Exam 2: The Recording Process

Exam 1: Accounting in Action276 Questions

Exam 2: The Recording Process223 Questions

Exam 3: Adjusting the Accounts303 Questions

Exam 4: Completing the Accounting Cycle262 Questions

Exam 5: Accounting for Merchandising Operations244 Questions

Exam 6: Inventories257 Questions

Exam 7: Fraud, Internal Control, and Cash238 Questions

Exam 8: Accounting for Receivables269 Questions

Exam 9: Plant Assets, Natural Resources, and Intangible Assets339 Questions

Exam 10: Liabilities317 Questions

Exam 12: Investments227 Questions

Exam 13: Statement of Cash Flows213 Questions

Exam 14: Financial Statement Analysis231 Questions

Exam 15: Accounting and Financial Reporting for Contingent Liabilities and Leases281 Questions

Select questions type

The chart of accounts is a listing of the accounts and the account numbers which identify their location in the ledger.

(True/False)

4.8/5  (40)

(40)

Use the information in BE 182 to answer the following questions.

1. What is the balance in Accounts Payable at June 30, 2014?

2. What is the balance in Accounts Receivable at June 30, 2014?

(Essay)

4.7/5  (37)

(37)

Debit and credit can be interpreted to mean increase and decrease, respectively.

(True/False)

4.8/5  (39)

(39)

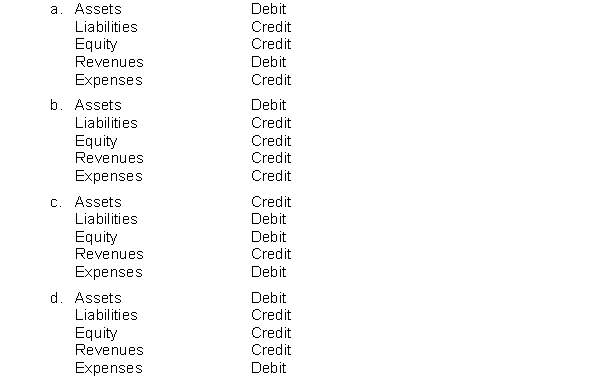

Which of the following correctly identifies normal balances of accounts?

(Short Answer)

4.9/5  (43)

(43)

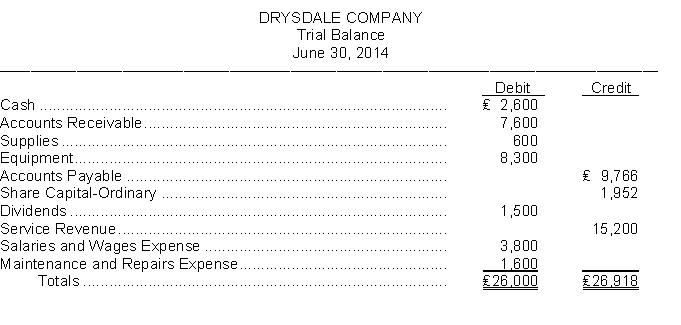

The trial balance of Drysdale Company shown below does not balance.  An examination of the ledger and journal reveals the following errors:

1. Each of the above listed accounts has a normal balance per the general ledger.

2. Cash of ₤170 received from a customer on account was debited to Cash ₤710 and credited to Accounts Receivable ₤710.

3. A dividend of ₤300 was posted as a credit to Dividends, ₤300 and credit to Cash ₤300.

4. A debit of ₤120 was not posted to Salaries and Wages Expense.

5. The purchase of equipment on account for ₤700 was recorded as a debit to Maintenance and Repairs Expense and a credit to Accounts Payable for ₤700.

6. Services were performed on account for a customer, ₤310, for which Accounts Receivable was debited ₤310 and Service Revenue was credited ₤31.

7. A payment on account for ₤225 was credited to Cash for ₤225 and credited to Accounts Payable for ₤252.

Instructions

Prepare a correct trial balance.

An examination of the ledger and journal reveals the following errors:

1. Each of the above listed accounts has a normal balance per the general ledger.

2. Cash of ₤170 received from a customer on account was debited to Cash ₤710 and credited to Accounts Receivable ₤710.

3. A dividend of ₤300 was posted as a credit to Dividends, ₤300 and credit to Cash ₤300.

4. A debit of ₤120 was not posted to Salaries and Wages Expense.

5. The purchase of equipment on account for ₤700 was recorded as a debit to Maintenance and Repairs Expense and a credit to Accounts Payable for ₤700.

6. Services were performed on account for a customer, ₤310, for which Accounts Receivable was debited ₤310 and Service Revenue was credited ₤31.

7. A payment on account for ₤225 was credited to Cash for ₤225 and credited to Accounts Payable for ₤252.

Instructions

Prepare a correct trial balance.

(Essay)

4.8/5  (27)

(27)

Sternberg Company purchases equipment for $1,200 and supplies for $400 from Tran Co. for $1,600 cash. The entry for this transaction will include a

(Multiple Choice)

4.9/5  (38)

(38)

Which of the following errors will prevent the trial balance from balance?

(Multiple Choice)

4.9/5  (34)

(34)

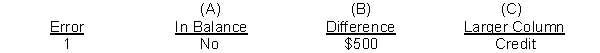

The bookkeeper for Dole Yard Service made a number of errors in journalizing and posting as described below:

1. A debit posting to accounts receivable for $500 was omitted.

2. A payment of accounts payable for $600 was credited to cash and debited to accounts receivable.

3. A credit to accounts receivable for $650 was posted as $65.

4. A cash purchase of equipment for $561 was journalized as a debit to equipment and a credit to notes payable. The credit posting was made for $516.

5. A debit posting of $300 for purchase of supplies was credited to supplies.

6. A debit to insurance expense for $591 was posted as $519.

7. A debit posting for salaries expense for $900 was made twice.

8. A cash purchase of supplies for $700 was journalized and posted as a debit to supplies for $70 and a credit to cash for $70.

Instructions

For each error, indicate (a) whether the trial balance will balance; if the trial balance will not balance, indicate (b) the amount of the difference, and (c) the trial balance column that will have the larger total. Consider each error separately. Use the following form, in which error (1) is given as an example.

(Essay)

4.7/5  (33)

(33)

All business transactions must be entered first in the general ledger.

(True/False)

4.8/5  (36)

(36)

A new account is opened for each transaction entered into by a business firm.

(True/False)

4.9/5  (33)

(33)

Which of the following is incorrect regarding a trial balance?

(Multiple Choice)

4.8/5  (33)

(33)

The account titles used in journalizing transactions need not be identical to the account titles in the ledger.

(True/False)

4.8/5  (42)

(42)

Match the basic step in the recording process described by each of the following statements.

A. Analyze each transaction

B. Enter each transaction in a journal

C. Transfer journal information to ledger accounts

____ 1. This step is called posting.

____ 2. Business documents are examined to determine the effects of transactions on the accounts.

____ 3. This step is called journalizing.

(Short Answer)

4.9/5  (32)

(32)

Wiser Inc. paid cash dividends of $300. The entry for this transaction will include a debit of $300 to

(Multiple Choice)

4.7/5  (30)

(30)

All recordable transactions are initially recorded in the journal. Discuss the contributions that the journal makses to the recording process.

(Essay)

4.8/5  (43)

(43)

Showing 201 - 220 of 223

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)