Exam 3: Basic Accounting Systems: Accrual Basis

Exam 1: The Role of Accounting in Business98 Questions

Exam 2: Basic Accounting Systems: Cash Basis99 Questions

Exam 3: Basic Accounting Systems: Accrual Basis119 Questions

Exam 4: Accounting for Merchandising Businesses154 Questions

Exam 5: Internal Control and Cash108 Questions

Exam 6: Receivables and Inventories104 Questions

Exam 7: Fixed Assets, Natural Resources, and Intangible Assets96 Questions

Exam 8: Liabilities and Stockholders Equity135 Questions

Exam 9: Metric Analysis of Financial Statements82 Questions

Exam 10: Accounting for Manufacturing Operations112 Questions

Exam 11: Cost-Volume-Profit Analysis129 Questions

Exam 12: Differential Analysis and Product Pricing102 Questions

Exam 13: Budgeting and Standard Costs178 Questions

Exam 14: Performance Evaluation for Decentralized Operations137 Questions

Exam 15: Capital Investment Analysis109 Questions

Select questions type

The updating of accrual accounting records before preparing financial statements is referred to as the:

(Multiple Choice)

4.8/5  (41)

(41)

On the statement of cash flows prepared by the indirect method, a $50,000 gain on the sale of investments would be:

(Multiple Choice)

4.8/5  (26)

(26)

The unearned rent account has a balance of $60,000.If $4,000 of the $60,000 is unearned at the end of the accounting period, the amount of the adjusting entry is:

(Multiple Choice)

4.8/5  (40)

(40)

_____ represent rights of a long-term nature, such as patent rights, copyrights, and goodwill.

(Multiple Choice)

4.8/5  (37)

(37)

The net income reported on the income statement for the current year was $310,000.Depreciation recorded on fixed assets and amortization of patents for the year were $40,000 and $9,000, respectively.Balances of current asset and current liability accounts at the end and at the beginning of the year are as follows: Beginning Cash \ 50,000 \ 60,000 Accounts receivable 112,000 108,000 Inventories 105,000 93,000 Prepaid expenses 4,500 6,500 Accounts payable (merchandise creditors) 75,000 89,000 What is the amount of cash flows from operating activities reported on the statement of cash flows prepared by the indirect method?

(Multiple Choice)

4.9/5  (46)

(46)

Identify the type of adjustment necessary (the type of item involved) and record the transaction for the event.Make sure to include the ending balances after adjustment.

Assume that on June 1, 2016, Tasty Sausage Corp.has a balance of $100 for supplies.On June 6 it purchased $600 in supplies for cash.On June 30, at the end of the accounting period, there are $300 of supplies on hand.The June 30

adjustment is: Assets = Liabilities + Stockholders' Equity Cash Supplies Office Equipment Accounts Payable Common Stock Retained Earnings Beg. Bal. -100 100 Supplies purchased -600 600 End. Bal. -700 700

(Essay)

4.9/5  (37)

(37)

It is easy to objectively determine the physical decline in the ability of fixed assets to provide service.

(True/False)

4.7/5  (50)

(50)

Why is a physical count of supplies necessary at the end of the accounting period?

(Essay)

4.9/5  (34)

(34)

On June 1, Unidevo, Inc.purchased $1,700 worth of supplies on account.Prior to the purchase, the balance in the supplies account was $0.On December 31, the fiscal year-end for Unidevo, it is determined that $800 of supplies still remain.What is the balance in the supplies account after adjustment?

(Multiple Choice)

4.8/5  (36)

(36)

Speedy Company's weekly payroll of $250 is paid on Fridays (five-day work week).Assume that the last day of the month falls on Thursday.Which of the following is the required month-end adjusting entry?

(Multiple Choice)

4.8/5  (38)

(38)

A&M Co.provided services of $1,000,000 to clients on account.How does this transaction affect A&M's accounts?

(Multiple Choice)

4.8/5  (39)

(39)

Which of the following is an example of an intangible asset?

(Multiple Choice)

4.8/5  (40)

(40)

Using accrual accounting, revenue is recorded and reported only:

(Multiple Choice)

4.7/5  (40)

(40)

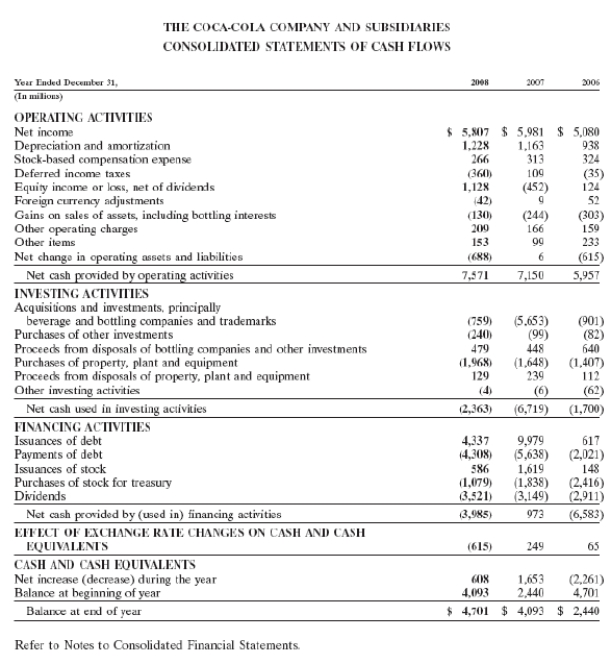

-Refer to Coke's Statement of Cash Flows.What amount of depreciation and amortization did Coke record in 2008?

-Refer to Coke's Statement of Cash Flows.What amount of depreciation and amortization did Coke record in 2008?

(Essay)

4.8/5  (33)

(33)

If land costing $75,000 was sold for $135,000, the amount reported in the investing activities section of the statement of cash flows would be $135,000.

(True/False)

4.8/5  (37)

(37)

BlueInk Corporation's accumulated depreciation increased by $14,000, while patents decreased by $3,875 between consecutive balance sheet dates.There were no purchases or sales of depreciable or intangible assets during the year.In addition, the income statement showed a loss on sale of land of $1,950.Accounts receivable increased $6,320, inventory decreased $3,125, prepaid expenses decreased $720, and account payable increased $2,760.Reconcile a net income of $55,000 to net cash flow from operating activities.

(Essay)

4.8/5  (41)

(41)

Depreciation on factory equipment would be reported in the statement of cash flows prepared by the indirect method in:

(Multiple Choice)

4.8/5  (37)

(37)

Showing 81 - 100 of 119

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)