Exam 16: Basic Accounting Concepts, Techniques, and Conventions

Exam 1: Managerial Accounting and the Business Organization173 Questions

Exam 2: Introduction to Cost Behavior and Cost Volume Relationships194 Questions

Exam 3: Measurement of Cost Behavior173 Questions

Exam 4: Cost Management Systems and Activity-Based Costing196 Questions

Exam 5: Relevant Information and Decision-Making: Marketing Decisions194 Questions

Exam 6: Relevant Information and Decision-Making: Product Decisions141 Questions

Exam 7: The Master Budget151 Questions

Exam 8: Flexible Budget and Variance Analysis166 Questions

Exam 9: Management Control Systems and Responsibility Accounting184 Questions

Exam 10: Management Control in Decentralized Organizations201 Questions

Exam 11: Capital Budgeting165 Questions

Exam 12: Cost Allocation158 Questions

Exam 13: Job-Costing176 Questions

Exam 14: Process-Costing Systems166 Questions

Exam 15: Overhead Application: Variable and Absorbtion Costing186 Questions

Exam 16: Basic Accounting Concepts, Techniques, and Conventions187 Questions

Exam 17: Understanding Corporate Annual Reports: Basic Financial Statements167 Questions

Select questions type

A gain on the sale of a fixed asset is reported on the statement of cash flows:

(Multiple Choice)

4.7/5  (41)

(41)

The difference between a single and multiple- step income statement is that:

(Multiple Choice)

4.7/5  (38)

(38)

Bing Company reported sales of $180,000, an increase in accounts receivable of $15,000, and a decrease in cash of $20,000. was received from Bing Company's customers.

(Multiple Choice)

4.8/5  (31)

(31)

Listed below are increases (decreases) in selected accounts of Leonardo Company. Accounts receivable \ 20,000 Inventory (40,000) Accounts p ay able 68,000 Wages p ayable (21,000) Net income for Leonardo Company was $42,000. The net cash provided by operating activities was:

(Multiple Choice)

4.7/5  (42)

(42)

When using the direct method, depreciation is added to net income.

(True/False)

4.9/5  (35)

(35)

Navidad Company's income statement included income tax expense of $18,000. Income tax payable at the beginning of the current year was $1,000. Income tax payable at the end of the current year was $4,000. Cash paid for taxes was:

(Multiple Choice)

4.9/5  (38)

(38)

Earnings per share = net income / average number of common and preferred shares outstanding during the year.

(True/False)

4.8/5  (33)

(33)

Investments made by lessee (tenant) that it cannot remove from the premises when the lease expires

(Short Answer)

4.9/5  (33)

(33)

The liabilities of Clare Company are listed below: Accounts payable \ 20,000 First Mortgage bonds payable \ 100,000 Debentures payable \ 80,000 Clare Company liquidated its assets, receiving $150,000 cash. The debenture holders will receive if the debentures are unsubordinated.

(Multiple Choice)

4.8/5  (35)

(35)

Depreciation method that allocates the same cost to each year of an asset's useful life

(Short Answer)

4.7/5  (35)

(35)

When reconciling net income to net cash provided by operating activities, a(n) is a deduction from net income.

(Multiple Choice)

4.7/5  (45)

(45)

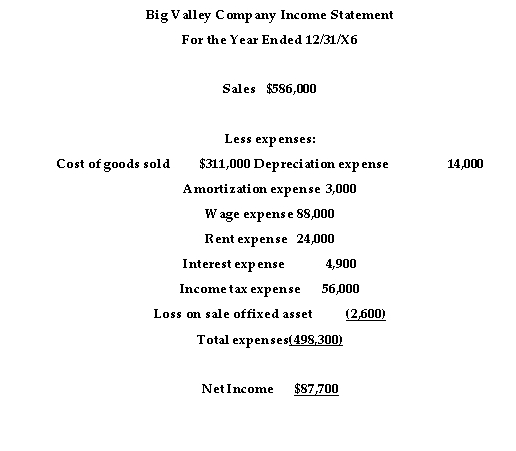

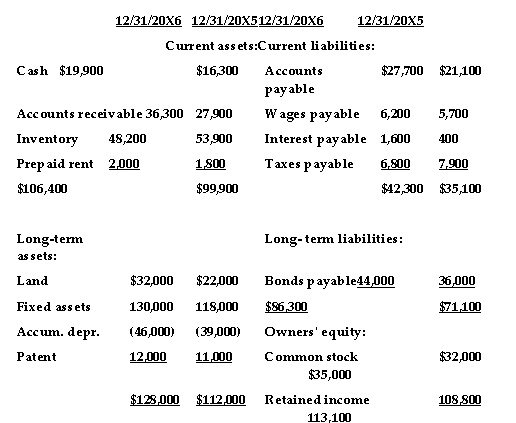

The income statement and comparative balance sheets for Big Valley Company are presented below. Construct a statement of cash flows using the indirect method.

No land was sold in 20X6, and any land purchased was acquired by issuing bonds payable. A fixed asset was sold for $4,100.

No land was sold in 20X6, and any land purchased was acquired by issuing bonds payable. A fixed asset was sold for $4,100.

(Essay)

5.0/5  (38)

(38)

On the books of a corporation, the total amount owed to the company by its customers

(Short Answer)

4.9/5  (38)

(38)

Referring to Tables 16- 1 and 16- 2, the cash paid out for dividends by Silver Company in 20X6 was:

(Multiple Choice)

4.7/5  (38)

(38)

Referring to Tables 16- 1 and 16- 2, the cash collected from the issuance of stock by Silver Company in 20X6 was:

(Multiple Choice)

4.8/5  (31)

(31)

Given the following information for Kings Company, prepare the operating activities section on the statement of cash flows using the direct method as of December 31, 20X5. Sales \8 91,000 Less expenses: Cost of goods sold \ 662,000 Depreciation expens e 16,000 Amortixation expense 3,000 Wage expense 91,000 Rent expense 4,000 Loss on sale of fixed asset 2,000 Interest expense 13,000 Income tax expense 829,000 Net income \6 2,000 Increases (decreases) in selected accounts are indicated below: Cash \2 ,800 Accounts pay able \2 ,400 Accounts 9,200 Wages payable (700) receivable Inventory (5,900) Taxes payable 1,100 Prep aid rent (300)

(Essay)

4.9/5  (35)

(35)

Showing 161 - 180 of 187

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)