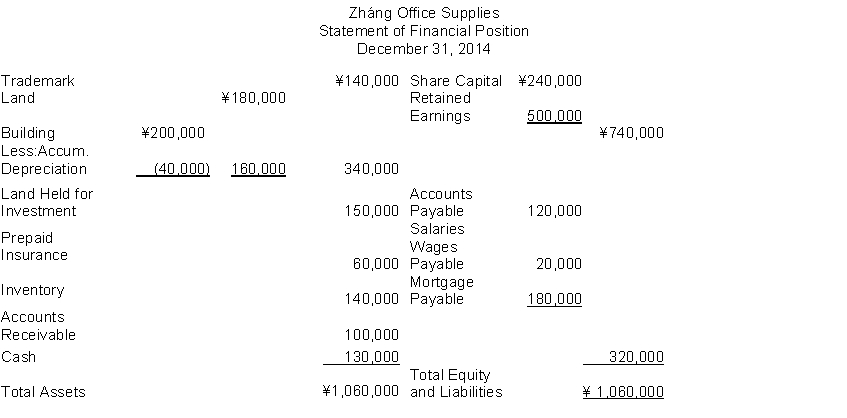

The following information (in thousands) is for Zháng Office Supplies:  The total amount of assets to be classified as property, plant, and equipment is

The total amount of assets to be classified as property, plant, and equipment is

(Multiple Choice)

4.8/5  (40)

(40)

On September 23, Riley Company received a $350 check from Jack Colaw for services to be performed in the future. The bookkeeper for Riley Company incorrectly debited Cash for $350 and credited Accounts Receivable for $350. The amounts have been posted to the ledger. To correct this entry, the bookkeeper should

(Multiple Choice)

4.9/5  (37)

(37)

The balance of the depreciation expense account will appear in the income statement debit column of a worksheet.

(True/False)

4.9/5  (42)

(42)

Identify which of the following accounts would appear in a post-closing trial balance.

Accumulated Depreciation-Equip. Dividends

Depreciation Expense Service Revenue

Interest Payable Equipment

(Essay)

4.8/5  (32)

(32)

The following items (in thousands) are taken from the financial statements of Huang Company for the year ending December 31, 2014:  What are total current assets at December 31, 2014?

What are total current assets at December 31, 2014?

(Multiple Choice)

4.8/5  (36)

(36)

Showing 181 - 200 of 262

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)