Exam 8: Inventory

Exam 1: The Canadian Financial Reporting Environment29 Questions

Exam 2: Conceptual Framework Underlying Financial Reporting54 Questions

Exam 3: The Accounting Information System54 Questions

Exam 4: Reporting Financial Performance61 Questions

Exam 5: Financial Position and Cash Flows49 Questions

Exam 6: Revenue Recognition63 Questions

Exam 7: Cash and Receivables53 Questions

Exam 8: Inventory99 Questions

Exam 9: Investments90 Questions

Exam 10: Property, Plant, and Equipment: Accounting Model Basics63 Questions

Exam 11: Depreciation, Impairment, and Disposition62 Questions

Exam 12: Intangible Assets and Goodwill52 Questions

Select questions type

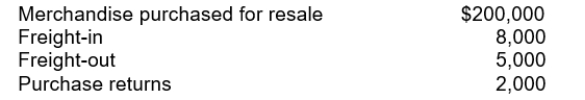

The following information applied to Mark, Inc.for 2010:  Mark's 2010 inventoriable cost was

Mark's 2010 inventoriable cost was

(Multiple Choice)

4.8/5  (39)

(39)

Assume that no correcting entries were made at December 31, 2010.Ignoring income taxes, by how much will retained earnings at December 31, 2011 be overstated or understated?

(Multiple Choice)

5.0/5  (39)

(39)

Under variable costing, fixed manufacturing overhead costs are

(Multiple Choice)

4.8/5  (35)

(35)

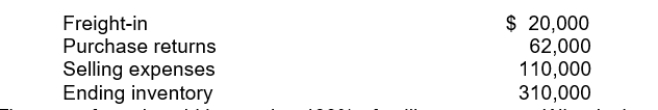

The following information is available for Kobold Company for 2010:  The cost of goods sold is equal to 400% of selling expenses.What is the cost of goods available for sale?

The cost of goods sold is equal to 400% of selling expenses.What is the cost of goods available for sale?

(Multiple Choice)

4.9/5  (36)

(36)

Other things being equal, income calculated by the variable costing method will exceed that calculated by the absorption method if

(Multiple Choice)

4.9/5  (47)

(47)

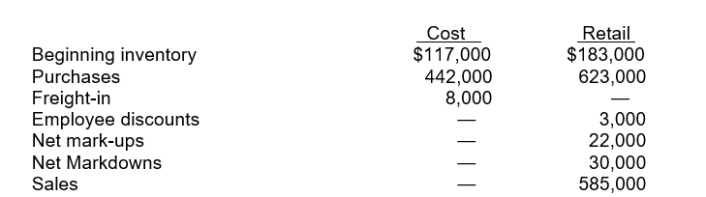

Use the following information for questions

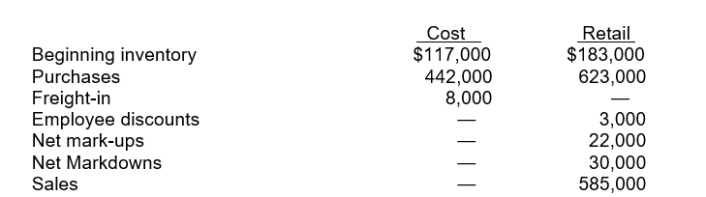

Toby Co.uses the retail inventory method.The following information is available for the current year.

-If the ending inventory is to be valued at approximately lower of average cost and market, the calculation of the cost ratio should be based on cost and retail of

-If the ending inventory is to be valued at approximately lower of average cost and market, the calculation of the cost ratio should be based on cost and retail of

(Multiple Choice)

4.9/5  (37)

(37)

Which of the following is least likely an example of a special sales agreement?

(Multiple Choice)

4.8/5  (41)

(41)

Eskins Co.received merchandise on consignment.As of January 31, Eskins included the goods in inventory, but did not record the transaction.The effect of this on its financial statements for January 31 would be

(Multiple Choice)

4.8/5  (30)

(30)

The gross profit method of inventory valuation is invalid when

(Multiple Choice)

4.9/5  (35)

(35)

Which of the following does not correctly describe the specific identification costing method?

(Multiple Choice)

4.9/5  (37)

(37)

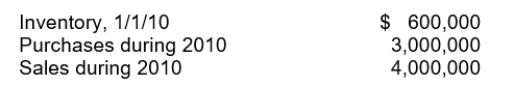

Greer Company's accounting records indicated the following information:  A physical inventory taken on December 31, 2010, resulted in an ending inventory of $700,000.Greer's gross profit on sales has remained constant at 30% in recent years.Greer suspects some inventory may have been taken by a new employee.At December

31, 2010, what is the estimated cost of missing inventory?

A physical inventory taken on December 31, 2010, resulted in an ending inventory of $700,000.Greer's gross profit on sales has remained constant at 30% in recent years.Greer suspects some inventory may have been taken by a new employee.At December

31, 2010, what is the estimated cost of missing inventory?

(Multiple Choice)

4.8/5  (49)

(49)

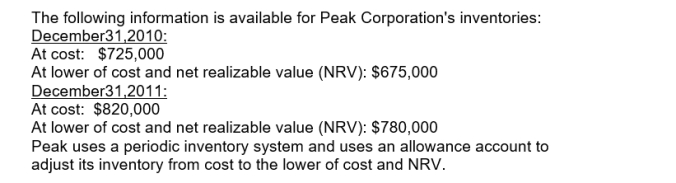

Use the following information for questions

-Peak's 2010 entry to record to adjust its inventory from cost to the lower of cost and net realizable value (NRV) is

-Peak's 2010 entry to record to adjust its inventory from cost to the lower of cost and net realizable value (NRV) is

(Multiple Choice)

4.9/5  (34)

(34)

Use the following information for questions

Toby Co.uses the retail inventory method.The following information is available for the current year.

-The approximate cost of the ending inventory by the conventional retail method is

-The approximate cost of the ending inventory by the conventional retail method is

(Multiple Choice)

4.9/5  (40)

(40)

A manufacturing company typically has the following inventory accounts:

(Multiple Choice)

4.8/5  (37)

(37)

Which of the following formulas is used to determine a company's inventory turnover?

(Multiple Choice)

4.8/5  (41)

(41)

Assume that the proper correcting entries were made at December 31, 2010.By how much will 2011 income before taxes be overstated or understated?

(Multiple Choice)

4.8/5  (37)

(37)

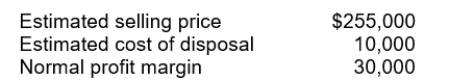

Walter Distribution Co.has determined its December 31, 2010 inventory on a FIFO basis at $240,000.Information pertaining to that inventory follows:  Walter records losses that result from applying the lower of cost and market rule.At December 31, 2010, the loss that Walter should recognize is

Walter records losses that result from applying the lower of cost and market rule.At December 31, 2010, the loss that Walter should recognize is

(Multiple Choice)

4.9/5  (43)

(43)

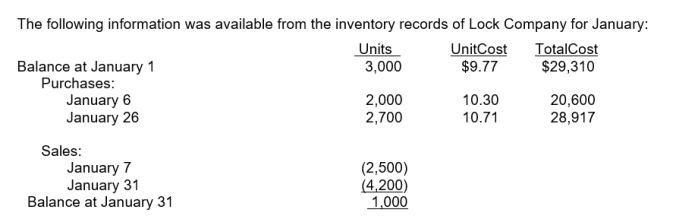

Use the following information for questions

-Assuming that Lock maintains perpetual inventory records, what should be the inventory at January 31, using the moving-average inventory method, rounded to the nearest dollar?

-Assuming that Lock maintains perpetual inventory records, what should be the inventory at January 31, using the moving-average inventory method, rounded to the nearest dollar?

(Multiple Choice)

4.8/5  (34)

(34)

Oxley Retailers purchased merchandise with a list price of $30,000, subject to trade discounts of 20 percent and 10 percent, with no cash discounts allowable.Oxley should record the cost of this merchandise as

(Multiple Choice)

4.9/5  (42)

(42)

Showing 21 - 40 of 99

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)