Exam 18: Option Valuation and Strategies Private

Exam 1: An Introduction to Investments Private20 Questions

Exam 2: Securities Markets79 Questions

Exam 3: The Time Value of Money Private42 Questions

Exam 4: Financial Planning, Taxation, and the Efficiency of Financial Markets57 Questions

Exam 5: Risk and Portfolio Management54 Questions

Exam 6: Investment Companies: Mutual Funds Private67 Questions

Exam 7: Closed-End Investment Companies, Real Estate Investment Trusts Reits, and Exchange-Traded Funds Etfs Private53 Questions

Exam 8: Stock Private106 Questions

Exam 9: The Valuation of Stock Private36 Questions

Exam 10: Investment Returns and Aggregate Measures of Stock Markets42 Questions

Exam 11: The Macroeconomic Environment for Investment36 Questions

Exam 12: Behavioral Finance and Technical Analysis34 Questions

Exam 13: The Bond Market Private63 Questions

Exam 14: The Valuation of Fixed Income Securities64 Questions

Exam 15: Government Securities51 Questions

Exam 16: Convertible Bonds and Convertible Preferred Stock47 Questions

Exam 17: An Introduction to Options84 Questions

Exam 18: Option Valuation and Strategies Private42 Questions

Exam 19: Commodity and Financial Futures Private47 Questions

Exam 20: Financial Planning and Investing in an Efficient Market Context22 Questions

Select questions type

If a call is overvalued, put-call parity suggeststhat the investor should

(Multiple Choice)

4.8/5  (38)

(38)

If an individual sells a stock short, that investor is protected from a large increase in the price of the stock by selling a call option.

(True/False)

4.7/5  (40)

(40)

According to the Black/Scholes option valuationmodel, a call option's value increases if

(Multiple Choice)

4.9/5  (45)

(45)

The price of a stock is $46 and the prices of call options to buy the stock at $45 and $50 are $6 and $3, respectively. What are the potential profits and losses when the price of the stock is $40, $45, $50, and $55 if the investor buys the call at $45 and sells the call at $50

(Essay)

4.8/5  (24)

(24)

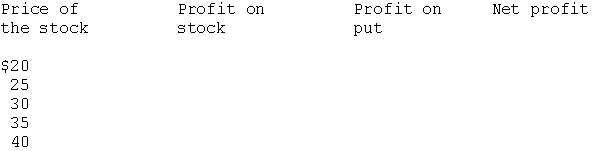

A put and a call have the following terms:Call: strike price $30term three monthsprice $3Put: strike price $30term three monthsprice $4The price of the stock is currently $29. You sell the stock short and purchase the call. Complete the following table and answer the questions.  a. What is the maximum possible profit on the position?

b. What is the maximum possible loss on the position?

c. What is the range of stock prices that generates a profit?

d. What advantage does this position offer?

a. What is the maximum possible profit on the position?

b. What is the maximum possible loss on the position?

c. What is the range of stock prices that generates a profit?

d. What advantage does this position offer?

(Essay)

4.9/5  (32)

(32)

According to the Black/Scholes option valuation model, the value of a call option rises as it approaches expiration.

(True/False)

4.9/5  (44)

(44)

According to put-call parity, if a stock is overpriced, the investor should sell the stock short, sell the put, buy the call, and buy the bond.

(True/False)

4.8/5  (30)

(30)

Put-call parity explains why a change in interest rates by the Federal Reserve affects stock and option prices.

(True/False)

4.9/5  (44)

(44)

Writing both a put and a call at the same strike price and expiration date is an illustration of a straddle.

(True/False)

4.9/5  (32)

(32)

Buying a call and a treasury bill produces similar results as buying a stock and a put.

(True/False)

4.9/5  (47)

(47)

The hedge ratio is one piece of information given bythe Black/Scholes option valuation model.

(True/False)

4.8/5  (33)

(33)

The "collar strategy" is used to lock-in profits from an increase in the price of a stock.

(True/False)

4.8/5  (42)

(42)

If the hedge ratio is 0.7, the number of call optionsnecessary to offset a long position in a stock is 7.0.

(True/False)

4.9/5  (30)

(30)

If investors believe that a stock's price willfluctuate but they are not certain as to the direction, these investors may buy a straddle.

(True/False)

4.8/5  (39)

(39)

Selling a call and purchasing a treasury bill produces the same returns as buying a stock.

(True/False)

4.9/5  (24)

(24)

Put-call parity basically says that combination of a put, a call, and a risk-free bond must be the same value as the underlying stock. If not, at least one market is in disequilibrium. The resulting arbitrage alters the securities' prices until the value of the call plus the bond is equal to the prices of the put plus the stock. Currently, the price of a stock is $100 while the price of a call option at $100 is $10; the price of the put option is $4.59, and the rate of interest is 8 percent, so that the investor may purchase a $100 discounted note for $92.59.

a. Do these prices indicate that the financial markets are in equilibrium? Show me how you derived your answer.

b. An arbitrage opportunity should exist, but if you set up the position incorrectly, you will always sustain losses. Verify to me that if you do set up an incorrect arbitrage, you will always sustain a loss. Please use prices of the stock at $80, $100, and $120 as of the expiration date of the options.

(Essay)

4.8/5  (38)

(38)

Showing 21 - 40 of 42

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)