Exam 4: Completing the Accounting Cycle

Exam 1: Introduction to Accounting and Business234 Questions

Exam 2: Analyzing Transactions240 Questions

Exam 3: The Adjusting Process210 Questions

Exam 4: Completing the Accounting Cycle197 Questions

Exam 5: Accounting for Merchandising Businesses233 Questions

Exam 6: Inventories205 Questions

Exam 7: Sarbanes-Oxley, Internal Control, and Cash187 Questions

Exam 8: Receivables196 Questions

Exam 9: Fixed Assets and Intangible Assets226 Questions

Exam 10: Current Liabilities and Payroll194 Questions

Exam 11: Corporations: Organization, Stock Transactions, and Dividends207 Questions

Exam 12: Long-Term Liabilities: Bonds and Notes174 Questions

Exam 13: Investments and Fair Value Accounting167 Questions

Exam 14: Statement of Cash Flows187 Questions

Exam 15: Financial Statement Analysis199 Questions

Exam 16: Managerial Accounting Concepts and Principles202 Questions

Exam 17: Job Order Costing195 Questions

Exam 18: Process Cost Systems198 Questions

Exam 19: Cost Behavior and Cost-Volume-Profit Analysis225 Questions

Exam 20: Variable Costing for Management Analysis160 Questions

Exam 21: Budgeting197 Questions

Exam 22: Performance Evaluation Using Variances From Standard Costs175 Questions

Exam 23: Performance Evaluation for Decentralized Operations217 Questions

Exam 24: Differential Analysis, Product Pricing, and Activity-Based Costing176 Questions

Exam 25: Capital Investment Analysis188 Questions

Exam 26: Cost Allocation and Activity-Based Costing110 Questions

Exam 27: Lean Principles, Lean Accounting, and Activity Analysis137 Questions

Select questions type

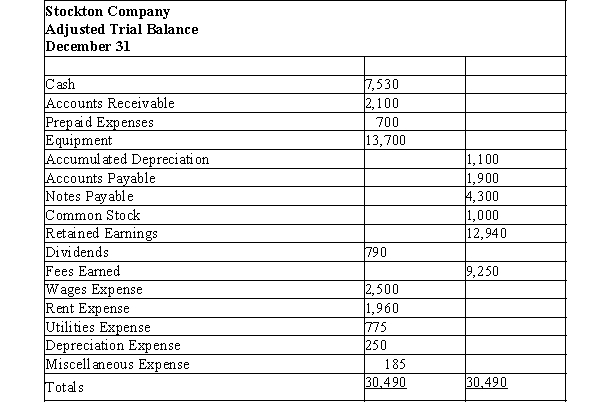

Use the adjusted trial balance for Stockton Company below to answer the questions that follow.  -Determine total assets.

-Determine total assets.

(Multiple Choice)

4.9/5  (43)

(43)

Any twelve-month accounting period adopted by a company is known as its fiscal year.

(True/False)

4.9/5  (36)

(36)

The accumulated depreciation account is closed to the income summary account.

(True/False)

4.8/5  (44)

(44)

If the totals of the Income Statement debit and credit columns of a work sheet are $27,000 and $29,000, respectively, after all account balances have been extended, the amount of the net loss is $2,000.

(True/False)

4.8/5  (38)

(38)

Accrued revenues are ordinarily listed on the balance sheet as current liabilities.

(True/False)

4.9/5  (38)

(38)

Match each journal entry that follows as one of the types of journal entries a-c) below.

-Wages Expense 870

Wages Payable 870

(Multiple Choice)

4.8/5  (37)

(37)

After posting the second closing entry to the income summary account, the balance will be equal to

(Multiple Choice)

4.7/5  (42)

(42)

A post-closing trial balance should be prepared before the financial statements are prepared.

(True/False)

4.9/5  (35)

(35)

When the end-of-period spreadsheet is complete, the adjustment columns should have

(Multiple Choice)

4.9/5  (37)

(37)

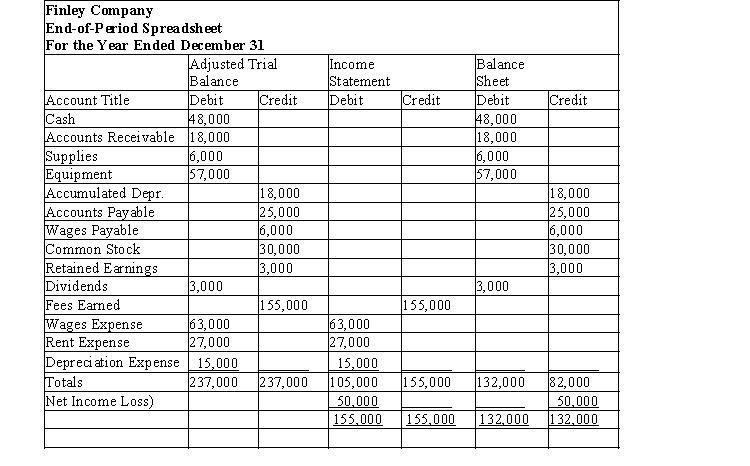

Use this end-of-period spreadsheet to answer the questions that follow.  -The journal entry to close revenues would be:

-The journal entry to close revenues would be:

(Multiple Choice)

4.9/5  (32)

(32)

After net income is entered on the end-of-period spreadsheet, the Balance Sheet Debit and Credit columns must

(Multiple Choice)

4.8/5  (39)

(39)

It is not necessary to post the closing entries to the general ledger.

(True/False)

4.8/5  (40)

(40)

Once the adjusted trial balance is in balance, the flow of accounts will now go into the financial statements.

(True/False)

4.8/5  (36)

(36)

The difference between the totals of the debit and credit columns of the Adjusted Trial Balance columns on the end-of-period spreadsheet

(Multiple Choice)

4.9/5  (36)

(36)

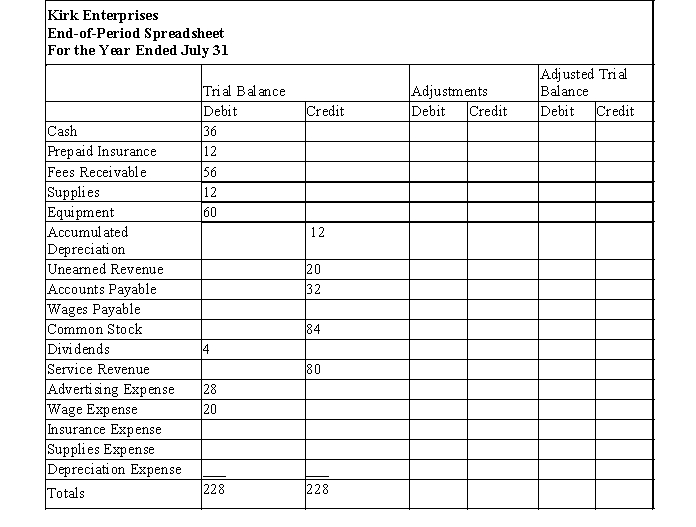

Kirk Enterprises offers rug cleaning services to business clients. Below is the adjustments data for the year ended July 31. Using this information along with the spreadsheet below, record the adjusting entries in proper general journal form.

Adjustments:

a) The equipment is estimated to last for 5 years with no salvage value. The asset will be depreciated evenly over its useful life. Record one month's depreciation.

b) Accrued wages, $2.

c) Unused supplies on hand, $8.

d) Of the unearned revenue, 75% has been earned.

e) Unexpired insurance remaining at the end of the month, $9.

(Essay)

4.8/5  (24)

(24)

You have just accepted your first job out of college, which requires you to evaluate loan requests at Eastwood National Bank. The first loan request you receive is from Richard Enterprises. Richard Tracy, the CEO, is requesting $105,000 and brings you the following trial balance or statement of accounts) for the first year of operations ended December 31.

What three accounts do you think should be relabeled for greater clarity? Richard Enterprises

Statement of Accounts

December 31

Cash \ 2,050 Billings Due from Others 15,070 Office Supplies 7,470 Trucks 36,370 Equipment 8,090 Amounts Owed to Others \ 2,850 Investment in Business 33,500 Service Revenues 73,650 Wages Expense 30,050 Rent Expense 7,330 Insurance Expense 2,400 Utilities Expenses 700 Miscell aneous Expenses 470 Totals \ 110,000 \ 110,000

(Essay)

4.9/5  (35)

(35)

Showing 41 - 60 of 197

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)