Exam 12: Reporting and Analyzing Investments

Exam 1: The Purpose and Use of Financial Statements109 Questions

Exam 2: A Further Look at Financial Statements149 Questions

Exam 3: The Accounting Information System148 Questions

Exam 4: Accrual Accounting Concepts145 Questions

Exam 5: Merchandising Operations137 Questions

Exam 6: Reporting and Analyzing Inventory102 Questions

Exam 7: Internal Control and Cash113 Questions

Exam 8: Reporting and Analyzing Receivables132 Questions

Exam 9: Reporting and Analyzing Long-Lived Assets150 Questions

Exam 10: Reporting and Analyzing Liabilities155 Questions

Exam 12: Reporting and Analyzing Investments112 Questions

Exam 13: Statement of Cash Flows133 Questions

Exam 14: Performance Measurement139 Questions

Select questions type

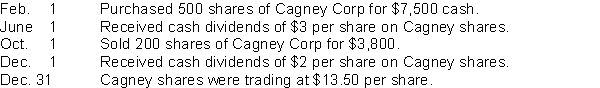

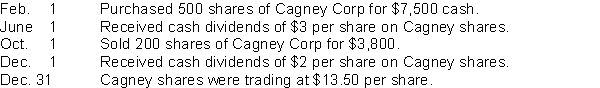

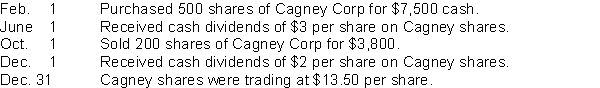

Use the following information to answer questions

Lacey Inc. reported these transactions relating to marketable trading investments intended to generate profits and to be sold in the near term:  -The entry to record the receipt of the dividends on June 1 would include a

-The entry to record the receipt of the dividends on June 1 would include a

Free

(Multiple Choice)

5.0/5  (44)

(44)

Correct Answer:

C

If a company reporting under ASPE decides to use the cost model to account for an investment in common shares, dividends received should be

Free

(Multiple Choice)

4.8/5  (40)

(40)

Correct Answer:

B

The receipt of dividends from an investment affects the investment account when which of the following methods is used?

Free

(Multiple Choice)

4.7/5  (27)

(27)

Correct Answer:

B

Under the equity method, the receipt of dividends from the investee results in an increase in the investment account.

(True/False)

4.9/5  (29)

(29)

When the equity method is used to account for an investment in shares, dividends received are accounted for as a reduction in the investment account.

(True/False)

4.7/5  (30)

(30)

One source of comprehensive income is created when unrealized gains and losses are recorded for trading investments.

(True/False)

4.8/5  (34)

(34)

The company that has the majority of its voting shares owned by a parent company is called the

(Multiple Choice)

4.9/5  (29)

(29)

Under both the fair value model and the amortized cost model, investments are adjusted upwards or downwards to reflect their fair value at year end.

(True/False)

4.9/5  (33)

(33)

Like profit (loss), other comprehensive income (loss) increases (decreases) retained earnings.

(True/False)

4.8/5  (35)

(35)

Loser Corp. holds two trading investments. At year end, one has an unrealized gain of $2,000 and the other has an unrealized loss of $4,500. The trading investments would be reported at fair value and Loser Corp. would report a net unrealized loss of:

(Multiple Choice)

4.9/5  (31)

(31)

Use the following information to answer questions

Lacey Inc. reported these transactions relating to marketable trading investments intended to generate profits and to be sold in the near term:  -The entry to record the sale of the shares on Oct. 1 would include a

-The entry to record the sale of the shares on Oct. 1 would include a

(Multiple Choice)

4.8/5  (37)

(37)

Use the following information to answer questions

Lacey Inc. reported these transactions relating to marketable trading investments intended to generate profits and to be sold in the near term:  -The entry to record the receipt of the dividends on December 1 would include a

-The entry to record the receipt of the dividends on December 1 would include a

(Multiple Choice)

4.9/5  (40)

(40)

If the equity method is used to account for an investment in common shares

(Multiple Choice)

4.9/5  (33)

(33)

Realized gains and losses are always reported in the income statement.

(True/False)

4.9/5  (31)

(31)

Under the equity method, the investment account is adjusted annually for a portion of associate's net profit and for dividends received.

(True/False)

4.8/5  (40)

(40)

The ability of an investor to affect the operating and financial activities of another company, even though the investor does not control the company, is known as

(Multiple Choice)

4.8/5  (31)

(31)

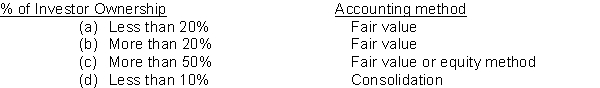

Which of the following is the correct match concerning the appropriate accounting for long-term equity investments?

(Short Answer)

4.9/5  (47)

(47)

Consolidated financial statements are appropriate when an investor has voting control of the investee's common shares.

(True/False)

4.9/5  (44)

(44)

The cost model is used when the investment is held to earn cash flows but there is no fair value available.

(True/False)

4.8/5  (34)

(34)

Showing 1 - 20 of 112

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)