Exam 6: Inventories

Exam 1: Accounting in Action189 Questions

Exam 2: The Recording Process151 Questions

Exam 3: Adjusting the Accounts187 Questions

Exam 4: Completing the Accounting Cycle170 Questions

Exam 5: Accounting for Merchandising Operations177 Questions

Exam 6: Inventories161 Questions

Exam 7: Fraud, Internal Control, and Cash164 Questions

Exam 8: Accounting for Receivables167 Questions

Exam 9: Plant Assets, Natural Resources, and Intangible Assets226 Questions

Exam 10: Liabilities230 Questions

Exam 11: Corporations: Organization, Stock Transactions, Dividends, and Retained Earnings244 Questions

Exam 12: Investments128 Questions

Exam 13: Statement of Cash Flows158 Questions

Exam 14: Financial Statement Analysis178 Questions

Select questions type

The requirements for accounting for and reporting of inventories under IFRS, compared to GAAP, tend to be more

(Multiple Choice)

4.9/5  (29)

(29)

Cost of goods sold is computed from the following equation:

(Multiple Choice)

4.7/5  (36)

(36)

Othello Company understated its inventory by $20,000 at December 31, 2014. It did not correct the error in 2014 or 2015. As a result, Othello's stockholder's equity was:

(Multiple Choice)

4.8/5  (47)

(47)

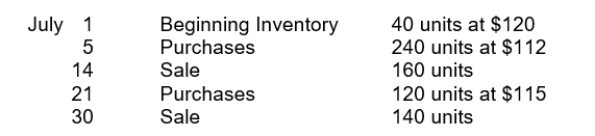

Moroni Industries has the following inventory information.  Assuming that a periodic inventory system is used, what is the amount allocated to ending inventory on a FIFO basis?

Assuming that a periodic inventory system is used, what is the amount allocated to ending inventory on a FIFO basis?

(Multiple Choice)

4.8/5  (41)

(41)

Under the retail inventory method, the estimated cost of ending inventory is computed by multiplying the cost-to-retail ratio by

(Multiple Choice)

4.8/5  (33)

(33)

The lower-of-cost-or-market basis is an example of the accounting concept of conservatism.

(True/False)

4.9/5  (33)

(33)

The specific identification method of costing inventories is used when the

(Multiple Choice)

4.8/5  (40)

(40)

At May 1, 2015, Kibbee Company had beginning inventory consisting of 200 units with a unit cost of $7. During May, the company purchased inventory as follows:  The company sold 1,000 units during the month for $12 per unit. Kibbee uses the average cost method. The value of Kibbee's inventory at May 31, 2015 is

The company sold 1,000 units during the month for $12 per unit. Kibbee uses the average cost method. The value of Kibbee's inventory at May 31, 2015 is

(Multiple Choice)

4.7/5  (31)

(31)

The selection of an appropriate inventory cost flow assumption for an individual company is made by

(Multiple Choice)

4.8/5  (34)

(34)

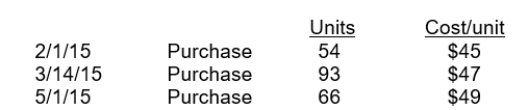

A company purchased inventory as follows:  The average unit cost for inventory is

The average unit cost for inventory is

(Multiple Choice)

4.8/5  (42)

(42)

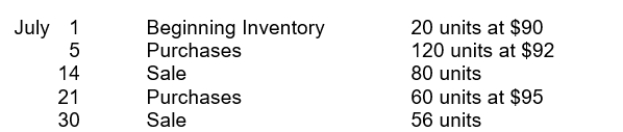

Pappy's Staff Junkets has the following inventory information.  Assuming that a perpetual inventory system is used, what is the ending inventory on a LIFO basis?

Assuming that a perpetual inventory system is used, what is the ending inventory on a LIFO basis?

(Multiple Choice)

4.8/5  (32)

(32)

If a company has no beginning inventory and the unit price of inventory is increasing during a period, the cost of goods available for sale during the period will be the same under the LIFO and FIFO inventory methods.

(True/False)

5.0/5  (41)

(41)

Which one of the following inventory methods is often impractical to use?

(Multiple Choice)

4.9/5  (35)

(35)

When valuing ending inventory under a perpetual inventory system, the

(Multiple Choice)

4.7/5  (32)

(32)

The following information was available for Pete Company at December 31, 2015: beginning inventory $90,000; ending inventory $70,000; cost of goods sold $984,000; and sales $1,350,000. Pete's inventory turnover in 2015 was

(Multiple Choice)

4.8/5  (36)

(36)

Romanoff Industries had the following inventory transactions occur during 2015:  The company sold 150 units at $70 each and has a tax rate of 30%. Assuming that a periodic inventory system is used, what is the company's after-tax income using FIFO? (rounded to whole dollars)

The company sold 150 units at $70 each and has a tax rate of 30%. Assuming that a periodic inventory system is used, what is the company's after-tax income using FIFO? (rounded to whole dollars)

(Multiple Choice)

5.0/5  (35)

(35)

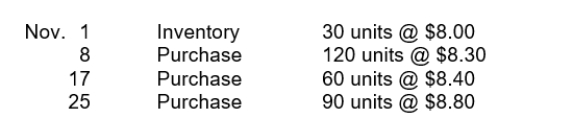

Netta Shutters has the following inventory information.  A physical count of merchandise inventory on November 30 reveals that there are 90 units on hand. Assume a periodic inventory system is used. Assuming that the specific identification method is used and that ending inventory consists of 20 units from each of the three purchases and 30 units from the November 1 inventory, cost of goods sold is

A physical count of merchandise inventory on November 30 reveals that there are 90 units on hand. Assume a periodic inventory system is used. Assuming that the specific identification method is used and that ending inventory consists of 20 units from each of the three purchases and 30 units from the November 1 inventory, cost of goods sold is

(Multiple Choice)

4.9/5  (29)

(29)

The more inventory a company has in stock, the greater the company's profit.

(True/False)

5.0/5  (40)

(40)

Showing 141 - 160 of 161

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)