Exam 3: Basic Accounting Systems: Accrual Basis

Exam 1: The Role of Accounting in Business98 Questions

Exam 2: Basic Accounting Systems: Cash Basis99 Questions

Exam 3: Basic Accounting Systems: Accrual Basis119 Questions

Exam 4: Accounting for Merchandising Businesses154 Questions

Exam 5: Internal Control and Cash108 Questions

Exam 6: Receivables and Inventories104 Questions

Exam 7: Fixed Assets, Natural Resources, and Intangible Assets96 Questions

Exam 8: Liabilities and Stockholders Equity135 Questions

Exam 9: Metric Analysis of Financial Statements82 Questions

Exam 10: Accounting for Manufacturing Operations112 Questions

Exam 11: Cost-Volume-Profit Analysis129 Questions

Exam 12: Differential Analysis and Product Pricing102 Questions

Exam 13: Budgeting and Standard Costs178 Questions

Exam 14: Performance Evaluation for Decentralized Operations137 Questions

Exam 15: Capital Investment Analysis109 Questions

Select questions type

Accrual accounting does not require that the accounting records be updated prior to preparing financial statements.

(True/False)

4.8/5  (33)

(33)

Which of the following is the effect of depreciation being recorded by a company?

(Multiple Choice)

4.9/5  (38)

(38)

Under the accrual basis of accounting, net cash flows from operating activities on the statement of cash flows will normally be the same as net income.

(True/False)

4.7/5  (40)

(40)

Cash and other assets that are expected to be converted to cash or sold or used up within one year or less through the normal operations of the business are called:

(Multiple Choice)

4.9/5  (42)

(42)

Under the cash basis of accounting, expenses are recorded when paid.

(True/False)

4.8/5  (31)

(31)

Which of the following should be added to net income in calculating net cash flow from operating activities using the indirect method?

(Multiple Choice)

4.9/5  (29)

(29)

Under accrual accounting, expenses are recorded when incurred regardless of when paid.

(True/False)

4.8/5  (41)

(41)

Which of the following statements is prepared with various sections, subsections, and captions?

(Multiple Choice)

4.8/5  (40)

(40)

Which of the following transactions will affect the profitability metric of a company?

(Multiple Choice)

4.8/5  (31)

(31)

To arrive at cash flows from operations, it is necessary to convert the income statement from an accrual basis to the cash basis of accounting.

(True/False)

4.9/5  (41)

(41)

Flyer Co.billed a client for flying lessons given in January.The payment was received in February.Under the accrual basis of accounting, when should Flyer Co.record the revenue?

(Multiple Choice)

4.8/5  (35)

(35)

Accounts receivable arising from trade transactions amounted to $62,000 and $78,000 at the beginning and end of the year, respectively.Net income reported on the income statement for the year was $125,000.Exclusive of the effect of other adjustments, the cash flows from operating activities to be reported on the statement of cash flows prepared by the indirect method are:

(Multiple Choice)

4.9/5  (31)

(31)

Which transaction would be recorded in a cash basis system of accounting?

(Multiple Choice)

4.8/5  (44)

(44)

Electrodo Co.purchased land for $55,000 with $20,000 paid in cash and $35,000 in notes payable.What effect does this transaction have on the accounts under the accrual basis of accounting?

(Multiple Choice)

4.8/5  (46)

(46)

Which of the following is not reported as revenue on the income statement?

(Multiple Choice)

4.9/5  (40)

(40)

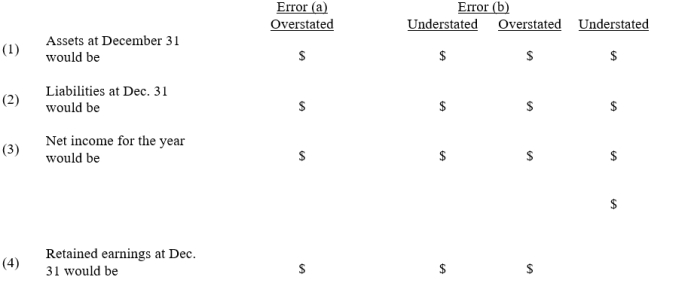

At the end of the fiscal year, the following adjusting entries were omitted:

(a)No adjusting entry was made to transfer the $3,000 of prepaid insurance from the asset account to the expense account.

(b)No adjusting entry was made to record accrued fees of $500 for services provided to customers.

Assuming that financial statements are prepared before the errors are discovered, indicate the effect of each error, considered individually, by inserting the dollar amount in the appropriate spaces.Insert "0" if the error does not affect the item.

(Essay)

4.7/5  (34)

(34)

Using accrual accounting, expenses are recorded and reported only:

(Multiple Choice)

4.7/5  (23)

(23)

Showing 41 - 60 of 119

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)