Exam 12: Corporations: Organization, Capital Structure, and Operating Rules

Exam 1: Introduction to Taxation98 Questions

Exam 2: Working With the Tax Law102 Questions

Exam 3: Taxes on the Financial Statements68 Questions

Exam 4: Gross Income96 Questions

Exam 5: Business Deductions208 Questions

Exam 6: Losses and Loss Limitations185 Questions

Exam 7: Property Transactions: Basis, Gain and Loss, and Nontaxable Exchanges118 Questions

Exam 8: Property Transactions: Capital Gains and Losses109 Questions

Exam 9: Individuals As the Taxpayer105 Questions

Exam 10: Individuals: Income, Deductions, and Credits119 Questions

Exam 11: Individuals As Employees and Proprietors131 Questions

Exam 12: Corporations: Organization, Capital Structure, and Operating Rules128 Questions

Exam 13: Corporations: Earnings and Profits and Distributions125 Questions

Exam 14: Partnerships and Limited Liability Entities122 Questions

Exam 15: S Corporations118 Questions

Exam 16: Multijurisdictional Taxation145 Questions

Exam 17: Business Tax Credits and the Alternative Minimum Tax132 Questions

Exam 18: Comparative Forms of Doing Business97 Questions

Select questions type

Mitchell and Powell form Green Corporation.Mitchell transfers property basis of $105,000 and fair market value of $90,000) while Powell transfers land basis of $8,000 and fair market value of $75,000) and $15,000 of cash.Each receives 50% of Green Corporation's stock total value of $180,000).As a result of these transfers:

(Multiple Choice)

4.9/5  (26)

(26)

When a taxpayer incorporates her business, she transfers several liabilities to the corporation.If one of the liabilities is personal in origin, the release of only that liability is treated as boot.

(True/False)

4.7/5  (41)

(41)

Nancy Smith is the sole shareholder and employee of White Corporation, a calendar year C corporation that is engaged exclusively in accounting services.During the current year, White has operating income of $320,000 and operating expenses excluding salary) of $150,000.Further, White Corporation pays Nancy a salary of $100,000.The salary is reasonable in amount and Nancy is in the 32% marginal tax bracket irrespective of any income from White.Assuming that White Corporation distributes all after-tax income as dividends, how much total combined income tax do White and Nancy pay in the current year? Ignore any employment tax considerations.)

(Multiple Choice)

4.8/5  (37)

(37)

Eagle Corporation, a calendar year C corporation, owns stock in Hawk Corporation and has taxable income of $100,000 for the year before considering the dividends received deduction.In the current year, Hawk Corporation pays Eagle a dividend of $130,000, which was considered in calculating the $100,000.What amount of dividends received deduction may Eagle claim if it owns 15% of Hawk's stock?

(Multiple Choice)

4.9/5  (27)

(27)

Rachel is the sole member of an LLC, and Jordan is the sole shareholder of a C corporation.Both businesses were started in the current year, and each business has a long-term capital gain of $10,000 for the year.Neither business made any distributions during the year.With respect to this information, which of the following statements is correct?

(Multiple Choice)

4.9/5  (43)

(43)

The use of § 351 is not limited to the initial formation of a corporation, and it can apply to later transfers as well.

(True/False)

4.7/5  (43)

(43)

One month after Sally incorporates her sole proprietorship, she gives 25% of the stock to her children.Section 351 cannot apply to Sally because she has not satisfied the 80% control requirement.

(True/False)

4.9/5  (33)

(33)

During the current year, Sparrow Corporation, a calendar year C corporation, had operating income of $425,000, operating expenses of $280,000, a short-term capital loss of $10,000, and a long-term capital gain of $25,000.How much is Sparrow's income tax liability for the year?

(Multiple Choice)

4.8/5  (40)

(40)

Three individuals form Skylark Corporation with the following contributions: Cliff, cash of $50,000 for 50 shares; Brad, land worth $20,000 basis of $11,000) for 20 shares; and Ron, cattle worth $9,000 basis of $6,000) for 9 shares and services worth $21,000 for 21 shares.

(Multiple Choice)

4.7/5  (43)

(43)

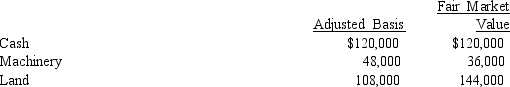

Donghai transferred the following assets to Starling Corporation.  In exchange, Donghai received 50% of Starling Corporation's only class of stock outstanding.The stock has no established value.However, all parties believe that the value of the stock Donghai received is the equivalent of the value of the assets she transferred.The only other shareholder, Rick, formed Starling Corporation five years ago.

In exchange, Donghai received 50% of Starling Corporation's only class of stock outstanding.The stock has no established value.However, all parties believe that the value of the stock Donghai received is the equivalent of the value of the assets she transferred.The only other shareholder, Rick, formed Starling Corporation five years ago.

(Multiple Choice)

4.8/5  (30)

(30)

Similar to like-kind exchanges, the receipt of "boot" under § 351 can cause loss to be recognized.

(True/False)

4.7/5  (37)

(37)

A city contributes $500,000 to a corporation as an inducement to locate in the city.Within the next 12 months, the corporation uses the money to purchase property worth $500,000.The corporation has income of $500,000 and must reduce its tax basis in the property by the same amount.

(True/False)

4.8/5  (34)

(34)

Alan, an Owl Corporation shareholder, makes a contribution to capital of equipment to Owl, basis of $40,000 and fair market value of $50,000.Owl's basis of the equipment that Alan contributes is equal to $50,000, the property's fair market value.

(True/False)

4.9/5  (33)

(33)

A taxpayer may never recognize a loss on the transfer of property in a transaction subject to § 351.

(True/False)

4.8/5  (35)

(35)

A calendar year C corporation can receive an automatic 9-month extension to file its corporate return Form 1120) by timely filing a Form 7004 for the tax year.

(True/False)

4.8/5  (37)

(37)

When a taxpayer transfers property subject to a mortgage to a controlled corporation in an exchange qualifying under § 351, the transferor shareholder's basis in stock received in the transferee corporation is increased by the amount of the mortgage on the property.

(True/False)

4.9/5  (34)

(34)

Thrush Corporation, a calendar year C corporation, files it's 2018 Form 1120, which reports taxable income of

$200,000 for the year.The corporation's tax is $61,250.

(True/False)

4.8/5  (32)

(32)

No dividends received deduction is allowed unless the corporation has held the stock for more than 90 days.

(True/False)

4.9/5  (35)

(35)

A person who performs services for a corporation in exchange for stock cannot be treated as a member of the transferring group even if that person also transfers some property to the corporation.

(True/False)

5.0/5  (32)

(32)

Lilac Corporation incurred $4,700 of legal and accounting fees associated with its incorporation.The $4,700 is deductible as startup expenditures on Lilac's tax return for the year in which it begins business.

(True/False)

4.9/5  (32)

(32)

Showing 41 - 60 of 128

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)