Exam 3: The Adjusting Process

Exam 1: Introduction to Accounting and Business234 Questions

Exam 2: Analyzing Transactions240 Questions

Exam 3: The Adjusting Process210 Questions

Exam 4: Completing the Accounting Cycle197 Questions

Exam 5: Accounting for Merchandising Businesses233 Questions

Exam 6: Inventories205 Questions

Exam 7: Sarbanes-Oxley, Internal Control, and Cash187 Questions

Exam 8: Receivables196 Questions

Exam 9: Fixed Assets and Intangible Assets226 Questions

Exam 10: Current Liabilities and Payroll194 Questions

Exam 11: Corporations: Organization, Stock Transactions, and Dividends207 Questions

Exam 12: Long-Term Liabilities: Bonds and Notes174 Questions

Exam 13: Investments and Fair Value Accounting167 Questions

Exam 14: Statement of Cash Flows187 Questions

Exam 15: Financial Statement Analysis199 Questions

Exam 16: Managerial Accounting Concepts and Principles202 Questions

Exam 17: Job Order Costing195 Questions

Exam 18: Process Cost Systems198 Questions

Exam 19: Cost Behavior and Cost-Volume-Profit Analysis225 Questions

Exam 20: Variable Costing for Management Analysis160 Questions

Exam 21: Budgeting197 Questions

Exam 22: Performance Evaluation Using Variances From Standard Costs175 Questions

Exam 23: Performance Evaluation for Decentralized Operations217 Questions

Exam 24: Differential Analysis, Product Pricing, and Activity-Based Costing176 Questions

Exam 25: Capital Investment Analysis188 Questions

Exam 26: Cost Allocation and Activity-Based Costing110 Questions

Exam 27: Lean Principles, Lean Accounting, and Activity Analysis137 Questions

Select questions type

Which account would normally not require an adjusting entry?

(Multiple Choice)

4.9/5  (39)

(39)

Using the following account balances for Garry's Tree Service, prepare a trial balance. Cash \ 25000 Supplies 1,000 Accounts Payable 7,000 Common Stock 32,910 Wage Expense 2,000 Machinery 18,350 Wages Payable 3,600 Service Revenue 21,000 Rent Expense 11,500 Unearned Revenue 1,500 Accumulated Depreciation-Machinery 7,340 Prepaid Rent 12,200 Dividends 3,300

(Essay)

4.9/5  (38)

(38)

The difference between the balance of a fixed asset account and the balance of its related accumulated depreciation account is termed the book value of the asset.

(True/False)

4.7/5  (34)

(34)

Ski Master Company pays weekly salaries of $18,000 on Friday for a five-day week ending on that day. Journalize the necessary adjusting entry at the end of the accounting period, assuming that the period ends on Wednesday.

(Essay)

4.9/5  (27)

(27)

The balance in the accumulated depreciation account is the sum of the depreciation expense recorded in past periods.

(True/False)

4.9/5  (34)

(34)

DogMart Company records depreciation for equipment. Depreciation for the period ending December 31 is $1,400 for office equipment and $2,650 for production equipment. Prepare the two entries to record the depreciation.

ِ

(Essay)

4.7/5  (43)

(43)

By ignoring and not posting the adjusting journal entries to the appropriate accounts, net income will always be overstated.

(True/False)

4.7/5  (36)

(36)

A one-year insurance policy was purchased on June 1 for $2,400. The adjusting entry on December 31 would be: Date Description Post. Ref. Debit Credit

(Essay)

4.9/5  (47)

(47)

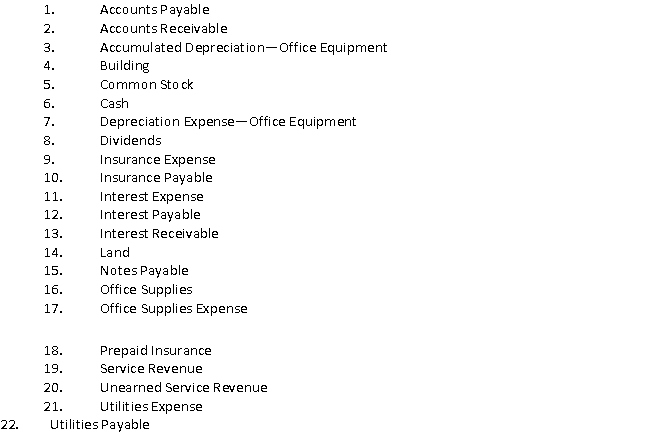

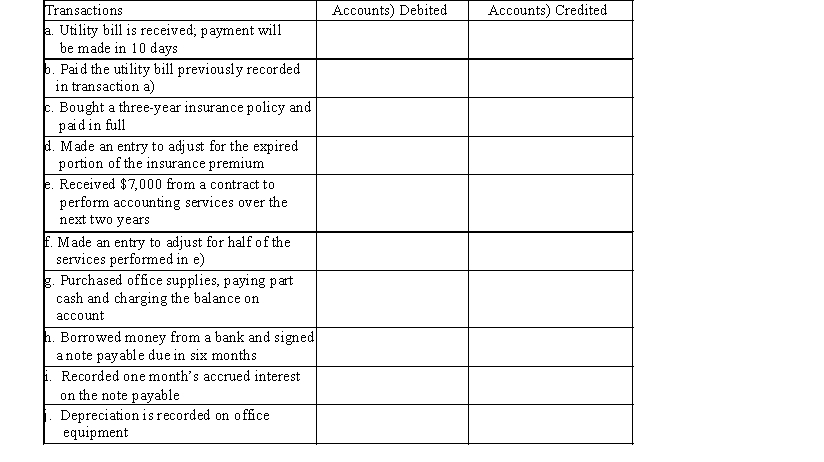

Listed below are accounts to use for transactions a) through j), each identified by a number. Following this list are the transactions. You are to indicate for each transaction the accounts that should be debited and credited by placing the account numbers) in the appropriate box.

(Essay)

4.7/5  (34)

(34)

The balance in the prepaid rent account before adjustment at the end of the year is $32,000, which represents four months' rent paid on December 1. The adjusting entry required on December 31 is

(Multiple Choice)

4.8/5  (37)

(37)

For the year ending December 31, Beard Clinical Supplies Co. mistakenly omitted adjusting entries for 1) $9,800 of unearned revenue that was earned, 2) earned revenue that was not billed of $10,200, and 3) accrued wages of $7,000. Indicate the combined effect of the errors on a) revenues, b) expenses, and c) net income.

(Essay)

4.9/5  (48)

(48)

The systematic allocation of land's cost to expense is called depreciation.

(True/False)

4.7/5  (38)

(38)

For most large businesses, the cash basis of accounting will provide accurate financial statements for user needs.

(True/False)

4.8/5  (30)

(30)

If the adjustment for accrued salaries at the end of the period is inadvertently omitted, both liabilities and stockholders' equity will be understated for the period.

(True/False)

4.8/5  (37)

(37)

The general term used to indicate delaying the recognition of an expense already paid or of a revenue already received is

(Multiple Choice)

4.9/5  (39)

(39)

The balance in the office supplies account on January 1 was $7,000, supplies purchased during January were $3,000, and the supplies on hand at January 30 were $2,000. The amount to be used for the appropriate adjusting entry is

(Multiple Choice)

4.8/5  (41)

(41)

What effect will this adjustment have on the accounting records? Unearned Revenue 6,375 Fees Earned 6,375

(Multiple Choice)

4.9/5  (46)

(46)

The following adjusting journal entry does not include an explanation. Select the best explanation for the entry. Unearned Revenue 7,500 Fees Earned 7,500 ????????????????

(Multiple Choice)

4.7/5  (32)

(32)

Showing 101 - 120 of 210

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)