Exam 18: Comparative Forms of Doing Business

Exam 1: Introduction to Taxation98 Questions

Exam 2: Working With the Tax Law102 Questions

Exam 3: Taxes on the Financial Statements68 Questions

Exam 4: Gross Income96 Questions

Exam 5: Business Deductions208 Questions

Exam 6: Losses and Loss Limitations185 Questions

Exam 7: Property Transactions: Basis, Gain and Loss, and Nontaxable Exchanges118 Questions

Exam 8: Property Transactions: Capital Gains and Losses109 Questions

Exam 9: Individuals As the Taxpayer105 Questions

Exam 10: Individuals: Income, Deductions, and Credits119 Questions

Exam 11: Individuals As Employees and Proprietors131 Questions

Exam 12: Corporations: Organization, Capital Structure, and Operating Rules128 Questions

Exam 13: Corporations: Earnings and Profits and Distributions125 Questions

Exam 14: Partnerships and Limited Liability Entities122 Questions

Exam 15: S Corporations118 Questions

Exam 16: Multijurisdictional Taxation145 Questions

Exam 17: Business Tax Credits and the Alternative Minimum Tax132 Questions

Exam 18: Comparative Forms of Doing Business97 Questions

Select questions type

The AMT tax rate for a C corporation is greater than the regular tax rate for C corporations.

(True/False)

4.8/5  (35)

(35)

Lime, Inc., has taxable income of $334,000.If Lime is a C corporation, its tax liability is $66,800.

(True/False)

4.9/5  (35)

(35)

Tuan and Ella are going to establish a business.They expect the business to be very successful in the long-run, but project losses of approximately $100,000 for each of the first five years.Due to potential environmental concerns, limited liability is a requisite for the owners.Which form of business entity should they select?

(Multiple Choice)

4.8/5  (44)

(44)

A limited partnership can indirectly avoid unlimited liability of the general partner if the general partner is a corporation.

(True/False)

4.8/5  (44)

(44)

List some techniques for reducing and/or avoiding double taxation by transferring funds to the shareholders that are deductible to the corporation.

(Essay)

4.8/5  (34)

(34)

The tax treatment of S corporation shareholders with respect to fringe benefits is not the same as the tax treatment for C corporation shareholders, but is the same as the fringe benefit treatment for partners.

(True/False)

4.9/5  (42)

(42)

When compared to a partnership, what additional requirement applies to keep a contribution of appreciated property to a corporation from causing recognized gain?

(Essay)

4.8/5  (39)

(39)

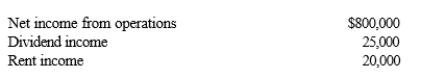

Catfish, Inc., a closely held corporation which is not a PSC, owns a 45% interest in Trout Partnership, which is classified as a passive activity.Trout's taxable loss for the current year is $250,000.During the year, Catfish receives a $60,000 cash distribution from Trout.Other relevant data for Catfish are as follows.  How much of Catfish's share of Trout's loss may it deduct in calculating its taxable income?

How much of Catfish's share of Trout's loss may it deduct in calculating its taxable income?

(Multiple Choice)

4.8/5  (43)

(43)

A limited liability company LLC) is a hybrid business form that combines the corporate characteristic of limited liability for the owners with the tax characteristics of a partnership.

(True/False)

4.8/5  (37)

(37)

Mercedes owns a 30% interest in Magenta Partnership basis of $52,000) which she sells to Calvin for $65,000.Mercedes' recognized gain of $13,000 will be classified as capital gain.

(True/False)

4.9/5  (35)

(35)

A corporation may alternate between S corporation and C corporation status each year, depending on which results in more tax savings.

(True/False)

5.0/5  (32)

(32)

S corporations can generate an AMT adjustment known as Adjusted Current Earnings ACE).

(True/False)

4.9/5  (49)

(49)

After an asset contribution by a partner to a partnership, the partner's basis for his or her ownership interest is the same as the basis of the assets contributed no liabilities are involved).

(True/False)

4.8/5  (39)

(39)

List some techniques which can be used to avoid and/or reduce double taxation for a C corporation.

(Essay)

4.9/5  (32)

(32)

Match the following statements.

-Sale of the corporate assets by the C corporation.

(Multiple Choice)

4.9/5  (40)

(40)

If an S corporation distributes appreciated property as a dividend, it must recognize gain as to the appreciation.

(True/False)

4.8/5  (48)

(48)

Do the at-risk rules apply to partnerships, LLCs, and S corporations?

(Essay)

4.8/5  (41)

(41)

Showing 61 - 80 of 97

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)