Exam 24: Differential Analysis, Product Pricing, and Activity-Based Costing

Exam 1: Introduction to Accounting and Business234 Questions

Exam 2: Analyzing Transactions240 Questions

Exam 3: The Adjusting Process210 Questions

Exam 4: Completing the Accounting Cycle197 Questions

Exam 5: Accounting for Merchandising Businesses233 Questions

Exam 6: Inventories205 Questions

Exam 7: Sarbanes-Oxley, Internal Control, and Cash187 Questions

Exam 8: Receivables196 Questions

Exam 9: Fixed Assets and Intangible Assets226 Questions

Exam 10: Current Liabilities and Payroll194 Questions

Exam 11: Corporations: Organization, Stock Transactions, and Dividends207 Questions

Exam 12: Long-Term Liabilities: Bonds and Notes174 Questions

Exam 13: Investments and Fair Value Accounting167 Questions

Exam 14: Statement of Cash Flows187 Questions

Exam 15: Financial Statement Analysis199 Questions

Exam 16: Managerial Accounting Concepts and Principles202 Questions

Exam 17: Job Order Costing195 Questions

Exam 18: Process Cost Systems198 Questions

Exam 19: Cost Behavior and Cost-Volume-Profit Analysis225 Questions

Exam 20: Variable Costing for Management Analysis160 Questions

Exam 21: Budgeting197 Questions

Exam 22: Performance Evaluation Using Variances From Standard Costs175 Questions

Exam 23: Performance Evaluation for Decentralized Operations217 Questions

Exam 24: Differential Analysis, Product Pricing, and Activity-Based Costing176 Questions

Exam 25: Capital Investment Analysis188 Questions

Exam 26: Cost Allocation and Activity-Based Costing110 Questions

Exam 27: Lean Principles, Lean Accounting, and Activity Analysis137 Questions

Select questions type

A practical approach that is frequently used by managers when setting normal long-run prices is the

(Multiple Choice)

4.8/5  (32)

(32)

Make-or-buy decisions should be made only with related parties.

(True/False)

4.8/5  (41)

(41)

Starling Co. is considering disposing of a machine with a book value of $12,500 and estimated remaining life of five years. The old machine can be sold for $1,500. A new high-speed machine can be purchased at a cost of $25,000. It will have a useful life of five years and no residual value. It is estimated that the annual variable manufacturing costs will be reduced from $26,000 to $23,500 if the new machine is purchased. The total net differential increase or decrease in cost for the new equipment for the entire five years is

(Multiple Choice)

4.9/5  (40)

(40)

Assuming that Widgeon Co. can sell all of the products it can make, what is the maximum contribution margin it can earn per month?

(Multiple Choice)

4.7/5  (43)

(43)

An unfinished desk is produced for $36.00 and sold for $65.00. A finished desk can be sold for $75.00. The additional processing cost to complete the finished desk is $5.95. Provide a differential analysis for further processing.

(Essay)

4.8/5  (29)

(29)

Keating Co. is considering disposing of equipment that cost $50,000 and has $40,000 of accumulated depreciation to date. Keating Co. can sell the equipment through a broker for $25,000 less 5% commission. Alternatively, Gunner Co. has offered to lease the equipment for five years for a total of $48,750. Keating will incur repair, insurance, and property tax expenses estimated at $8,000 over the five-year period. At lease-end, the equipment is expected to have no residual value. The net differential income from the lease alternative is

(Multiple Choice)

4.8/5  (35)

(35)

Differential analysis only considers the short-term one-year) effects of discontinuing a product.

(True/False)

4.8/5  (40)

(40)

Match the definitions that follow with the term a-e) it defines.

-Only includes the costs of manufacturing in product cost per unit

(Multiple Choice)

4.7/5  (39)

(39)

Match each of the definitions that follow with the term a-e) it defines.

-Variable manufacturing costs plus variable selling and administrative costs are included in cost per unit

(Multiple Choice)

4.7/5  (44)

(44)

Mallard Corporation uses the product cost concept of product pricing. Below is cost information for the production and sale of 45,000 units of its sole product. Mallard desires a profit equal to a 12% rate of return on invested assets of $800,000. Fixed factory overhead cost \ 82,000 Fixed selling and administrative costs 45,000 Variable direct materials cost per unit 5.50 Variable direct labor cost per unit 7.65 Variable factory overhead cost per unit 2.25 Variable selling and administrative cost per unit 0.90

-What pricing concept considers the price that other providers charge for the same product?

(Multiple Choice)

4.8/5  (34)

(34)

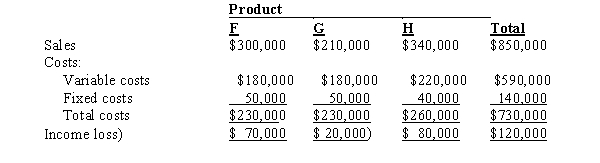

The condensed income statement for a Fletcher Inc. for the past year is as follows:  Management is considering the discontinuance of the manufacture and sale of Product G at the beginning of the current year. The discontinuance would have no effect on the total fixed costs and expenses or on the sales of Products F and H. What is the amount of change in net income for the current year that will result from the discontinuance of Product G?

Management is considering the discontinuance of the manufacture and sale of Product G at the beginning of the current year. The discontinuance would have no effect on the total fixed costs and expenses or on the sales of Products F and H. What is the amount of change in net income for the current year that will result from the discontinuance of Product G?

(Multiple Choice)

4.8/5  (35)

(35)

The Eastwood Cake Factory sells chocolate cakes, birthday decorated cakes, and specialty cakes. The factory is experiencing a bottleneck and is trying to determine which cake is more profitable. Even though the company may have to limit the orders that it takes, Eastwood is concerned about customer service and satisfaction. Chocolate Cake Birthday Cake Specialty Cake Sales price \ 20.00 \ 45.00 \ 60.00 Variable cost per cake \ 5.00 \ 12.00 \ 20.00 Hours needed to bake, frost, and decorate 1 hour 2.5 hour 2 hour a) Calculate the contribution margin per hour per cake.

b) Determine which cakes the company should try to sell more of first, second, and then last.

(Essay)

4.8/5  (40)

(40)

Farris Company is considering a cash outlay of $500,000 for the purchase of land, which it could lease out for $40,000 per year. If alternative investments are available that yield a 15% return, the opportunity cost of the purchase of the land is

(Multiple Choice)

4.7/5  (43)

(43)

Match the definitions that follow with the term a-e) it defines.

-Sets the price according to demand

(Multiple Choice)

4.8/5  (36)

(36)

In deciding whether to accept business at a special price, the short-run price should be set high enough to cover all variable costs and expenses.

(True/False)

4.8/5  (39)

(39)

Ptarmigan Company produces two products. Product A has a contribution margin of $20 and requires 4 machine hours. Product B has a contribution margin of $18 and requires 3 machine hours. Determine the most profitable product assuming the machine hours are the constraint.

(Essay)

4.7/5  (33)

(33)

Showing 101 - 120 of 176

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)