Exam 20: Variable Costing for Management Analysis

Exam 1: Introduction to Accounting and Business234 Questions

Exam 2: Analyzing Transactions240 Questions

Exam 3: The Adjusting Process210 Questions

Exam 4: Completing the Accounting Cycle197 Questions

Exam 5: Accounting for Merchandising Businesses233 Questions

Exam 6: Inventories205 Questions

Exam 7: Sarbanes-Oxley, Internal Control, and Cash187 Questions

Exam 8: Receivables196 Questions

Exam 9: Fixed Assets and Intangible Assets226 Questions

Exam 10: Current Liabilities and Payroll194 Questions

Exam 11: Corporations: Organization, Stock Transactions, and Dividends207 Questions

Exam 12: Long-Term Liabilities: Bonds and Notes174 Questions

Exam 13: Investments and Fair Value Accounting167 Questions

Exam 14: Statement of Cash Flows187 Questions

Exam 15: Financial Statement Analysis199 Questions

Exam 16: Managerial Accounting Concepts and Principles202 Questions

Exam 17: Job Order Costing195 Questions

Exam 18: Process Cost Systems198 Questions

Exam 19: Cost Behavior and Cost-Volume-Profit Analysis225 Questions

Exam 20: Variable Costing for Management Analysis160 Questions

Exam 21: Budgeting197 Questions

Exam 22: Performance Evaluation Using Variances From Standard Costs175 Questions

Exam 23: Performance Evaluation for Decentralized Operations217 Questions

Exam 24: Differential Analysis, Product Pricing, and Activity-Based Costing176 Questions

Exam 25: Capital Investment Analysis188 Questions

Exam 26: Cost Allocation and Activity-Based Costing110 Questions

Exam 27: Lean Principles, Lean Accounting, and Activity Analysis137 Questions

Select questions type

If variable selling and administrative expenses totaled $124,000 for the year 80,000 units at $1.55 each) and the planned variable selling and administrative expenses totaled $136,500 78,000 units at $1.75 each), the effect of the quantity factor on the change in contribution margin is:

(Multiple Choice)

4.8/5  (28)

(28)

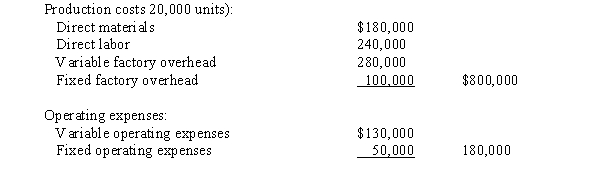

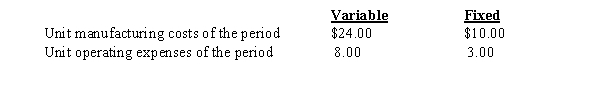

A business operated at 100% of capacity during its first month and incurred the following costs:  If 1,500 units remain unsold at the end of the month, what is the amount of inventory that would be reported on the variable costing balance sheet?

If 1,500 units remain unsold at the end of the month, what is the amount of inventory that would be reported on the variable costing balance sheet?

(Multiple Choice)

4.8/5  (44)

(44)

In which of the following types of firms would it be appropriate to prepare contribution margin reporting and analysis?

(Multiple Choice)

4.7/5  (42)

(42)

In evaluating the performance of salespersons, the salesperson with the highest level of sales should be evaluated as the best performer.

(True/False)

4.9/5  (37)

(37)

A business operated at 100% of capacity during its first month and incurred the following costs:  If 1,000 units remain unsold at the end of the month, what is the amount of inventory that would be reported on the absorption costing balance sheet?

If 1,000 units remain unsold at the end of the month, what is the amount of inventory that would be reported on the absorption costing balance sheet?

(Multiple Choice)

5.0/5  (40)

(40)

It would be acceptable to have the selling price of a product just above the variable costs and expenses of making and selling it in:

(Multiple Choice)

4.7/5  (36)

(36)

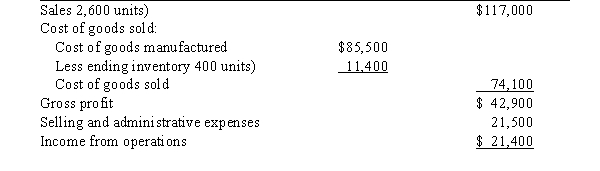

On October 31, the end of the first month of operations, Morristown & Co. prepared the following income statement based on absorption costing:

Morristown & Co.

Absorption Costing Income Statement

For Month Ended October 31, 20-  If the fixed manufacturing costs were $42,900 and the variable selling and administrative expenses were $14,600, prepare an income statement using variable costing.

If the fixed manufacturing costs were $42,900 and the variable selling and administrative expenses were $14,600, prepare an income statement using variable costing.

(Essay)

4.9/5  (40)

(40)

Fixed factory overhead costs are included as part of the cost of products manufactured under the absorption costing concept.

(True/False)

4.9/5  (42)

(42)

The amount of income under absorption costing will be more than the amount of income under variable costing when units manufactured:

(Multiple Choice)

5.0/5  (39)

(39)

For a period during which the quantity of inventory at the end was smaller than that at the beginning, income from operations reported under variable costing will be smaller than income from operations reported under absorption costing.

(True/False)

4.7/5  (39)

(39)

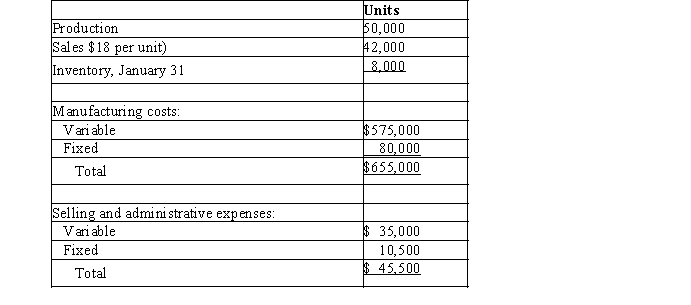

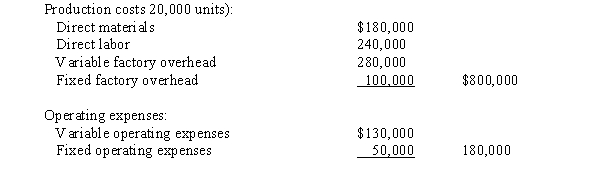

On January 1 of the current year, Townsend Co. commenced operations. It operated its plant at 100% of capacity during January. The following data summarized the results for January:  a) Prepare an income statement using absorption costing.

b) Prepare an income statement using variable costing.

a) Prepare an income statement using absorption costing.

b) Prepare an income statement using variable costing.

(Essay)

4.7/5  (34)

(34)

The systematic examination of the differences between planned and actual contribution margin is

(Multiple Choice)

4.7/5  (36)

(36)

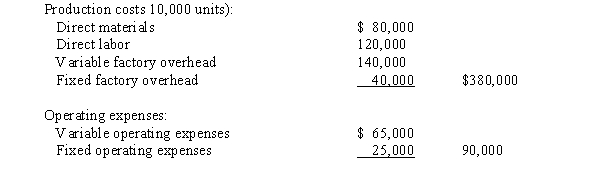

The level of inventory of a manufactured product has increased by 5,000 units during a period. The following data are also available:  What would be the effect on income from operations if variable costing is used rather than absorption costing?

What would be the effect on income from operations if variable costing is used rather than absorption costing?

(Multiple Choice)

4.8/5  (39)

(39)

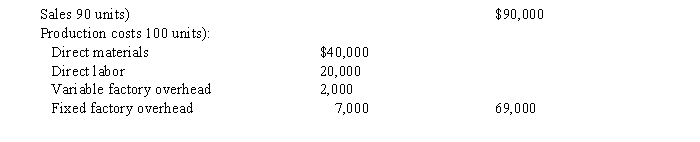

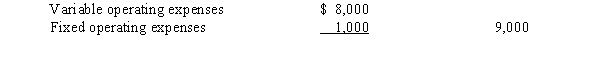

A business operated at 100% of capacity during its first month, with the following results:  Operating expenses:

Operating expenses:  -What is the amount of the income from operations that would be reported on the absorption costing income statement?

-What is the amount of the income from operations that would be reported on the absorption costing income statement?

(Multiple Choice)

4.9/5  (48)

(48)

In contribution margin analysis, the unit price or unit cost factor is computed as the difference between the actual unit price or unit cost and the planned unit price or unit cost, multiplied by the actual quantity sold.

(True/False)

5.0/5  (35)

(35)

In contribution margin analysis, the unit price or unit cost factor is computed as:

(Multiple Choice)

4.7/5  (32)

(32)

Under absorption costing, the cost of finished goods includes only direct materials, direct labor, and variable factory overhead.

(True/False)

4.9/5  (27)

(27)

A business operated at 100% of capacity during its first month and incurred the following costs:  If 1,600 units remain unsold at the end of the month, what is the amount of inventory that would be reported on the variable costing balance sheet?

If 1,600 units remain unsold at the end of the month, what is the amount of inventory that would be reported on the variable costing balance sheet?

(Multiple Choice)

4.9/5  (41)

(41)

If variable manufacturing costs are $15 per unit and total fixed manufacturing costs are $200,000, what is the manufacturing cost per unit if:

a) 20,000 units are manufactured and the company uses the variable costing concept?

b) 25,000 units are manufactured and the company uses the variable costing concept?

c) 20,000 units are manufactured and the company uses the absorption costing concept?

d) 25,000 units are manufactured and the company used the absorption costing concept?

(Essay)

4.8/5  (36)

(36)

Ford's Expedition sport utility vehicle is its most profitable model. Therefore, Ford need not promote its Expedition model anymore.

(True/False)

4.9/5  (31)

(31)

Showing 141 - 160 of 160

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)