Exam 6: Inventories

Exam 1: Accounting in Action240 Questions

Exam 2: The Recording Process207 Questions

Exam 3: Adjusting the Accounts261 Questions

Exam 4: Completing the Accounting Cycle239 Questions

Exam 5: Accounting for Merchandising Operations246 Questions

Exam 6: Inventories232 Questions

Exam 7: Accounting Information Systems150 Questions

Exam 8: Fraud, Internal Control, and Cash230 Questions

Exam 9: Accounting for Receivables239 Questions

Exam 10: Plant Assets, Natural Resources, and Intangible Assets305 Questions

Exam 11: Current Liabilities and Payroll Accounting218 Questions

Exam 12: Accounting for Partnerships210 Questions

Exam 13: Corporations: Organization and Capital Stock Transactions204 Questions

Exam 14: Corporations: Dividends, Retained Earnings, and Income Reporting191 Questions

Exam 15: Long-Term Liabilities209 Questions

Exam 16: Investments188 Questions

Exam 17: Statement of Cash Flows215 Questions

Exam 18: Financial Statement Analysis224 Questions

Exam 19: Managerial Accounting206 Questions

Exam 20: Job Order Costing204 Questions

Exam 21: Process Costing195 Questions

Exam 22: Cost-Volume-Profit215 Questions

Exam 23: Budgetary Planning214 Questions

Exam 24: Budgetary Control and Responsibility Accounting213 Questions

Exam 25: Standard Costs and Balanced Scorecard244 Questions

Exam 26: Incremental Analysis and Capital Budgeting217 Questions

Exam 27: Time Value of Money72 Questions

Select questions type

This information is available for Sheena's Photo Corporation for 2016 and 2017. Beginning inventory \ 200,000 \ 300,000 Ending inventory 300,000 365,000 Cost of goods sold 1,200,000 1,330,000 Sales revenue 1,600,000 1,900,000 Instructions

Calculate inventory turnover days in inventory and gross profit rate for Sheena's Photo Corporation for 2016 and 2017. Comment on any trends.

(Essay)

4.9/5  (39)

(39)

Flite Company had beginning inventory on May 1 of $12000. During the month the company made purchases of $38000 but returned $2000 of goods because they were defective. At the end of the month the inventory on hand was valued at $16500.

Calculate cost of goods available for sale and cost of goods sold for the month.

(Essay)

4.9/5  (38)

(38)

Liche Company reported net income of $54000 in 2016 and $80000 in 2017. However ending inventory was overstated by $6000 in 2016.

Instructions

Compute the correct net income for Liche Company for 2016 and 2017.

(Essay)

4.7/5  (38)

(38)

An error that overstates the ending inventory will also cause net income for the period to be overstated.

(True/False)

4.8/5  (34)

(34)

In applying the LIFO assumption in a perpetual inventory system the cost of the units most recently purchased prior to sale is allocated first to the units sold.

(True/False)

4.8/5  (38)

(38)

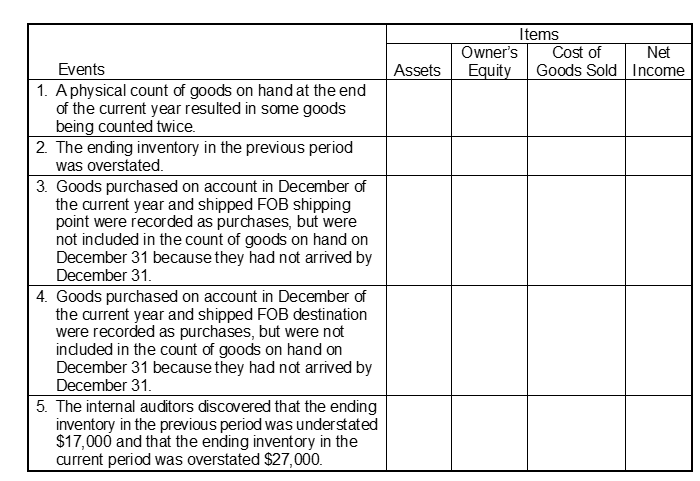

For each of the independent events listed below analyze the impact on the indicated items at the end of the current year by placing the appropriate code letter in the box under each item.

Code: O = item is overstated

U = item is understated

NA = item is not affected

(Essay)

4.7/5  (44)

(44)

In a period of rising prices the costs allocated to ending inventory may be understated in the

(Multiple Choice)

4.9/5  (37)

(37)

Under the gross profit method each of the following items are estimated except for the

(Multiple Choice)

4.9/5  (43)

(43)

Henri Company's inventory records show the following data: Units Unit Cost Inventory, January 1 10,000 \ 9.20 Purchases: June 18 9,000 8.00 November 8 6,000 7.25

A physical inventory on December 31 shows 3000 units on hand. Henri sells the units for $12 each. The company has an effective tax rate of 20%. Henri uses the periodic inventory method. Under the LIFO method cost of goods sold is

(Multiple Choice)

5.0/5  (35)

(35)

If a company uses the FIFO cost assumption the cost of goods sold for the period will be the same under a perpetual or periodic inventory system.

(True/False)

4.9/5  (31)

(31)

Under the retail inventory method the estimated cost of ending inventory is computed by multiplying the cost-to-retail ratio by

(Multiple Choice)

4.9/5  (31)

(31)

The cost of goods purchased during a period plus the beginning inventory is the amount of goods ________________ during the period.

(Short Answer)

4.8/5  (37)

(37)

Queen Company is in the electronics industry and the price it pays for inventory is decreasing.

Instructions

Indicate which inventory method will:

a. provide the highest ending inventory.

b. provide the highest cost of goods sold.

c. result in the highest net income.

d. result in the lowest income tax expense.

e. produce the most stable earnings over several years.

(Essay)

4.9/5  (29)

(29)

The specific identification method of costing inventories is used when the

(Multiple Choice)

4.8/5  (29)

(29)

In a period of increasing prices which inventory flow assumption will result in the lowest amount of income tax expense?

(Multiple Choice)

4.9/5  (31)

(31)

The cost flow method that often parallels the actual physical flow of merchandise is the

(Multiple Choice)

4.9/5  (32)

(32)

The cost of goods available for sale is allocated to the cost of goods sold and the

(Multiple Choice)

4.8/5  (40)

(40)

Pasquale has the following inventory information. July 1 Beginning Inventory 20 units at \ 19 \ 380 7 Purchases 70 units at \ 20 1,400 22 Purchases 10 units at \ 24 240 \2 ,020 A physical count of merchandise inventory on July 31 reveals that there are 30 units on hand. Using the LIFO inventory method the amount allocated to cost of goods sold for July is

(Multiple Choice)

4.9/5  (42)

(42)

Showing 61 - 80 of 232

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)