Exam 6: Reporting and Analyzing Inventory

Exam 1: The Purpose and Use of Financial Statements105 Questions

Exam 2: A Further Look at Financial Statements129 Questions

Exam 3: The Accounting Information System145 Questions

Exam 4: Accrual Accounting Concepts134 Questions

Exam 5: Merchandising Operations159 Questions

Exam 6: Reporting and Analyzing Inventory103 Questions

Exam 7: Internal Control and Cash95 Questions

Exam 8: Reporting and Analyzing Receivables114 Questions

Exam 9: Reporting and Analyzing Long-Lived Assets154 Questions

Exam 10: Reporting and Analyzing Liabilities92 Questions

Exam 12: Reporting and Analyzing Investments117 Questions

Exam 13: Statement of Cash Flows123 Questions

Exam 14: Performance Measurement127 Questions

Select questions type

Inventory that originally cost $11,200 was written down to its net realizable value of $9,400 at the end of 2021.At the end of 2022, the net realizable value is determined to be $11,700.At what amount should the inventory be reported on the December 31, 2022 statement of financial position?

Free

(Multiple Choice)

4.9/5  (33)

(33)

Correct Answer:

B

In a period of rising prices, which of the following inventory cost formulas generally results in the lowest net income figure?

Free

(Multiple Choice)

4.7/5  (42)

(42)

Correct Answer:

A

The first-in, first-out (FIFO) inventory cost formula results in an ending inventory valued at the most recent cost.

Free

(True/False)

4.7/5  (39)

(39)

Correct Answer:

True

Inventory cost formulas such as FIFO and average cost, deal more with the flow of costs than with the flow of goods.

(True/False)

4.7/5  (37)

(37)

Which of the following is not a guideline when choosing between whether to use FIFO or the average cost method?

(Multiple Choice)

4.9/5  (33)

(33)

Approximating the physical flow of inventory is not important when selecting an inventory cost formula.

(True/False)

4.8/5  (32)

(32)

The inventory cost formula that results in the inventory value on the statement of financial position that is closest to its actual cost is

(Multiple Choice)

4.7/5  (28)

(28)

Which of the following should a business consider when choosing between the FIFO and average cost formulas?

(Multiple Choice)

4.8/5  (47)

(47)

Use the following information for questions

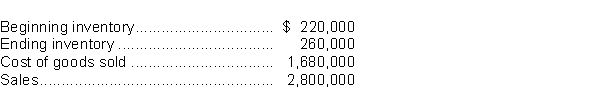

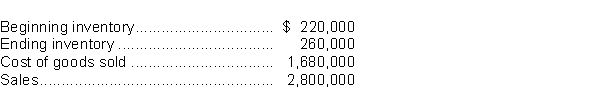

The following information was available for Free for All Limited at December 31, 2022:

-Free for All days in inventory was

-Free for All days in inventory was

(Multiple Choice)

4.9/5  (31)

(31)

Inventory that originally cost $100 had been written down to its net realizable value (NRV) of $75.Subsequently, the NRV of the inventory recovered to equal its cost of $100.In this situation, the amount of the $25 ($100 - $75) prior writedown in value should be reversed.

(True/False)

4.8/5  (40)

(40)

Once goods leave the premises of the seller, they should never be added to the seller's physical inventory count.

(True/False)

5.0/5  (39)

(39)

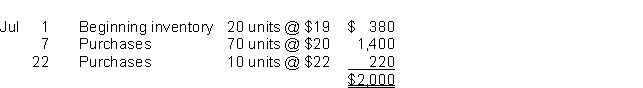

Use the following information to answer questions

Abalone Corp.uses a periodic inventory system.

A physical count of merchandise inventory on July 31 shows that 25 units are on hand.

-Under the average cost method, cost of goods sold for July was

A physical count of merchandise inventory on July 31 shows that 25 units are on hand.

-Under the average cost method, cost of goods sold for July was

(Multiple Choice)

4.9/5  (34)

(34)

A system of internal control is not needed when a company regularly takes a physical inventory.

(True/False)

4.9/5  (43)

(43)

In order to remove the cost of items sold from inventory, a unit cost must be determined.

(True/False)

4.9/5  (40)

(40)

In the average cost formula used in a periodic inventory system, the same weighted average cost per unit is used to calculate all of the goods sold during the period.

(True/False)

4.7/5  (38)

(38)

When using the average method under the periodic inventory system the average cost is calculated:

(Multiple Choice)

4.9/5  (34)

(34)

If a company has no beginning inventory and the unit cost of inventory items does not change during the year, the unit cost assigned to the cost of goods sold will be the same under FIFO and average cost formulas.

(True/False)

4.8/5  (33)

(33)

Use the following information for questions

The following information was available for Free for All Limited at December 31, 2022:

-Free for All inventory turnover was

-Free for All inventory turnover was

(Multiple Choice)

4.8/5  (43)

(43)

Which cost formula provides the better (1) statement of income and (2) statement of financial position valuations, respectively?

(Multiple Choice)

4.9/5  (36)

(36)

Showing 1 - 20 of 103

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)