Exam 7: Inventories: Cost Measurement and Flow Assumptions

Exam 1: The Demand for and Supply of Financial Accounting Information85 Questions

Exam 2: Financial Reporting: Its Conceptual Framework83 Questions

Exam 3: Review of a Company S Accounting System148 Questions

Exam 5: The Income Statement and the Statement of Cash Flows Time Value of Money Module136 Questions

Exam 6: Cash and Receivables172 Questions

Exam 7: Inventories: Cost Measurement and Flow Assumptions114 Questions

Exam 8: Inventories: Special Valuation Issues141 Questions

Exam 9: Current Liabilities and Contingent Obligations125 Questions

Exam 10: Property, Plant, and Equipment: Acquisition and Subsequent Investments111 Questions

Exam 11: Depreciation, Depletion, Impairment, and Disposal136 Questions

Exam 12: Intangibles136 Questions

Exam 13: Investments and Long-Term Receivables135 Questions

Exam 14: Financing Liabilities: Bonds and Long-Term Notes Payable192 Questions

Exam 15: Contributed Capital153 Questions

Exam 17: Advanced Issues in Revenue Recognition103 Questions

Exam 18: Accounting for Income Taxes113 Questions

Exam 19: Accounting for Post-Retirement Benefits94 Questions

Exam 20: Accounting for Leases116 Questions

Exam 21: The Statement of Cash Flows103 Questions

Exam 22: Accounting for Changes and Errors130 Questions

Exam 23: Understanding Time Value of Money Formulas and Concepts142 Questions

Select questions type

The LIFO conformity rule allows a company to use FIFO for financial reporting and LIFO for income taxes.

(True/False)

4.7/5  (47)

(47)

Which of the following are characteristics of a perpetual inventory system?

(Multiple Choice)

4.8/5  (34)

(34)

For companies that have little change in the characteristics of their inventory items, the most appropriate method for computing a cost index for dollar-value LIFO is the

(Multiple Choice)

4.8/5  (35)

(35)

When goods are shipped FOB shipping point, the buyer has economic control of the inventory and must record the goods in its inventory accounts as soon as the goods are shipped.

(True/False)

4.8/5  (32)

(32)

Exhibit 7-4

RJ, Inc. had the following activity for an inventory item during June:

-Refer to Exhibit 7-4. Assuming RJ uses a perpetual moving average cost flow assumption, cost of goods sold for June would be

-Refer to Exhibit 7-4. Assuming RJ uses a perpetual moving average cost flow assumption, cost of goods sold for June would be

(Multiple Choice)

4.7/5  (29)

(29)

Inventory costs include all costs directly or indirectly associated with bringing an item to its existing condition or location for sale.

(True/False)

4.8/5  (29)

(29)

Morton uses the moving average flow assumption. On January 1, there were 180 units on hand and the total inventory cost was $900. On January 10, 40 more units were purchased at a cost of $6 per unit. Sales included 20 units on January 3 and 60 units on January 17. What was the total cost of goods sold recorded for the units sold on January 17?

(Multiple Choice)

4.8/5  (31)

(31)

On June 1, Dollar Hardware, Inc. had an inventory of 300 gas grills costing $100 each. Purchases and sales during June are as follows:  What is the cost of Dollar's inventory on June 30 using the FIFO method?

What is the cost of Dollar's inventory on June 30 using the FIFO method?

(Multiple Choice)

4.7/5  (37)

(37)

Morris Corp. uses dollar-value LIFO. Certain information follows:  Compute the ending 2018 inventory.

Compute the ending 2018 inventory.

(Multiple Choice)

4.8/5  (38)

(38)

Exhibit 7-5

Sullivan Produce Co. switched from FIFO to LIFO on January 1, 2015, for external reporting and income tax purposes, while retaining FIFO for internal reports. On that date, the FIFO inventory equaled $360,000. The ensuing three-year period resulted in the following:

-Refer to Exhibit 7-5. The ending inventory at December 31, 2017, using the dollar-value LIFO method would be

-Refer to Exhibit 7-5. The ending inventory at December 31, 2017, using the dollar-value LIFO method would be

(Multiple Choice)

4.9/5  (45)

(45)

Which of the following is not a disadvantage of using the FIFO cost flow assumption?

(Multiple Choice)

4.9/5  (37)

(37)

The cost of goods sold can be determined only after a physical count of inventory on hand under the

(Multiple Choice)

4.9/5  (39)

(39)

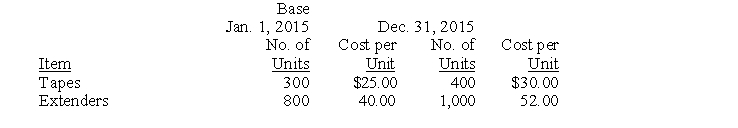

The information below is provided for the only two inventory items held by Hammond, Inc.:  The company uses double-extension dollar-value LIFO with only one pool.

Required:

a. Calculate the cost index for 2015. Round to the nearest hundredth for decimals.

b. Calculate the December 31, 2015 ending inventory for Hammond using dollar-value LIFO. Round to the nearest dollar.

The company uses double-extension dollar-value LIFO with only one pool.

Required:

a. Calculate the cost index for 2015. Round to the nearest hundredth for decimals.

b. Calculate the December 31, 2015 ending inventory for Hammond using dollar-value LIFO. Round to the nearest dollar.

(Essay)

4.8/5  (25)

(25)

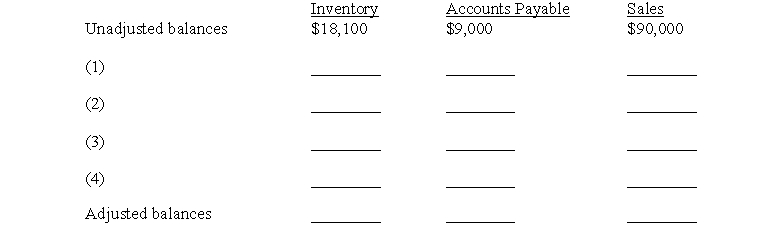

Logan Company has provided the following information:

1) Included in the physical count were inventory items billed to a customer FOB shipping point on December 31, 2016. The goods had a cost of $280 and had been billed at $400. The shipment was on Logan's loading dock waiting to be picked up by the trucking company.

2) Goods returned by customers and held pending inspection in the returned goods area on December 31, 2016, were not included in the physical count. On January 5, 2017, the goods costing $260 were inspected and returned to inventory. Credit memos totaling $380 were issued to the customers on the same date.

3) On January 3, 2017, a monthly freight bill in the amount of $170 was received. The bill specifically related to merchandise purchased in December 2016, 30% of which was still in inventory at December 31, 2016. The freight charges had not been recorded at December 31, 2016.

4) Goods were shipped out on consignment on December 15, 2016, and were recorded as a sale at the sales price of $550. The consignee has not yet sold these items. Goods are sold at a markup of 10% on cost. The goods were not included in inventory.

Required:

Logan's unadjusted balances on December 31, 2016, for Inventory, Accounts Payable, and Sales are provided in the three columns of the schedule below.

a. Complete the schedule to provide the correct adjusted balances at December 31, 2016.

b. Prepare the December 31, 2016, adjusting journal entry that Logan would prepare to record the freight charges described in item 3 above.

b. Prepare the December 31, 2016, adjusting journal entry that Logan would prepare to record the freight charges described in item 3 above.

(Essay)

4.9/5  (31)

(31)

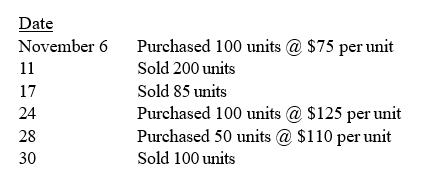

On November 1, Lacy Company began business with the purchase of 250 units of inventory for $21,625. During the month, Lacy had the following inventory transactions:

Required:

Compute the cost of the inventory at the end of November under the following alternatives:

a. FIFO periodic

b. FIFO perpetual

c. LIFO periodic

d. LIFO perpetual

e. Weighted average round unit costs to 2 decimal places)

Required:

Compute the cost of the inventory at the end of November under the following alternatives:

a. FIFO periodic

b. FIFO perpetual

c. LIFO periodic

d. LIFO perpetual

e. Weighted average round unit costs to 2 decimal places)

(Essay)

4.9/5  (43)

(43)

What are the cost flow assumptions available to record costs associated with inventory?

(Essay)

4.8/5  (35)

(35)

Eller Company uses a periodic inventory system. Relevant inventory information for the year follows:  At year-end, 50 units remain in inventory. What is the cost of the ending inventory on a LIFO basis?

At year-end, 50 units remain in inventory. What is the cost of the ending inventory on a LIFO basis?

(Multiple Choice)

4.8/5  (42)

(42)

Showing 41 - 60 of 114

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)