Exam 3: Taxable Entities, Tax Formula, Introduction to Property Transactions

Exam 1: An Overview of Federal Taxation52 Questions

Exam 2: Tax Practice and Research42 Questions

Exam 3: Taxable Entities, Tax Formula, Introduction to Property Transactions68 Questions

Exam 4: Personal and Dependency Exemptions; Filing Status; Determination of Tax for an Individual; Filing Requirements62 Questions

Exam 5: Gross Income74 Questions

Exam 6: Gross Income: Inclusions and Exclusions82 Questions

Exam 7: Overview of Deductions and Losses25 Questions

Exam 8: Employee Business Expenses40 Questions

Exam 9: Capital Recovery: Depreciation, Amortization, and Depletion48 Questions

Exam 10: Certain Business Deductions and Losses52 Questions

Exam 11: Itemized Deductions60 Questions

Exam 12: Deductions for Certain Investment Expenses and Losses57 Questions

Exam 13: The Alternative Minimum Tax and Tax Credits49 Questions

Exam 14: Property Transactions: Basis Determination and Recognition of Gain or Loss60 Questions

Exam 15: Nontaxable Exchanges52 Questions

Exam 16: Property Transactions: Capital Gains and Losses60 Questions

Exam 17: Property Transactions: Dispositions of Trade or Business Property42 Questions

Exam 18: Employee Compensation and Retirement Plans43 Questions

Exam 19: Taxation of Business Forms and Their Owners30 Questions

Select questions type

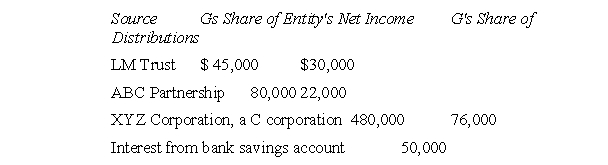

G is an 11-year-old heiress whose share of income from various sources is as follows for the current year:  G's A.G.I, (ignoring the deduction for one-half of any self-employment tax, if any) is how much?

G's A.G.I, (ignoring the deduction for one-half of any self-employment tax, if any) is how much?

(Multiple Choice)

4.9/5  (36)

(36)

A partnership is taxed at the same rates as estates and trusts for Federal income tax purposes.

(True/False)

5.0/5  (40)

(40)

W, a U.S.citizen, earned $6,000 from foreign sources on which she paid tax of $1,200 to the foreign government.W's U.S.tax was $4,000, $1,500 of which was on the foreign income.W must pay $2,800, after the foreign tax credit, to the United States.

(True/False)

4.9/5  (29)

(29)

The following represent elements of the tax formula for individual taxpayers:

A.Income from any source

B.Personal and dependency exemptions

C.Itemized deductions

D.Deductions for A.G.I.

E.Exclusions from gross income

F.Standard deduction amount

Which of the items listed are considered in arriving at A.G.I.?

(Multiple Choice)

4.9/5  (38)

(38)

Barnum and Bailey incorporated their circus this year and elected to be treated as an S corporation.Barnum owns 60% of the corporation's stock while Bailey owns the remaining 40%.This year, the corporation had net income of $300,000 before the owners took any money out of the business (e.g., before salaries, dividend distributions, etc.).Assuming the corporation paid Barnum a deductible salary of $100,000 for managing the business and made dividend distributions of $12,000 to Barnum and $8,000 to Bailey, what is the amount of taxable income to be reported by Barnum?

(Multiple Choice)

4.9/5  (35)

(35)

Which of the following income is generally excluded from gross income?

(Multiple Choice)

4.7/5  (43)

(43)

An increase in adjusted gross income can cause a decrease in certain otherwise allowable itemized deductions.

(True/False)

4.8/5  (31)

(31)

Showing 61 - 68 of 68

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)