Exam 8: Reporting and Analyzing Receivables

Exam 1: The Purpose and Use of Financial Statements105 Questions

Exam 2: A Further Look at Financial Statements129 Questions

Exam 3: The Accounting Information System145 Questions

Exam 4: Accrual Accounting Concepts134 Questions

Exam 5: Merchandising Operations159 Questions

Exam 6: Reporting and Analyzing Inventory103 Questions

Exam 7: Internal Control and Cash95 Questions

Exam 8: Reporting and Analyzing Receivables114 Questions

Exam 9: Reporting and Analyzing Long-Lived Assets154 Questions

Exam 10: Reporting and Analyzing Liabilities92 Questions

Exam 12: Reporting and Analyzing Investments117 Questions

Exam 13: Statement of Cash Flows123 Questions

Exam 14: Performance Measurement127 Questions

Select questions type

The carrying amount of accounts receivable

Free

(Multiple Choice)

4.7/5  (32)

(32)

Correct Answer:

A

Advances to employees are a type of accounts receivable.

Free

(True/False)

4.9/5  (35)

(35)

Correct Answer:

False

Under the allowance method for uncollectible accounts, when a specific account is written off

Free

(Multiple Choice)

4.9/5  (34)

(34)

Correct Answer:

A

If eventual collection is expected after a note has been dishonoured an accounts receivable replaces the note including any unpaid interest.

(True/False)

4.8/5  (42)

(42)

The balance of the Allowance for Doubtful Accounts prior to making the adjusting entry to record Bad Debts Expense

(Multiple Choice)

4.7/5  (36)

(36)

Uncollectible accounts must be estimated because it is not possible to know which accounts will not be collected.

(True/False)

4.7/5  (36)

(36)

The account Allowance for Doubtful Accounts is necessary because

(Multiple Choice)

4.9/5  (37)

(37)

Allowance for Doubtful Accounts is credited when an account is determined to be uncollectible.

(True/False)

4.7/5  (36)

(36)

A note receivable is a written promise by the maker to the payee to pay a specified amount of money at a definite time.

(True/False)

4.9/5  (29)

(29)

You have just received notice that a customer with an Accounts Receivable balance of $500 has gone bankrupt and will not make any future payments.Assuming you use the allowance method for uncollectible accounts, the entry you make is to

(Multiple Choice)

4.8/5  (42)

(42)

Under the aging method of estimating the allowance for doubtful accounts, the balance in the allowance account must be considered prior to adjusting for estimated uncollectible accounts.

(True/False)

4.9/5  (40)

(40)

The total interest owing on a $10,000, 6%, 6-month note receivable is

(Multiple Choice)

4.9/5  (39)

(39)

The balance in Allowance for Doubtful Accounts would have a debit balance when

(Multiple Choice)

4.8/5  (39)

(39)

Uncollectible notes receivable should be estimated at year end and recorded as a debit to Bad Debts Expense and a credit to Notes Receivable.

(True/False)

4.8/5  (46)

(46)

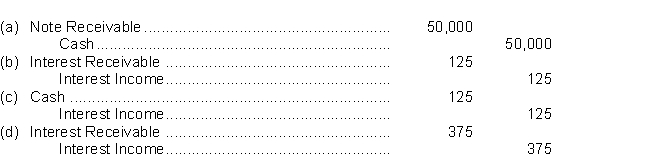

Tabby Inc.lends Siamese Ltd.$50,000 on April 1, accepting a 3-month, 3% interest note.Interest is due the first of each month, commencing May 1.Tabby Inc.prepares financial statements on April 30.What adjusting entry should be made before the financial statements can be prepared?

(Short Answer)

4.8/5  (48)

(48)

Under the allowance method for uncollectible accounts, Bad Debts Expense is recorded

(Multiple Choice)

4.7/5  (40)

(40)

Interest on a 3-month, 3%, $20,000 note is calculated by multiplying $20,000 * 3% * 3.

(True/False)

4.8/5  (36)

(36)

Showing 1 - 20 of 114

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)