Exam 7: Reporting and Interpreting Inventories and Cost of Goods Sold

Exam 1: Business Decisions and Financial Accounting135 Questions

Exam 2: Reporting Investing and Financing Results on the Balance Sheet126 Questions

Exam 3: Reporting Operating Results on the Income Statement137 Questions

Exam 4: Adjustments, Financial Statements, and Financial Results138 Questions

Exam 5: Financial Reporting and Analysis140 Questions

Exam 6: Internal Control and Financial Reporting for Cash and Merchandise Sales131 Questions

Exam 7: Reporting and Interpreting Inventories and Cost of Goods Sold138 Questions

Exam 8: Reporting and Interpreting Receivables, Bad Debt Expense, and Interest Revenue140 Questions

Exam 9: Reporting and Interpreting Long-Lived Tangible and Intangible Assets141 Questions

Exam 10: Reporting and Interpreting Liabilities133 Questions

Exam 11: Reporting and Interpreting Stockholders Equity142 Questions

Exam 12: Reporting and Interpreting the Statement of Cash Flows143 Questions

Exam 13: Measuring and Evaluating Financial Performance143 Questions

Select questions type

A merchandise company's beginning inventory plus merchandise purchases minus ending inventory equals:

(Multiple Choice)

4.8/5  (40)

(40)

In each accounting period, a manager can select the inventory costing method that yields the most positive net income.

(True/False)

4.9/5  (38)

(38)

An adjustment to ending inventory under the lower of cost or market (LCM) rule would be least likely to be recorded by a company that sells:

(Multiple Choice)

4.7/5  (41)

(41)

Given the following information for Maynor Company in 2011, calculate the company's ending inventory, cost of goods sold and gross profit, using the following inventory costing methods, assuming the company uses a periodic inventory system:

a) Weighted Average

b) FIFO

c) LIFO

d) Specific Identification. (The ending inventory consisted of 15 @ $66; 10 @ $70; and 5 @ $76.)

(Essay)

4.9/5  (28)

(28)

Your company has 100 units in inventory, purchased at $16 per unit, that could be replaced for $14.

(Multiple Choice)

4.8/5  (36)

(36)

A company had been selling its product for $20 per unit, but recently lowered the selling price to $15 per unit. The company's current inventory consists of 200 units purchased at $16 per unit. The replacement cost of this merchandise is currently $13 per unit. At what amount should the company's inventory to be reported on the balance sheet under the lower of cost or market rule?

(Multiple Choice)

4.9/5  (42)

(42)

If a firm's beginning inventory is $35,000, goods purchased during the period cost $120,000, and the cost of goods sold for the period is $140,000, what is the amount of the ending inventory?

(Multiple Choice)

4.8/5  (40)

(40)

If the market value of goods in inventory falls to $26,000 below its cost, the company should:

(Multiple Choice)

4.9/5  (31)

(31)

Which of the following statements regarding the calculations used for the weighted average inventory costing method is true?

(Multiple Choice)

4.8/5  (43)

(43)

A merchandise company's beginning inventory plus merchandise purchases equals:

(Multiple Choice)

4.9/5  (41)

(41)

Goods on consignment are goods shipped by the owner to another company that holds the goods and sells them for the owner.

(True/False)

4.8/5  (39)

(39)

Which of the following would cause the greatest increase in a company's inventory turnover ratio?

(Multiple Choice)

4.8/5  (37)

(37)

Alphabet Company buys different letters for resale. It buys A thru G on January 1 at $4 per letter, and sells A and E on January 15. On February 1, it buys H thru L at $6 per letter and sells D, H and J on February 9. It then buys M thru R on March 1 at $7 per letter and sells N on March 19. If the company uses the LIFO method on a perpetual basis, what is the cost of its ending inventory (rounded to the nearest dollar)?

(Multiple Choice)

4.8/5  (30)

(30)

Company X uses LIFO while its main competitor, Company Y, uses FIFO. Which of the following statements is true?

(Multiple Choice)

4.9/5  (38)

(38)

When the lower of cost or market (LCM) rule requires an inventory adjustment:

(Multiple Choice)

4.8/5  (30)

(30)

Which of the following statements regarding comparisons made in managing inventory is not true?

(Multiple Choice)

5.0/5  (31)

(31)

The inventory costing method that identifies the invoice cost of each item in the ending inventory in order to determine the cost assigned to inventory is the specific identification method.

(True/False)

4.8/5  (39)

(39)

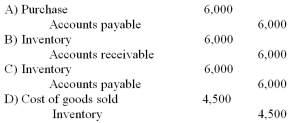

On July 1,B. Darin Company sold merchandise costing $4,500 to S. Dee Company for $6,000, terms 2/10, n/30. Both companies use a perpetual inventory system. What is the journal entry that S. Dee Company will make on July 1?

(Multiple Choice)

4.8/5  (36)

(36)

Showing 81 - 100 of 138

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)