Exam 8: Reporting and Analyzing Receivables

Exam 1: Introduction to Financial Statements174 Questions

Exam 2: A Further Look at Financial Statements191 Questions

Exam 3: The Accounting Information System221 Questions

Exam 4: Accrual Accounting Concepts258 Questions

Exam 5: Merchandising Operations and the Multiple-Step Income Statement211 Questions

Exam 6: Reporting and Analyzing Inventory189 Questions

Exam 7: Fraud, Internal Control, and Cash195 Questions

Exam 8: Reporting and Analyzing Receivables203 Questions

Exam 9: Reporting and Analyzing Long-Lived Assets219 Questions

Exam 10: Reporting and Analyzing Liabilities246 Questions

Exam 11: Reporting and Analyzing Stockholders Equity216 Questions

Exam 12: Statement of Cash Flows177 Questions

Exam 13: Financial Analysis: The Big Picture203 Questions

Exam 14: Understanding Investments in Debt and Equity Securities209 Questions

Select questions type

ABC Company accepted a national credit card for a $9,000 purchase.The cost of the goods sold is $7,200.The credit card company charges a 3% fee.What is the impact of this transaction on net operating income?

(Multiple Choice)

5.0/5  (33)

(33)

When an account becomes uncollectible and must be written off

(Multiple Choice)

4.8/5  (37)

(37)

When an account is written off using the allowance method, the

(Multiple Choice)

4.8/5  (37)

(37)

When using the balance sheet approach, the balance in Allowance for Doubtful Accounts must be considered prior to the end of period adjustment when using which of the following methods?

(Multiple Choice)

4.8/5  (50)

(50)

A concentration of credit risk is a threat of nonpayment from a single customer or class of customers that could adversely affect the financial health of the company.

(True/False)

4.8/5  (33)

(33)

Receivables are valued and reported in the balance sheet at their gross amount less any sales returns and allowances and any cash discounts.

(True/False)

4.7/5  (44)

(44)

When an account is written off using the allowance method, accounts receivable

(Multiple Choice)

4.9/5  (35)

(35)

The financial statements of the Phelps Manufacturing Company report net sales of $600,000 and accounts receivable of $80,000 and $40,000 at the beginning of the year and the end of the year, respectively.What is the accounts receivable turnover for Phelps?

(Multiple Choice)

4.7/5  (39)

(39)

A factor buys receivables from businesses for a fee and collects the payment directly from customers.

(True/False)

4.8/5  (38)

(38)

A note receivable is issued in December.When the note is paid the following February, the payee's entry includes (assuming a calendar-year accounting period and no reversing entries) a

(Multiple Choice)

4.8/5  (38)

(38)

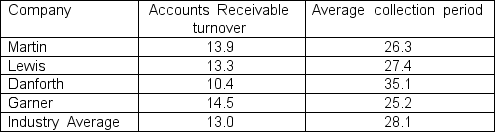

In the table below the information for four companies is provided.  If Garner's net credit sales are $435,000, what are its average net accounts receivable?

If Garner's net credit sales are $435,000, what are its average net accounts receivable?

(Multiple Choice)

4.8/5  (40)

(40)

The receivable that is usually evidenced by a formal instrument of credit is a(n)

(Multiple Choice)

4.8/5  (40)

(40)

When an account receivable that was previously written off is collected, it is first necessary to reverse the entry to reinstate the customer's account before recording the collection.

(True/False)

4.8/5  (41)

(41)

Douglas Company has a $60,000 note that carries an annual interest rate of 10%.If the amount of the total interest on the note is equal to $4,500, then what is the duration of the note in months?

(Multiple Choice)

4.7/5  (35)

(35)

Using the percentage-of-receivables method for recording bad debt expense, estimated uncollectible accounts are $55,000.If the balance of the Allowance for Doubtful Accounts is an $11,000 debit before adjustment, what is the amount of bad debt expense for that period?

(Multiple Choice)

4.8/5  (42)

(42)

The allowance for doubtful accounts is similar to accumulated depreciation in that it shows the total of all accounts written off over the years.

(True/False)

4.8/5  (46)

(46)

When a company receives an interest-bearing note receivable, it will

(Multiple Choice)

4.7/5  (32)

(32)

Showing 121 - 140 of 203

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)