Exam 11: The Income-Expenditure Model

Exam 1: Introduction: What Is Economics?118 Questions

Exam 2: The Key Principles of Economics144 Questions

Exam 3: Exchange and Markets111 Questions

Exam 4: Demand, Supply, and Market Equilibrium172 Questions

Exam 5: Measuring a Nation's Production and Income152 Questions

Exam 6:Unemployment and Inflation155 Questions

Exam 7:The Economy at Full Employment148 Questions

Exam 8: Why Do Economies Grow?167 Questions

Exam 9: Aggregate Demand and Aggregate Supply160 Questions

Exam 10: Fiscal Policy133 Questions

Exam 11: The Income-Expenditure Model193 Questions

Exam 12: Investment and Financial Markets150 Questions

Exam 13: Money and the Banking System170 Questions

Exam 14: The Federal Reserve and Monetary Policy149 Questions

Exam 15: Modern Macroeconomics: From the Short Run to the Long Run152 Questions

Exam 16: The Dynamics of Inflation and Unemployment149 Questions

Exam 17: Macroeconomic Policy Debates147 Questions

Exam 18: International Trade and Public Policy155 Questions

Exam 19: The World of International Finance150 Questions

Select questions type

The tax multiplier is negative because increases in taxes lead to decreases in consumer spending.

Free

(True/False)

4.8/5  (41)

(41)

Correct Answer:

True

Which of the following causes autonomous consumption to decrease?

Free

(Multiple Choice)

4.9/5  (37)

(37)

Correct Answer:

B

Assume that GDP = $10,000 and the MPC = 0.75. If policy makers want to increase GDP by 30 percent, and they want to change taxes and government spending by equal amounts, how much would government spending and taxes each need to increase?

(Multiple Choice)

4.8/5  (25)

(25)

Unlike Classical economists, Keynes believed that the economy could be trapped in a depression and not return to full employment without government intervention.

(True/False)

4.8/5  (37)

(37)

Recall the Application about the impact that home equity values have on consumer spending and wealth to answer the following question(s). From 1997 to mid-2006, housing prices rose nationally by approximately 90 percent and consumer wealth increased by $6.5 trillion, but in the summer of 2006, housing prices began to fall. Home equity is the single largest component of net wealth for most families in the United States, and changes in the value of home equity affect consumer spending.

-According to this Application, what is home equity?

(Multiple Choice)

4.8/5  (34)

(34)

Suppose planned expenditures exceed output. Explain how equilibrium is restored in this economy.

(Essay)

5.0/5  (34)

(34)

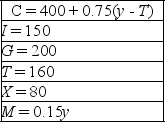

Table 11.1

-Refer to Table 11.1. What is the value of the marginal propensity to save?

-Refer to Table 11.1. What is the value of the marginal propensity to save?

(Multiple Choice)

4.8/5  (35)

(35)

Suppose policy makers want to increase GDP by $450 billion. If the marginal propensity to consume is 0.9, by how much must government spending increase to achieve this target?

(Essay)

4.9/5  (34)

(34)

Suppose the overall MPC is 0.9. If a $2 billion increase in imports to the United States will lead to a $10 billion decrease in GDP, the value of the marginal propensity to import must be

(Multiple Choice)

4.7/5  (34)

(34)

Which of the following shifts the entire consumption function upwards?

(Multiple Choice)

4.9/5  (30)

(30)

Higher tax rates lower the value of the spending multiplier and make the economy more susceptible to shocks.

(True/False)

4.8/5  (25)

(25)

At the equilibrium level of income, the value of consumption is equal to

(Multiple Choice)

4.9/5  (35)

(35)

Why do our political leaders favor exports of U.S. goods and "buy American" policies?

(Essay)

4.8/5  (33)

(33)

Let C = 300 + 0.9y and I = 125. The value of the multiplier is

(Multiple Choice)

4.8/5  (36)

(36)

The aggregate demand curve shows the equilibrium output level at different price levels determined from the income-expenditures model.

(True/False)

4.9/5  (29)

(29)

A movement along the consumption function is the result of a change in

(Multiple Choice)

5.0/5  (41)

(41)

Showing 1 - 20 of 193

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)