Exam 16: Simple Interest

Exam 1: Problem Solving With Math66 Questions

Exam 2: Fractions97 Questions

Exam 3: Decimals126 Questions

Exam 4: Solving for the Unknown105 Questions

Exam 5: Business Statistics76 Questions

Exam 6: Banking and Budgeting70 Questions

Exam 7: Payroll and Income Tax86 Questions

Exam 8: Sales, Excise, and Property Taxes82 Questions

Exam 9: Risk Management105 Questions

Exam 10: Installment Buying and Revolving Charge Credit Cards60 Questions

Exam 11: Discounts: Trade and Cash101 Questions

Exam 12: Markups and Markdowns: Perishables and Breakeven Analysis87 Questions

Exam 13: How to Read, Analyze, and Interpret Financial Reports53 Questions

Exam 14: Depreciation50 Questions

Exam 15: Inventory and Overhead68 Questions

Exam 16: Simple Interest69 Questions

Exam 17: Promissory Notes, Simple Discount Notes, and the Discount Process64 Questions

Exam 18: The Cost of Home Ownership44 Questions

Exam 19: Compound Interest and Present Value64 Questions

Exam 20: Annuities and Sinking Funds40 Questions

Exam 21: Stocks, Bonds, and Mutual Funds65 Questions

Select questions type

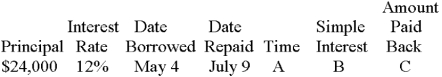

Use exact interest:

Free

(Short Answer)

4.9/5  (45)

(45)

Correct Answer:

A. 66 days; B. $520.77; C. $24,520.77

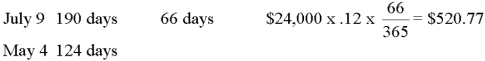

Round all answers to the nearest cent. Woody's Café's real estate tax of $1,110.85 was due on November 1, 2014. Due to financial problems, Woody was unable to pay his café's real estate tax bill until January 15, 2015. The penalty for late payment is 8 1/4% ordinary interest. (A) What is the penalty Woody will have to pay and (B) what will Woody pay on January 15?

Free

(Short Answer)

4.9/5  (36)

(36)

Correct Answer:

A. $19.09

B. $1,129.94

Jim Murphy borrowed $30,000 on a 120-day 14% note. Jim paid $5,000 toward the note on day 95. On day 105 he paid an additional $6,000. Using the U.S. Rule, Jim's adjusted balance after the first payment is:

Free

(Multiple Choice)

4.7/5  (31)

(31)

Correct Answer:

D

Given interest of $11,900 at 6% for 50 days (ordinary interest), one can calculate the principal as:

(Multiple Choice)

5.0/5  (36)

(36)

Janet Home went to Citizen Bank. She borrowed $7,000 at a rate of 8%. The date of the loan was September 20. Janet hoped to repay the loan on January 20. Assuming the loan is based on ordinary interest, Janet will pay back how much interest on January 20?

(Multiple Choice)

4.8/5  (36)

(36)

Round all answers to the nearest cent. Lou Valdez is buying a truck. His monthly interest is $155 at 10 1/4 %. What is Lou's principal balance after the beginning of November? Use 360 days. DO NOT round the denominator in your calculation.

(Short Answer)

4.7/5  (33)

(33)

The U.S. Rule is a method that allows the borrower to receive proper interest credit when a debt is paid off in more than one payment before the maturity date.

(True/False)

4.8/5  (34)

(34)

A $40,000 loan at 4% dated June 10 is due to be paid on October 11. The amount of interest is (assume ordinary interest):

(Multiple Choice)

4.8/5  (34)

(34)

The amount a bank charges for the use of money is called interest.

(True/False)

4.7/5  (34)

(34)

Christina Hercher borrowed $50,000 on a 90-day 8% note. Christina paid $3,000 toward the note on day 40. On day 60 she paid an additional $4,000. Using the U.S. Rule, Christina's adjusted balance after the first payment is:

(Multiple Choice)

4.8/5  (37)

(37)

Jane Smith took out a loan for $40,000 to pay for her child's education. The loan would be repaid at the end of eight years in one payment with interest of 12%. What is the total amount Jane has to pay back at the end of the loan?

(Short Answer)

4.9/5  (33)

(33)

Joyce took out a loan for $21,900 at 12% on March 18, 2013, which will be due on January 9, 2014. Using ordinary interest, Joyce will pay back on Jan. 9 a total amount of:

(Multiple Choice)

4.8/5  (42)

(42)

Round all answers to the nearest cent. Amy Koy met Pat Quin on Sept. 8 at Queen Bank. After talking with Pat, Amy decided she would like to consider a $9,000 loan at 10 1/2% to be repaid on Feb. 17 of the next year on exact interest. Calculate the amount that Amy would pay at maturity under this assumption.

(Short Answer)

4.8/5  (39)

(39)

Alice took out a loan for $19,500 at 13 1/2% on March 4, 2013, which will be due on

January 14, 2014. Using ordinary interest, what will be the interest cost and what amount will Alice pay back on January 14, 2014?

(Short Answer)

4.8/5  (35)

(35)

Showing 1 - 20 of 69

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)