Exam 9: Current Liabilities and Contingent Obligations

Exam 1: The Demand for and Supply of Financial Accounting Information85 Questions

Exam 2: Financial Reporting: Its Conceptual Framework83 Questions

Exam 3: Review of a Company S Accounting System148 Questions

Exam 5: The Income Statement and the Statement of Cash Flows Time Value of Money Module136 Questions

Exam 6: Cash and Receivables172 Questions

Exam 7: Inventories: Cost Measurement and Flow Assumptions114 Questions

Exam 8: Inventories: Special Valuation Issues141 Questions

Exam 9: Current Liabilities and Contingent Obligations125 Questions

Exam 10: Property, Plant, and Equipment: Acquisition and Subsequent Investments111 Questions

Exam 11: Depreciation, Depletion, Impairment, and Disposal136 Questions

Exam 12: Intangibles136 Questions

Exam 13: Investments and Long-Term Receivables135 Questions

Exam 14: Financing Liabilities: Bonds and Long-Term Notes Payable192 Questions

Exam 15: Contributed Capital153 Questions

Exam 17: Advanced Issues in Revenue Recognition103 Questions

Exam 18: Accounting for Income Taxes113 Questions

Exam 19: Accounting for Post-Retirement Benefits94 Questions

Exam 20: Accounting for Leases116 Questions

Exam 21: The Statement of Cash Flows103 Questions

Exam 22: Accounting for Changes and Errors130 Questions

Exam 23: Understanding Time Value of Money Formulas and Concepts142 Questions

Select questions type

Which of the following statements is not true?

Free

(Multiple Choice)

4.8/5  (45)

(45)

Correct Answer:

D

Voluntary payroll deductions may include all of the following except

Free

(Multiple Choice)

4.9/5  (33)

(33)

Correct Answer:

D

Bonus agreements can be structured in various ways. A typical bonus calculation could involve income before or after taxes and income before or after the bonus.

Free

(True/False)

4.8/5  (39)

(39)

Correct Answer:

True

A gain contingency that is reasonably possible and for which the amount can be reasonably estimated should be

(Multiple Choice)

4.8/5  (33)

(33)

Which of the following loss contingencies is not usually accrued?

(Multiple Choice)

4.9/5  (31)

(31)

Management of current liabilities arises, in part, because of a concern over

(Multiple Choice)

4.8/5  (32)

(32)

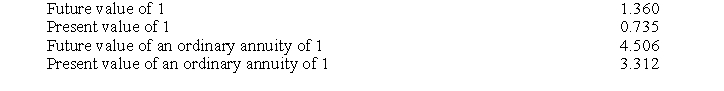

On January 1, 2015, Peg, Inc. bought some equipment by signing a non-interest-bearing note for $160,000. The note is to be paid in four equal annual $40,000 payments, beginning on December 31, 2015. Current interest rates were 8%. The present value and future value information for 8%, 4 periods follows:  Required:

Prepare the journal entries necessary on January 1, 2015, and December 31, 2015.

Required:

Prepare the journal entries necessary on January 1, 2015, and December 31, 2015.

(Essay)

4.8/5  (43)

(43)

Explain the deficiencies in accounting for warranty costs under the modified cash basis.

(Essay)

4.7/5  (35)

(35)

The operating cycle is typically defined as the time it requires to convert

(Multiple Choice)

4.9/5  (46)

(46)

Existing claims related to product warranties and litigation as of December 31, 2016, indicate that it is probable that a liability has been incurred. However, as of December 31, 2016, the amount of the obligation cannot be reasonably estimated. Based on these facts, an estimated loss contingency should be

(Multiple Choice)

4.8/5  (39)

(39)

Excellence, Inc., places a coupon in each box of its product. Customers may send in ten coupons and $2.50, and the company will send them a CD. Sufficient CDs were purchased at $6 a piece to meet the expected demand. A certain number of boxes of product were sold in 2016. It was estimated that a total of 5% of the coupons will be redeemed. In 2016, 18,000 coupons were redeemed. Mailing costs were $0.75 per CD. At December 31, 2016, the following adjusting entry was made to record the estimated liability for premium outstanding:

Premium Expense 25,500

Estimated Premium Claims Outstanding 25,500

Required:

Compute the number of boxes of product sold by Excellence in 2016.

(Essay)

4.8/5  (28)

(28)

Concerning accounting for warranties, which of the following statements is true?

(Multiple Choice)

4.9/5  (42)

(42)

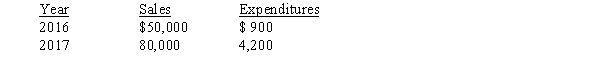

American Business Services introduced a new machine on January 1, 2016. The machine carried a two-year warranty against defects. The estimated warranty costs related to dollar sales were 3% in the year of sale and 5% in the year after sale. Additional information follows: Actual Warranty  If American Business Services considers these warranties to be assurance-type and accounts for them by accruing the expense and the related liability) in the year of the sale, what amount relating to warranties should be reflected on the December 31, 2017, balance sheet?

If American Business Services considers these warranties to be assurance-type and accounts for them by accruing the expense and the related liability) in the year of the sale, what amount relating to warranties should be reflected on the December 31, 2017, balance sheet?

(Multiple Choice)

4.7/5  (32)

(32)

Exhibit 9-1

The Happy Cereal Company includes a premium in each box of its cereal. For four premiums plus $2.00, customers are entitled to a plastic wiggle worm that costs Happy $4.50 each. Happy expects 60% of the premiums to be redeemed. In 2016, Happy sold 500,000 boxes of cereal and distributed 25,000 wiggle worms.

-Refer to Exhibit 9-1. What is Happy's premium expense for 2016?

(Multiple Choice)

4.7/5  (35)

(35)

Unearned revenue also called deferred revenue) can occur when

(Multiple Choice)

4.8/5  (42)

(42)

Current liabilities are obligations of a company that it expects to liquidate within

(Multiple Choice)

4.8/5  (30)

(30)

What are the FASB's broad guidelines for reporting assets, liabilities, and equity on the balance sheet?

(Essay)

4.8/5  (28)

(28)

Showing 1 - 20 of 125

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)