Exam 3: Issues of Budgeting and Control

Exam 1: The Government and Not-For-Profit Environment50 Questions

Exam 2: Fund Accounting50 Questions

Exam 3: Issues of Budgeting and Control50 Questions

Exam 4: Recognizing Revenues in Governmental Funds62 Questions

Exam 5: Recognizing Expenditures in Governmental Funds67 Questions

Exam 6: Accounting for Capital Projects and Debt Service69 Questions

Exam 7: Capital Assets and Investments in Marketable Securities58 Questions

Exam 8: Long-Term Obligations53 Questions

Exam 9: Business-Type Activities66 Questions

Exam 10: Pensions and Other Fiduciary Activities64 Questions

Exam 11: Issues of Reporting, Disclosure, and Financial Analysis68 Questions

Exam 12: Not-For-Profit Organizations63 Questions

Exam 13: Colleges and Universities39 Questions

Exam 14: Health Care Providers47 Questions

Exam 15: Managing for Results50 Questions

Exam 16: Auditing Governments and Notforprofit Organizations59 Questions

Exam 17: Federal Government Accounting66 Questions

Select questions type

When Spruce City receives goods at a cost of $9,700 that were encumbered in the prior year for $10,000, which of the following entries are required (assume that encumbrances lapse at year end)?

Free

(Multiple Choice)

4.9/5  (42)

(42)

Correct Answer:

B

In which of the following cases would the reserve for encumbrances account be decreased?

Free

(Multiple Choice)

4.8/5  (37)

(37)

Correct Answer:

C

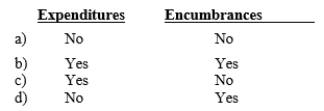

Washington County received goods that had been approved for purchase but for which payment had not yet been made.Should the following accounts be increased?

Free

(Short Answer)

4.9/5  (35)

(35)

Correct Answer:

C

State and local governments must prepare their GAAP budgetary comparisons on the modified accrual basis of accounting.

(True/False)

4.8/5  (45)

(45)

A city formally adopted a budget at the beginning of the current year.Budgeted revenues were $500 and budgeted expenditures were $490.During the year actual revenues were $520 and actual expenditures were $480.Which of the following statements is true?Fund balance at the end of the current year in comparison to fund balance at the end of the preceding year will be

(Multiple Choice)

4.9/5  (34)

(34)

A city received supplies that had been previously encumbered.The supplies were encumbered for $5,000 and had an actual cost of $4,900.To recognize this event the county should make which of the following entries?

(Multiple Choice)

4.8/5  (47)

(47)

A governmental entity has formally integrated the budget into its accounting records and uses encumbrance accounting.During the year the government ordered but had not yet received a new police car.What effect will this event have on the unencumbered balance in the account "Expenditures-capital outlay, police department"?

(Multiple Choice)

4.8/5  (38)

(38)

A university that formally integrates the budget in the accounting system and uses encumbrance accounting orders some new computers that will cost approximately $20,000.To recognize this event the university should make which of the following entries?

(Multiple Choice)

4.8/5  (40)

(40)

Per GASB standards, a budget-to-actual comparison must include columns for the actual results and

(Multiple Choice)

4.9/5  (29)

(29)

Which of the following is a primary benefit of a performance budget?

(Multiple Choice)

4.8/5  (29)

(29)

At year-end Oakland County had $3,000 of outstanding purchase commitments on the books.After the appropriate closing entries are made, what is the effect on the total fund balance of Oakland County?

(Multiple Choice)

4.8/5  (44)

(44)

Which of the following is the primary reason why governments formally integrate their legally adopted budget into their accounting systems?

(Multiple Choice)

4.9/5  (44)

(44)

Which of the following is the best reason for preparing budgets for government entities on the cash basis?

(Multiple Choice)

4.9/5  (38)

(38)

During the previous year, Bane County closed its Encumbrances account.At the end of the previous year there was $5,000 of outstanding purchase commitments.To restore these commitments to the accounts, which of the following entries would be required?

(Multiple Choice)

4.7/5  (48)

(48)

To close Reserve for encumbrances at the end of the year which of the following entries should be made?

(Multiple Choice)

4.9/5  (22)

(22)

The City of Denton uses encumbrance accounting to control expenditures.It charges the cost of outstanding purchase commitments to expenditures in the year they are received, not in the year they are ordered.If the city had $11,000 of purchase commitments outstanding at the end of Year 1 and received those goods during Year 2 at a cost of $11,700, what would be the impact on total fund balance for Year 2?

(Multiple Choice)

4.7/5  (33)

(33)

A governmental entity has formally integrated the budget into its accounting records.At year-end the ledger account "Revenues from property taxes" has a debit balance.Which of the following is the best explanation for the debit balance?

(Multiple Choice)

4.7/5  (35)

(35)

A governmental entity has formally integrated the budget into its accounting records.At the end of the third quarter the ledger account "Expenditures--salaries" has a $100,000 debit balance.Which of the following is a true statement?

(Multiple Choice)

4.7/5  (33)

(33)

To close Encumbrances at the end of the year which of the following entries should be made?

(Multiple Choice)

4.8/5  (37)

(37)

Lincoln County uses encumbrance accounting to control expenditures.It charges the cost of outstanding purchase commitments to expenditures in the year they are ordered, not in the year they are received.If the county had $7,000 of purchase commitments outstanding at the end of Year 1 and received those goods during Year 2 at a cost of $7,800, what would be the impact on total fund balance for Year 2?

(Multiple Choice)

4.9/5  (39)

(39)

Showing 1 - 20 of 50

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)