Exam 6: Inventories

Exam 1: Accounting in Action240 Questions

Exam 2: The Recording Process207 Questions

Exam 3: Adjusting the Accounts261 Questions

Exam 4: Completing the Accounting Cycle239 Questions

Exam 5: Accounting for Merchandising Operations246 Questions

Exam 6: Inventories232 Questions

Exam 7: Accounting Information Systems150 Questions

Exam 8: Fraud, Internal Control, and Cash230 Questions

Exam 9: Accounting for Receivables239 Questions

Exam 10: Plant Assets, Natural Resources, and Intangible Assets305 Questions

Exam 11: Current Liabilities and Payroll Accounting218 Questions

Exam 12: Accounting for Partnerships210 Questions

Exam 13: Corporations: Organization and Capital Stock Transactions204 Questions

Exam 14: Corporations: Dividends, Retained Earnings, and Income Reporting191 Questions

Exam 15: Long-Term Liabilities209 Questions

Exam 16: Investments188 Questions

Exam 17: Statement of Cash Flows215 Questions

Exam 18: Financial Statement Analysis224 Questions

Exam 19: Managerial Accounting206 Questions

Exam 20: Job Order Costing204 Questions

Exam 21: Process Costing195 Questions

Exam 22: Cost-Volume-Profit215 Questions

Exam 23: Budgetary Planning214 Questions

Exam 24: Budgetary Control and Responsibility Accounting213 Questions

Exam 25: Standard Costs and Balanced Scorecard244 Questions

Exam 26: Incremental Analysis and Capital Budgeting217 Questions

Exam 27: Time Value of Money72 Questions

Select questions type

Use of the LIFO inventory valuation method enables a company to report paper or phantom profits.

(True/False)

4.8/5  (33)

(33)

A. Macarty Company's records indicate the following information for the year: Merchandise inventory, 1/1 \ 550,000 Purchases 2,250,000 Net sales 3,100,000 On December 31 a physical inventory determined that ending inventory of $600000 was in the warehouse. A. Macarty's gross profit on sales has remained constant at 30%. A. Macarty suspects some of the inventory may have been taken by some new employees. At December 31 what is the estimated cost of missing inventory?

(Multiple Choice)

4.9/5  (42)

(42)

Certain agricultural and mineral products can be reported at net realizable value under

A) Yes No

B) Yes Yes

C) No No

D) No Yes

(Short Answer)

4.9/5  (39)

(39)

The managers of Venice Company receive performance bonuses based on the net income of the firm. Which inventory costing method are they likely to favor in periods of declining prices?

(Multiple Choice)

4.8/5  (38)

(38)

Under the lower-of-cost-or-market basis market is defined as current replacement cost.

(True/False)

4.8/5  (39)

(39)

Which of the following statements is correct with respect to inventories?

(Multiple Choice)

4.8/5  (37)

(37)

Inventoriable costs may be thought of as a pool of costs consisting of which two elements?

(Multiple Choice)

4.8/5  (33)

(33)

FIFO and LIFO are the two most common cost flow assumptions made in costing inventories. The amounts assigned to the same inventory items on hand may be different under each cost flow assumption. If a company has no beginning inventory explain the difference in ending inventory values under the FIFO and LIFO cost bases when the price of inventory items purchased during the period have been (1) increasing (2) decreasing and (3) remained constant.

(Essay)

5.0/5  (33)

(33)

Determine the difference in the amount of income that the company would have reported if it had used the FIFO method instead of the LIFO method. Would income have been greater or less?

(Essay)

4.8/5  (31)

(31)

Errors occasionally occur when physically counting inventory items on hand. Identify the financial statement effects of an overstatement of the ending inventory in the current period. If the error is not corrected how does it affect the financial statements for the following year?

(Essay)

4.7/5  (42)

(42)

If a company changes its inventory valuation method the effect of the change on net income should be disclosed in the financial statements.

(True/False)

4.8/5  (35)

(35)

Barley Company developed the following information about its inventories in applying the lower-of-cost-or-market (LCM) basis in valuing inventories: Product Cost Market A \ 115,000 \ 120,000 B 80,000 73,000 C 158.000 162,000

If Barley applies the LCM basis the value of the inventory reported on the balance sheet would be

(Multiple Choice)

4.8/5  (36)

(36)

An auto manufacturer would classify vehicles in various stages of production as

(Multiple Choice)

4.8/5  (29)

(29)

Storme Shutters has the following inventory information. Nov. 1 Inventory 30 units @\ 8.00 8 Purchase 120 units @\ 8.30 17 Purchase 60 units @\ 8.70 25 Purchase 90 units @\ 8.80 A physical count of merchandise inventory on November 30 reveals that there are 80 units on hand. Assume a periodic inventory system is used. Ending inventory under FIFO is

(Multiple Choice)

4.8/5  (40)

(40)

The lower-of-cost-or-market basis of valuing inventories is an example of

(Multiple Choice)

4.9/5  (38)

(38)

Glenn Company has the following inventory information. July 1 Beginning Inventory 10 units at \ 90 5 Purchases 60 units at \ 92 14 Sale 50 units 21 Purchases 30 units at \ 95 30 Sale 35 units Assuming that a perpetual inventory system is used what is the ending inventory (round all calculations to nearest dollar) under the moving-average cost method?

(Multiple Choice)

4.8/5  (39)

(39)

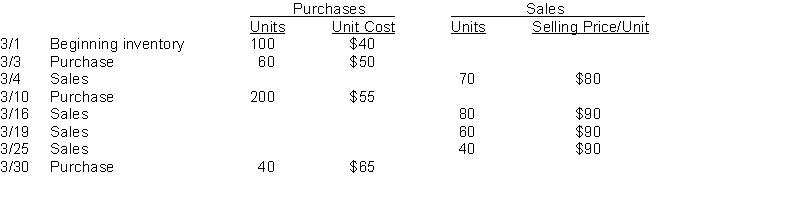

Lester Company sells many products. Hackenberry is one of its popular items. Below is an analysis of the inventory purchases and sales of Hackenberry for the month of March. Lester Company uses the periodic inventory system.  Instructions

(a) Using the FIFO assumption calculate the amount charged to cost of goods sold for March. (Show computations)

(b) Using the weighted average method calculate the amount assigned to the inventory on hand on March 31. (Show computations)

(c) Using the LIFO assumption calculate the amount assigned to the inventory on hand on March 31. (Show computations)

Instructions

(a) Using the FIFO assumption calculate the amount charged to cost of goods sold for March. (Show computations)

(b) Using the weighted average method calculate the amount assigned to the inventory on hand on March 31. (Show computations)

(c) Using the LIFO assumption calculate the amount assigned to the inventory on hand on March 31. (Show computations)

(Essay)

4.9/5  (29)

(29)

Storme Shutters has the following inventory information. Nov. 1 Inventory 30 units @\ 8.00 8 Purchase 120 units @\ 8.30 17 Purchase 60 units @\ 8.70 25 Purchase 90 units @\ 8.80 A physical count of merchandise inventory on November 30 reveals that there are 80 units on hand. Assume a periodic inventory system is used. Assuming that the specific identification method is used and that ending inventory consists of 20 units from each of the three purchases and 20 units from the November 1 inventory cost of goods sold is

(Multiple Choice)

4.8/5  (29)

(29)

Showing 81 - 100 of 232

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)