Exam 6: Inventories

Exam 1: Introduction to Accounting and Business234 Questions

Exam 2: Analyzing Transactions240 Questions

Exam 3: The Adjusting Process210 Questions

Exam 4: Completing the Accounting Cycle197 Questions

Exam 5: Accounting for Merchandising Businesses233 Questions

Exam 6: Inventories205 Questions

Exam 7: Sarbanes-Oxley, Internal Control, and Cash187 Questions

Exam 8: Receivables196 Questions

Exam 9: Fixed Assets and Intangible Assets226 Questions

Exam 10: Current Liabilities and Payroll194 Questions

Exam 11: Corporations: Organization, Stock Transactions, and Dividends207 Questions

Exam 12: Long-Term Liabilities: Bonds and Notes174 Questions

Exam 13: Investments and Fair Value Accounting167 Questions

Exam 14: Statement of Cash Flows187 Questions

Exam 15: Financial Statement Analysis199 Questions

Exam 16: Managerial Accounting Concepts and Principles202 Questions

Exam 17: Job Order Costing195 Questions

Exam 18: Process Cost Systems198 Questions

Exam 19: Cost Behavior and Cost-Volume-Profit Analysis225 Questions

Exam 20: Variable Costing for Management Analysis160 Questions

Exam 21: Budgeting197 Questions

Exam 22: Performance Evaluation Using Variances From Standard Costs175 Questions

Exam 23: Performance Evaluation for Decentralized Operations217 Questions

Exam 24: Differential Analysis, Product Pricing, and Activity-Based Costing176 Questions

Exam 25: Capital Investment Analysis188 Questions

Exam 26: Cost Allocation and Activity-Based Costing110 Questions

Exam 27: Lean Principles, Lean Accounting, and Activity Analysis137 Questions

Select questions type

1. Explain the effect of the following on the financial statements:

Goods held on consignment were included in the ending inventory count.

Goods purchased FOB shipping point were in transit on the last day of the year. The goods were not counted as part of ending inventory.

Goods sold FOB shipping point were in transit on the last day of the year. These goods were not counted as part of ending inventory.

2. What happens if inventory errors are not found and corrected?

(Essay)

4.7/5  (36)

(36)

All of the following are documents used for inventory control except

(Multiple Choice)

5.0/5  (25)

(25)

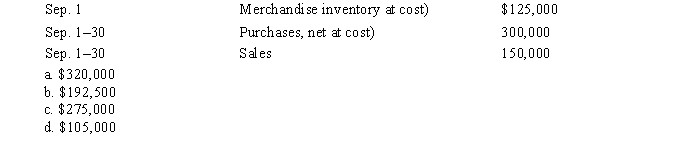

If the estimated rate of gross profit is 30%, what is the estimated cost of the merchandise inventory on September 30, based on the following data?

(Short Answer)

5.0/5  (41)

(41)

Which of the following measures the relationship between cost of merchandise sold and the amount of inventory carried during the period?

(Multiple Choice)

4.9/5  (40)

(40)

Assume that three identical units of merchandise were purchased during October, as follows: Units Cost October 5 Purchase 1 \ 5 12 Purchase 1 13 28 Purchase 1 15 Total \ 33 Assume one unit is sold on October 31 for $28. Determine cost of merchandise sold, gross profit, and ending inventory under the average cost method.

(Essay)

4.8/5  (33)

(33)

When using the FIFO inventory costing method, the most recent costs are assigned to the cost of merchandise sold.

(True/False)

4.8/5  (38)

(38)

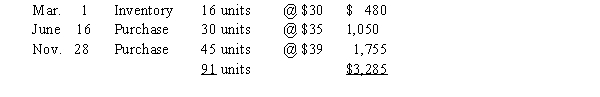

The units of Manganese Plus available for sale during the year were as follows:

There are 15 units of the product in the physical inventory at November 30. The periodic inventory system is used. Determine the difference in gross profit between the LIFO and FIFO inventory cost systems.

There are 15 units of the product in the physical inventory at November 30. The periodic inventory system is used. Determine the difference in gross profit between the LIFO and FIFO inventory cost systems.

(Essay)

4.7/5  (34)

(34)

The firm uses the periodic system and there are 20 units of the commodity on hand at the end of the year. What is the amount of inventory at the end of the year rounded to nearest dollar according to the average cost method?

(Multiple Choice)

4.8/5  (33)

(33)

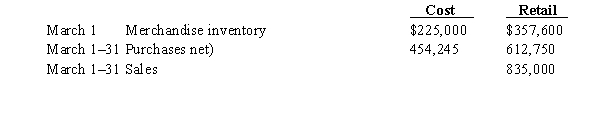

Based on the following data, calculate the estimated cost of the merchandise inventory on March 31 using the retail method.

(Essay)

4.8/5  (41)

(41)

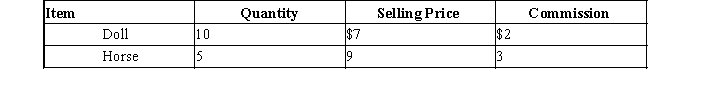

Determine the total value of the merchandise using net realizable value.

(Essay)

4.8/5  (39)

(39)

When using a perpetual inventory system, the journal entry to record the cost of merchandise sold is:

(Multiple Choice)

4.9/5  (42)

(42)

Which document authorizes the purchase of the inventory from an approved vendor?

(Multiple Choice)

4.8/5  (24)

(24)

The use of the lower-of-cost-or-market method of inventory valuation increases net income for the period in which the inventory replacement price declined.

(True/False)

4.8/5  (38)

(38)

Use the information below to answer the following questions.

The Boxwood Company sells blankets for $60 each. The following was taken from the inventory records during May. The company had no beginning inventory on May 1. Date Blankets Units Cost May 3 Purchase 5 \ 20 10 Sale 3 17 Purchase 10 \ 24 20 Sale 6 23 Sale 3 30 Purchase 10 \ 30

-Assuming that the company uses the perpetual inventory system, determine the ending inventory for the month of May using the LIFO inventory cost method.

(Multiple Choice)

4.8/5  (35)

(35)

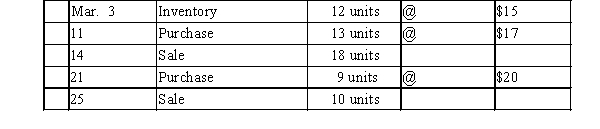

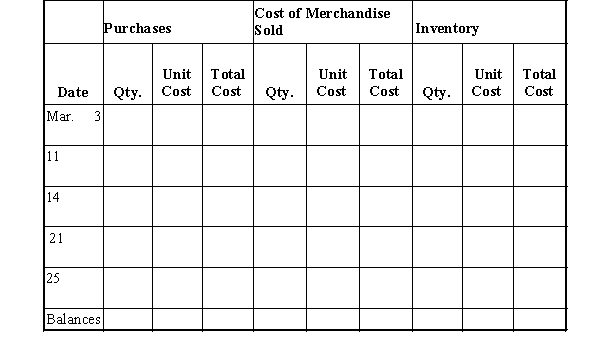

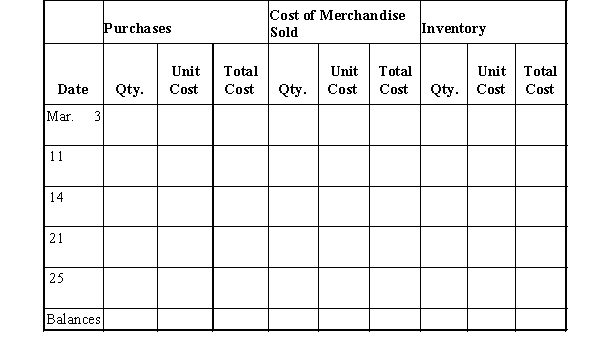

Beginning inventory, purchases, and sales data for hammers are as follows:  Assuming the business maintains a perpetual inventory system, complete the inventory cards and calculate the cost of merchandise sold and ending inventory under the following assumptions:

a) First-in, first-out

Assuming the business maintains a perpetual inventory system, complete the inventory cards and calculate the cost of merchandise sold and ending inventory under the following assumptions:

a) First-in, first-out  b) Last-in, first-out

b) Last-in, first-out

(Essay)

4.9/5  (40)

(40)

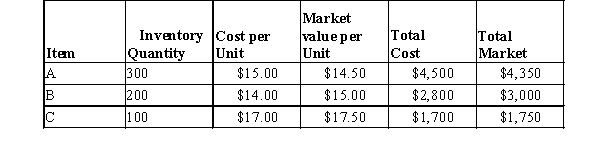

Applying the lower of cost or market to each item of inventory, what should the total inventory value be for the following items?

(Essay)

4.9/5  (31)

(31)

Control of inventory should begin as soon as the inventory is received. Which of the following internal control steps is not done to meet this goal?

(Multiple Choice)

4.9/5  (37)

(37)

If Beginning Inventory BI) + Purchases P) - Ending Inventory EI) = Cost of Merchandise Sold COMS), an equivalent equation can be written as

(Multiple Choice)

4.8/5  (29)

(29)

Showing 81 - 100 of 205

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)