Exam 6: Corporations: Additional Topics and IFRS

Exam 1: Long-Lived Assets263 Questions

Exam 2: Current Liabilities and Payroll191 Questions

Exam 3: Financial Reporting Concepts138 Questions

Exam 4: Accounting for Partnerships171 Questions

Exam 5: Introduction to Corporations210 Questions

Exam 6: Corporations: Additional Topics and IFRS42 Questions

Exam 7: Non-Current Liabilities39 Questions

Exam 8: Investments273 Questions

Exam 9: The Cash Flow Statement169 Questions

Exam 10: Financial Statement Analysis172 Questions

Exam 11: Understanding Interest, Annuities, and Bond Valuation188 Questions

Select questions type

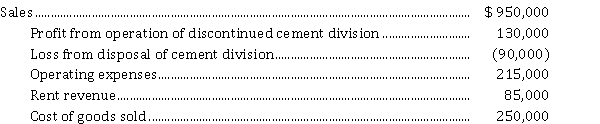

Appier Corporation had the information listed below available in preparing an income statement for the year ended December 31, 2021. All amounts are before income taxes. Assume a 30% income tax rate for all items.  Instructions

Prepare a multiple-step income statement in good form.

Instructions

Prepare a multiple-step income statement in good form.

Free

(Essay)

4.9/5  (30)

(30)

Correct Answer:

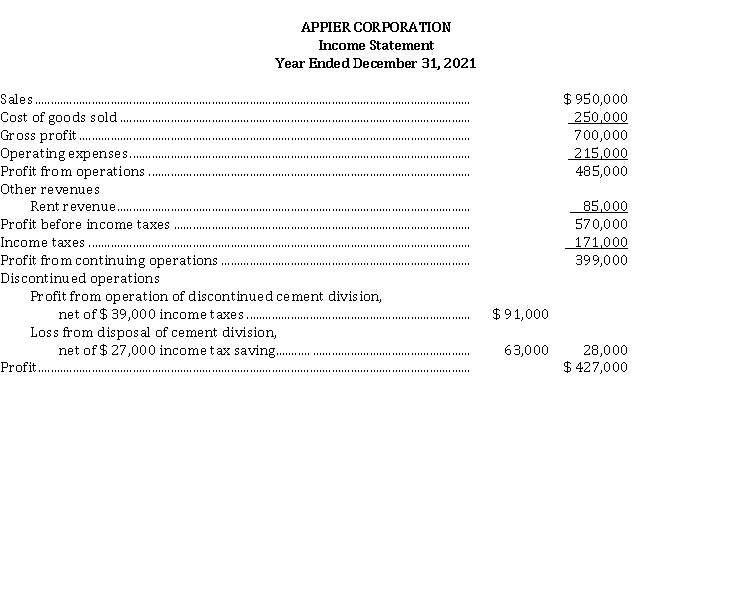

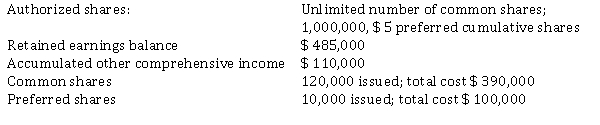

The following accounts appear in the ledger of Niagra Inc. after the books are closed at December 31, 2021:  Instructions

Prepare the shareholders' equity section of the balance sheet at December 31, 2021.

Instructions

Prepare the shareholders' equity section of the balance sheet at December 31, 2021.

Free

(Essay)

4.8/5  (37)

(37)

Correct Answer:

Match the items below by entering the appropriate code letter in the space provided.

Correct Answer:

Premises:

Responses:

Free

(Matching)

4.9/5  (45)

(45)

Correct Answer:

Jasper Corporation is preparing its year-end financial statements and needs your assistance evaluating the following items:

1. When recording the current year depreciation expense, the controller noticed that depreciation expense recorded in the prior year did not consider the residual value into the calculation.

2. Management has decided to change the method used to depreciate the company's equipment from double-declining balance to straight-line method because of a change in the pattern of benefits received from the assets.

3. Management has changed the rate used to calculate the company's estimated warranty liability.

4. After defending a legal dispute relating to its patent, the company reduced the patent's amortization period.

Instructions

a) Analyze each of the four events described above and identify the type of accounting change that has occurred.

b) Indicate whether each event above should be accounted for retrospectively or prospectively.

(Essay)

4.9/5  (33)

(33)

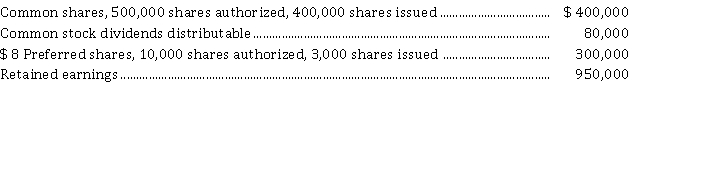

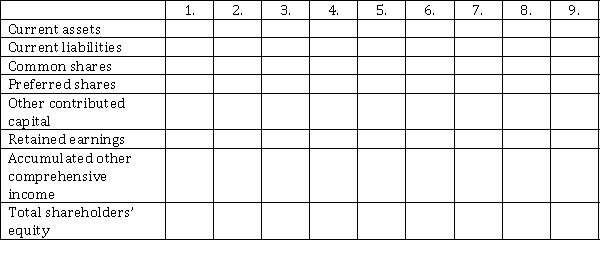

Connolly Corporation had the following events during one fiscal year:

1. A stock dividend is declared on common shares.

2. The stock dividend is distributed.

3. Other comprehensive income for the year totals $ 350,000.

4. Cash dividends are declared.

5. The cash dividends are paid.

6. Profit for the year is $ 1,500,000.

7. Prior year's profit had to be corrected to record additional revenue that had been earned, but which had not yet been paid for by the customer. The additional revenue increases the amount of taxes payable on the prior year's income.

8. Repurchased common shares for an amount less than their average cost.

9. One third of the preferred shares are converted to common shares on a 1:10 ratio.

Instructions

Using the table provided, for each of the following financial statement categories, indicate the effect of the transaction as follows:

The category is increased +

The category is decreased -

There is no effect on the category NE

(Essay)

4.8/5  (39)

(39)

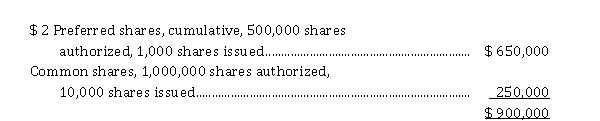

At January 1, 2021, Morrisey Corporation had the following share capital. At that time no preferred dividends were in arrears:  On July 1, 2021, the board of directors declared and paid a $ 1.50 cash dividend on common shares, and the full annual dividend to which the preferred shareholders were entitled. On October 1, 2021, Morrisey sold an additional 80,000 common shares for proceeds of $ 280,000. The corporation earned $ 650,000 during the year.

Instructions

a) Calculate Morrisey's earnings per share for 2021.

b) Calculate Morrisey's total dividend payout ratio for 2021.

On July 1, 2021, the board of directors declared and paid a $ 1.50 cash dividend on common shares, and the full annual dividend to which the preferred shareholders were entitled. On October 1, 2021, Morrisey sold an additional 80,000 common shares for proceeds of $ 280,000. The corporation earned $ 650,000 during the year.

Instructions

a) Calculate Morrisey's earnings per share for 2021.

b) Calculate Morrisey's total dividend payout ratio for 2021.

(Essay)

4.9/5  (32)

(32)

Hanley Corporation is preparing its year-end financial statements and needs your assistance evaluating the following items:

1. Management has decided to switch from FIFO inventory cost flow assumption to weighted average cost formula.

2. It was discovered during the year-end inventory count that the prior year inventory balance reported on the balance sheet incorrectly excluded a lot of inventory received in the warehouse while the year-end count was being performed.

3. Management decided to reduce the remaining useful life of its specialized equipment from 6 years to 4 years to reflect new information that suggests the equipment will be outdated earlier than originally expected.

4. Hanley began bidding on long-term contracts for the first time in the company's history. Management decided to use the percentage of completion method to account for these long-term contracts.

Instructions

a) Analyze each of the four events described above and identify the type of accounting change that has occurred.

b) Indicate whether each event above should be accounted for retrospectively or prospectively.

(Essay)

4.9/5  (22)

(22)

Lee Holdings Ltd. was incorporated on January 2, 2021 and on that date issued 50,000 common shares for cash at $ 1 each. On April 30, Lee issued 1,000 preferred, $ 3 cumulative preferred shares, convertible to common shares at the rate of 6 common shares for one preferred share. The preferred shares were issued for $ 18 each. On October 15, 600 of the preferred shares were converted to common shares. On that date, the market value was $ 1.50 for the common shares and $ 17.50 for the preferred shares. On December 15, 10,000 common shares were reacquired for $ 0.90 each.

Instructions

a) Journalize the share transactions described.

b) Calculate the number of issued shares and average per share amount of each class remaining at the end of the year.

(Essay)

4.8/5  (30)

(30)

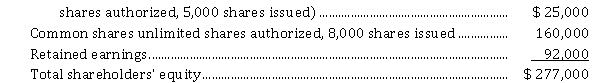

Mana Inc. had the following balances in its shareholders' equity at the beginning of the current year (January 1, 2021):

Preferred shares ($ 1.50, cumulative*, 100,000  *two years of dividends are in arrears.

During the year ended December 31, 2021, the following transactions took place:

1. On January 1, issued 9,000 common shares at $ 18 per share.

2. On July 1, declared a 10% stock dividend on the common shares, market price $ 18.50 per share. The dividend is to be paid on August 15 to shareholders of record on July 31.

3. On August 15, the company paid the stock dividend.

4. On September 15, Ryder's board of directors declared a 4-for-1 stock split.

During the year, the company had a profit of $ 85,000.

Instructions

a) Prepare the journal entries to record the above transactions. Closing entries are not required.

b) Prepare a statement of changes in shareholders' equity for 2021.

c) Prepare the shareholders' equity section of the balance sheet at December 31, 2021.

*two years of dividends are in arrears.

During the year ended December 31, 2021, the following transactions took place:

1. On January 1, issued 9,000 common shares at $ 18 per share.

2. On July 1, declared a 10% stock dividend on the common shares, market price $ 18.50 per share. The dividend is to be paid on August 15 to shareholders of record on July 31.

3. On August 15, the company paid the stock dividend.

4. On September 15, Ryder's board of directors declared a 4-for-1 stock split.

During the year, the company had a profit of $ 85,000.

Instructions

a) Prepare the journal entries to record the above transactions. Closing entries are not required.

b) Prepare a statement of changes in shareholders' equity for 2021.

c) Prepare the shareholders' equity section of the balance sheet at December 31, 2021.

(Essay)

4.8/5  (40)

(40)

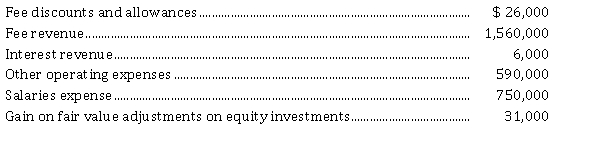

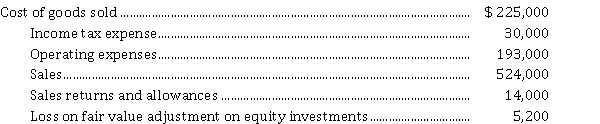

The following information is available from the accounting records of DeWitt Engineering Ltd. for the year ended June 30, 2021:  Instructions

Prepare a combined Statement of Income and Comprehensive Income for the year ended June 30, 2021. The company has a 30% income tax rate and records gains and losses on equity investments as other comprehensive income.

Instructions

Prepare a combined Statement of Income and Comprehensive Income for the year ended June 30, 2021. The company has a 30% income tax rate and records gains and losses on equity investments as other comprehensive income.

(Essay)

4.8/5  (34)

(34)

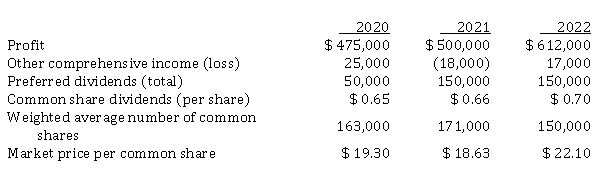

The following information is available for a fictitious Canadian public corporation:  Instructions

For each of the three years, calculate the earnings per share, the price earnings ratio, and the common share dividend payout ratio.

Instructions

For each of the three years, calculate the earnings per share, the price earnings ratio, and the common share dividend payout ratio.

(Essay)

4.8/5  (31)

(31)

The following is information taken from the shareholders' equity section of the projected summary financial statements of Deer Fly Corp. to December 31, 2021, prior to the board of directors' meeting to decide on dividends or other share transactions related to its 10,000 issued common shares for the year.  Instructions

Prepare in three-column comparative format, the shareholders' equity section as it would appear under each of the following possible options that the board is considering. Only one of the options will be chosen, so assume they are mutually exclusive. Describe any additional disclosure that would be required.

a) The board declares a 20% stock dividend.

b) The board approves a 3-for-1 stock split.

Instructions

Prepare in three-column comparative format, the shareholders' equity section as it would appear under each of the following possible options that the board is considering. Only one of the options will be chosen, so assume they are mutually exclusive. Describe any additional disclosure that would be required.

a) The board declares a 20% stock dividend.

b) The board approves a 3-for-1 stock split.

(Essay)

4.7/5  (30)

(30)

Gabrial Ltd. was incorporated February 1, 2021 and is authorized to issue an unlimited number of preferred and common shares. The company entered into the following transactions during the year:

Feb 10 Issued 30,000 common shares for $ 2.30 per share.

Feb 21 Issued 4,000 common shares to the company's accountants as payment for a bill of $ 18,000 for services performed in helping the company to incorporate.

Mar 16 Issued 1,000 preferred shares for $ 95 per share.

Sep 10 Reacquired 3,000 common shares for $ 1.75 per share.

Instructions

Prepare the journal entries to record the above transactions.

(Essay)

4.8/5  (38)

(38)

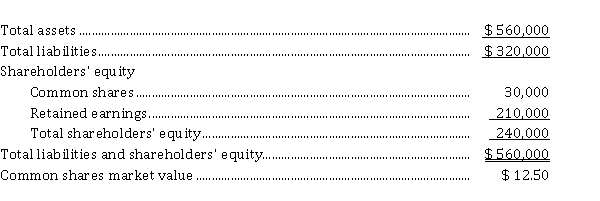

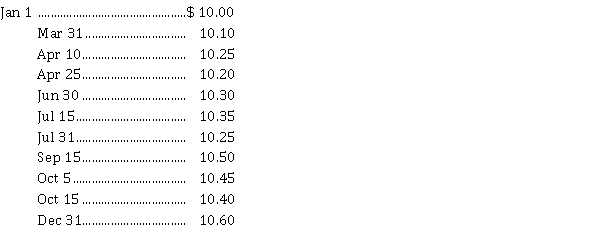

On January 1, 2021, the following information appears in the records of Brown Holdings Inc.:  During the year, the company had the following transactions:

Mar 31 Declared cash dividends on common shares of $ 0.50 per share; payable to shareholders of record on April 10, and payable on April 25.

Jun 30 Declared the entire annual dividend required on preferred shares; payable to shareholders of record on July 15, and payable on July 31.

Sep 15 Declared a 10% stock dividend to shareholders of record on October 5, and distributable on October 15.

All dividends were paid or distributed on the due date.

Market price of Brown's common shares at various dates was as follows:

During the year, the company had the following transactions:

Mar 31 Declared cash dividends on common shares of $ 0.50 per share; payable to shareholders of record on April 10, and payable on April 25.

Jun 30 Declared the entire annual dividend required on preferred shares; payable to shareholders of record on July 15, and payable on July 31.

Sep 15 Declared a 10% stock dividend to shareholders of record on October 5, and distributable on October 15.

All dividends were paid or distributed on the due date.

Market price of Brown's common shares at various dates was as follows:  At December 31, 2021 the accounting records indicate that Brown's profit for 2021 was $ 350,000 and other comprehensive income, consisting of a gain on fair value adjustments on equity investments was $ 28,000.

Instructions

a) Journalize the dividend transactions.

b) Prepare the statement of changes in shareholders equity for the year ended December 31, 2021.

c) Prepare the shareholders' equity section of Brown's balance sheet at December 31, 2021.

At December 31, 2021 the accounting records indicate that Brown's profit for 2021 was $ 350,000 and other comprehensive income, consisting of a gain on fair value adjustments on equity investments was $ 28,000.

Instructions

a) Journalize the dividend transactions.

b) Prepare the statement of changes in shareholders equity for the year ended December 31, 2021.

c) Prepare the shareholders' equity section of Brown's balance sheet at December 31, 2021.

(Essay)

4.7/5  (32)

(32)

During 2021, the following independent events occurred at Sarajavo Corporation on the dates indicated:

1. Sales were understated by $ 145,000 for 2020. This error was discovered on January 20, 2021, when trying to reconcile the accounts receivable balance.

2. On March 31, 2021, Sarajavo Corporation discovered that Depreciation Expense on factory equipment for the year ended December 31, 2020, had been recorded twice, for a total amount of $ 60,000 instead of the correct amount of $ 30,000.

3. On June 30, 2021, Sarajavo Corporation discovered that its 2020 cost of goods sold was overstated by $ 14,500 as a result in counting inventory.

Assume Sarajavo has a 20% income tax rate.

Instructions

Prepare any journal entries required as a result of the information provided.

(Essay)

4.8/5  (39)

(39)

Lake Ltd. was incorporated July 1, 2020. The company is authorized to issue an unlimited number of preferred and common shares. The company entered into the following transactions during its fiscal year ending June 30, 2021:

Jul 10 Issued 100,000 common shares for $ 12.50 per share.

Jul 15 Issued 400,000 common shares for $ 13 per share.

Sep 30 Issued 30,000 common shares in return for a warehouse. The common shares were trading for $ 15.50 on the date the warehouse was acquired. The assessed value of the warehouse on that date was $ 450,600.

Mar 16 Issued 1,000 preferred shares for $ 95 per share.

May 10 Reacquired 65,000 common shares for $ 15 per share.

Instructions

Record the above transactions.

(Essay)

4.9/5  (30)

(30)

At December 31, 2021, Sookie Limited has $ 500,000 of $ 4, cumulative preferred shares issued at $ 100 per share and $ 3,000,000 of common shares issued at $ 10 per share. Sookie's profit for the year is $ 960,000.

Instructions

Calculate earnings per share for 2021 under the following independent situations. (Round to two decimals.)

a) The dividend to preferred shareholders was declared, and there has been no change in the number of common shares during the year.

b) The dividend to preferred shareholders was not declared. The preferred shares are cumulative.

(Essay)

4.7/5  (24)

(24)

For the year ended December 31, 2021, Chess Corporation reported the following information:  Instructions

Prepare the statement of comprehensive income for the year ended December 31, 2021 starting with profit. The company records gains and losses on its equity investments as other comprehensive income and has a 25% income tax rate.

Instructions

Prepare the statement of comprehensive income for the year ended December 31, 2021 starting with profit. The company records gains and losses on its equity investments as other comprehensive income and has a 25% income tax rate.

(Essay)

4.9/5  (31)

(31)

Groom Corporation had profit of $ 415,000 for the year ended December 31, 2021. On January 1, 2021, there were 90,000 common shares issued. Preferred dividends of $ 70,000 were declared and paid during 2021.

Instructions

Calculate the earnings per share for Groom Corporation for the year ended December 31, 2021.

(Essay)

4.8/5  (36)

(36)

The market price of Sanji's Paper Inc.'s common shares was $ 50 per share as quoted in today's Globe and Mail. Earnings per share were $ 5.

Instructions

Calculate the price earnings ratio for Sanji. If the price earnings ratio is high, what can the ratio mean?

(Essay)

4.8/5  (30)

(30)

Showing 1 - 20 of 42

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)