Exam 11: Reporting and Analyzing Shareholders Equity

Exam 1: The Purpose and Use of Financial Statements109 Questions

Exam 2: A Further Look at Financial Statements149 Questions

Exam 3: The Accounting Information System148 Questions

Exam 4: Accrual Accounting Concepts145 Questions

Exam 5: Merchandising Operations137 Questions

Exam 6: Reporting and Analyzing Inventory102 Questions

Exam 7: Internal Control and Cash113 Questions

Exam 8: Reporting and Analyzing Receivables132 Questions

Exam 9: Reporting and Analyzing Long-Lived Assets150 Questions

Exam 10: Reporting and Analyzing Liabilities155 Questions

Exam 12: Reporting and Analyzing Investments112 Questions

Exam 13: Statement of Cash Flows133 Questions

Exam 14: Performance Measurement139 Questions

Select questions type

Irwin Inc. had 300,000 common shares before a stock split occurred and 600,000 shares after the stock split. The stock split was

(Multiple Choice)

4.9/5  (36)

(36)

The number of common shares authorized can never be greater than the number of shares issued.

(True/False)

4.9/5  (29)

(29)

Ford Harrison has invested $650,000 in a corporation. The corporation does not do well and must declare bankruptcy. What amount does Harrison stand to lose?

(Multiple Choice)

4.9/5  (27)

(27)

Coombs Corp. declared a two-for-one stock split. Solly Fogarty owned 500 shares of Coombs that were trading for $20 each before the split. Which of the following is likely to be true after the split?

(Multiple Choice)

4.8/5  (25)

(25)

A corporation is not an entity that is separate and distinct from its owners.

(True/False)

4.8/5  (43)

(43)

For a corporation reporting under IFRS, when shares are issued for a non-cash consideration and a ready market for the shares exists, they are recorded at

(Multiple Choice)

4.7/5  (35)

(35)

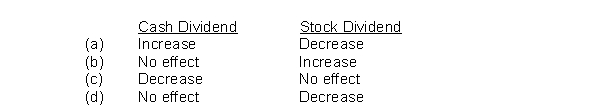

Identify the effect the declaration of a cash dividend and a stock dividend has on the total shareholders' equity of a corporation:

(Short Answer)

4.8/5  (41)

(41)

Which of the following statements about dividends is not correct?

(Multiple Choice)

4.7/5  (35)

(35)

A corporation acts under its' own name rather than in the name of its shareholders.

(True/False)

4.9/5  (41)

(41)

The payout ratio is calculated by dividing the cash dividends paid on common shares by retained earnings.

(True/False)

4.8/5  (27)

(27)

The board of directors of Wessex Inc. declared a cash dividend on November 15, 2012, to be paid on December 15, 2012, to shareholders owning shares on November 30, 2012. Given these facts, the date of November 30, 2012, is referred to as the

(Multiple Choice)

4.9/5  (38)

(38)

The date on which a cash dividend becomes a binding legal obligation is on the

(Multiple Choice)

4.7/5  (40)

(40)

Legal capital cannot be distributed to the shareholders, but must remain invested in the corporation for the protection of its creditors.

(True/False)

4.7/5  (35)

(35)

The cumulative effect of the declaration and payment of a cash dividend on a company's financial statements is to

(Multiple Choice)

4.8/5  (40)

(40)

Showing 101 - 120 of 149

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)