Exam 24: Presentation and Disclosure in Financial Reporting

Exam 1: Financial Accounting and Accounting Standards86 Questions

Exam 2: Conceptual Framework Underlying Financial Accounting123 Questions

Exam 3: The Accounting Information System110 Questions

Exam 4: Income Statement and Related Information59 Questions

Exam 5: Statement of Financial Position and Statement of Cash Flows111 Questions

Exam 6: Accounting and the Time Value of Money118 Questions

Exam 7: Cash and Receivables135 Questions

Exam 8: Valuation of Inventories: a Cost-Basis Approach136 Questions

Exam 9: Inventories: Additional Valuation Issues120 Questions

Exam 10: Acquisition and Disposition of Property, Plant, and Equipment137 Questions

Exam 11: Depreciation, Impairments, and Depletion123 Questions

Exam 12: Intangible Assets126 Questions

Exam 13: Current Liabilities, Provisions, and Contingencies129 Questions

Exam 14: Non-Current Liabilities108 Questions

Exam 15: Equity108 Questions

Exam 17: Investments74 Questions

Exam 18: Revenue83 Questions

Exam 19: Accounting for Income Taxes92 Questions

Exam 20: Accounting for Pensions and Postretirement Benefits100 Questions

Exam 21: Accounting for Leases105 Questions

Exam 22: Accounting Changes and Error Analysis78 Questions

Exam 23: Statement of Cash Flows112 Questions

Exam 24: Presentation and Disclosure in Financial Reporting83 Questions

Select questions type

All of the following are reasons that the amount of disclosure provisions issued by the IASB has increased in the last 10 years except?

(Multiple Choice)

4.9/5  (32)

(32)

A financial projection is a set of prospective financial statements that present a company's expected financial position, results of operations, and cash flows.

(True/False)

4.8/5  (28)

(28)

Which of the following subsequent events (events after the reporting date) would require adjustment of the accounts before issuance of the financial statements?

(Multiple Choice)

4.7/5  (32)

(32)

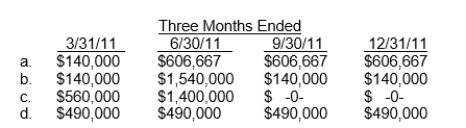

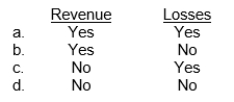

On January 15, 2011, Vancey Company paid property taxes on its factory building for the calendar year 2011 in the amount of $560,000.In the first week of April 2011, Vancey made unanticipated major repairs to its plant equipment at a cost of $1,400,000.These repairs will benefit operations for the remainder of the calendar year.How should these expenses be reflected in Vancey's quarterly income statements?

(Short Answer)

4.8/5  (39)

(39)

Theoretically, in computing the receivables turnover, the numerator should include

(Multiple Choice)

4.7/5  (38)

(38)

The basic limitations associated with ratio analysis include

(Multiple Choice)

4.9/5  (37)

(37)

Management commentary helps in the interpretation of the financial position, financial performance, and cash flows of a company.

(True/False)

4.9/5  (35)

(35)

IFRS requires that general-purpose financial statements include selected information on a single basis of segmentation.

(True/False)

4.9/5  (36)

(36)

In considering interim financial reporting, how does IFRS conclude that such reporting should be viewed?

(Multiple Choice)

4.9/5  (41)

(41)

Which of the following ratios is(are) useful in assessing a company's ability to meet current maturing or short-term obligations?

(Short Answer)

4.9/5  (42)

(42)

Accounting policies are modified for the following at interim dates.

(Short Answer)

5.0/5  (50)

(50)

Companies should report accounting transactions as they occur, and expense recognition should not change with the period of time covered under the integral approach.

(True/False)

4.8/5  (26)

(26)

The full disclosure principle, as adopted by the accounting profession, is best described by which of the following?

(Multiple Choice)

4.9/5  (42)

(42)

For interim financial reporting, a company's income tax expense for the second quarter should be computed by using the:

(Multiple Choice)

4.8/5  (36)

(36)

Use the following information for questions.

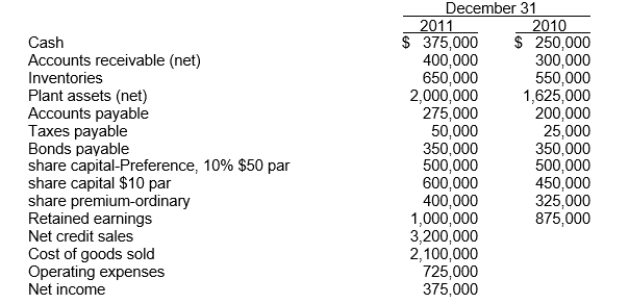

The following data are provided:

Additional information:

Depreciation included in cost of goods sold and operating expenses is $305,000.On May 1, 2011, 15,000 ordinary shares were issued.The preference share are cumulative.The preference dividends were not declared during 2011.

-The profit margin on sales for 2011 is

Additional information:

Depreciation included in cost of goods sold and operating expenses is $305,000.On May 1, 2011, 15,000 ordinary shares were issued.The preference share are cumulative.The preference dividends were not declared during 2011.

-The profit margin on sales for 2011 is

(Multiple Choice)

4.8/5  (34)

(34)

All of the following information about each operating segment must be reported except

(Multiple Choice)

4.9/5  (40)

(40)

Other types of information found in the annual report, such as management commentary and the letter to shareholders, are subject to IASB rules.

(True/False)

4.9/5  (35)

(35)

IFRS requires that a company report all to the following except

(Multiple Choice)

4.7/5  (33)

(33)

The IASB and FASB require companies to provide expanded about their contractual obligations.

(True/False)

4.8/5  (43)

(43)

Showing 61 - 80 of 83

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)