Exam 7: Reporting and Interpreting Inventories and Cost of Goods Sold

Exam 1: Business Decisions and Financial Accounting135 Questions

Exam 2: Reporting Investing and Financing Results on the Balance Sheet126 Questions

Exam 3: Reporting Operating Results on the Income Statement137 Questions

Exam 4: Adjustments, Financial Statements, and Financial Results138 Questions

Exam 5: Financial Reporting and Analysis140 Questions

Exam 6: Internal Control and Financial Reporting for Cash and Merchandise Sales131 Questions

Exam 7: Reporting and Interpreting Inventories and Cost of Goods Sold138 Questions

Exam 8: Reporting and Interpreting Receivables, Bad Debt Expense, and Interest Revenue140 Questions

Exam 9: Reporting and Interpreting Long-Lived Tangible and Intangible Assets141 Questions

Exam 10: Reporting and Interpreting Liabilities133 Questions

Exam 11: Reporting and Interpreting Stockholders Equity142 Questions

Exam 12: Reporting and Interpreting the Statement of Cash Flows143 Questions

Exam 13: Measuring and Evaluating Financial Performance143 Questions

Select questions type

Which of the following will occur when inventory costs are decreasing?

(Multiple Choice)

4.9/5  (30)

(30)

In a period of rising prices, the inventory costing method that will cause the company to have the lowest cost of goods sold is

(Multiple Choice)

4.7/5  (31)

(31)

Last year bell-bottom jeans were fashionable and this year bootcut jeans are. A retail company's inventory has 375 bell-bottom jeans that cost $17 each and could be replaced for $15. The inventory also includes 1,000 bootcut jeans that cost $16 each and could be replaced for $19. Explain why this situation requires an adjustment to the accounting records, prepare the journal entry that would be used to make the adjustment, and show the effects of the adjustment on the accounting equation.

(Essay)

4.9/5  (33)

(33)

Generally accepted accounting principles (GAAP) require that the inventory be reported at:

(Multiple Choice)

4.9/5  (45)

(45)

The assignment of costs to cost of goods sold and to inventory using the weighted average method usually yields different results depending on whether a perpetual or a periodic system was used.

(True/False)

4.8/5  (38)

(38)

For a manufacturer, inventory turnover refers to how many times:

(Multiple Choice)

4.8/5  (30)

(30)

In a period of rising prices, the inventory costing method that will cause the company to have the lowest income taxes is

(Multiple Choice)

4.7/5  (39)

(39)

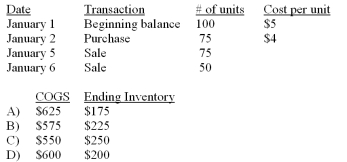

Maxell Company uses the periodic FIFO method to assign costs to inventory and cost of goods sold. Given the following information, what would be reported as the cost of goods sold (COGS) and ending inventory balances for the period?

(Multiple Choice)

4.9/5  (28)

(28)

How long on average does it take to sell something from inventory after it is purchased?

(Multiple Choice)

4.8/5  (46)

(46)

The lower the inventory turnover ratio, the more efficiently the company manages its inventory, all other things equal.

(True/False)

4.8/5  (43)

(43)

Specific identification is the best inventory costing method because it is least open to manipulation by unscrupulous managers.

(True/False)

4.9/5  (39)

(39)

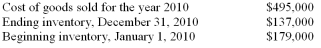

Use the following information to determine the amount of purchases for the period.

(Multiple Choice)

4.7/5  (37)

(37)

If the company uses the LIFO method, what is the cost of its ending inventory?

(Multiple Choice)

4.8/5  (27)

(27)

Which of the following would be in the raw materials inventory of a company making cheese?

(Multiple Choice)

4.8/5  (34)

(34)

A rising balance in the inventory account and a falling inventory turnover ratio implies that the inventory build up is occurring because:

(Multiple Choice)

4.9/5  (27)

(27)

LIFO is preferred when costs are rising and managers have incentives to report higher income because of bonus plans and job security.

(True/False)

4.7/5  (41)

(41)

The inventory costing method that results in the lowest taxable income in a period of inflation is the LIFO

method.

(True/False)

4.9/5  (33)

(33)

Showing 21 - 40 of 138

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)