Exam 7: Depreciation and Income Taxes

Exam 1: Introduction to Engineering Economy5 Questions

Exam 2: Cost Concepts and Design Economics14 Questions

Exam 3: Cost-Estimation Techniques14 Questions

Exam 4: The Time Value of Money30 Questions

Exam 5: Evaluating a Single Project30 Questions

Exam 6: Comparison and Selection Among Alternatives27 Questions

Exam 7: Depreciation and Income Taxes27 Questions

Exam 8: Price Changes and Exchange Rates15 Questions

Exam 9: Replacement Analysis8 Questions

Exam 10: Evaluating Projects With the Benefitcost Ratio Method10 Questions

Exam 11: Breakeven and Sensitivity Analysis10 Questions

Exam 12: Probabilistic Risk Analysis7 Questions

Exam 13: The Capital Budgeting Process5 Questions

Exam 14: Decision Making Considering Multiattributes5 Questions

Select questions type

Bulldog Shipping, Inc. has purchased new cargo containers for $500,000. MACRS with a

5- year recovery period and an estimated salvage value of $96,000 is to be used to write off the capital investment. The company expects to realize net revenue of $170,000 each year for the next 6 years. Assume an effective federal tax of 38%, state income tax of 10.5% per year, and an after- tax MARR of 13% per year. Calculate the present worth of this investment.

5- year recovery period and an estimated salvage value of $96,000 is to be used to write off the capital investment. The company expects to realize net revenue of $170,000 each year for the next 6 years. Assume an effective federal tax of 38%, state income tax of 10.5% per year, and an after- tax MARR of 13% per year. Calculate the present worth of this investment.

Free

(Short Answer)

4.8/5  (31)

(31)

Correct Answer:

PW = $63,264.58

A coil winding and unwinding machine that costs $32,000 has a life of 9 years with a $4000 salvage value. Use classical straight line depreciation to determine the book value after 7 years.

Free

(Short Answer)

4.9/5  (35)

(35)

Correct Answer:

BV7 = $10,222.23

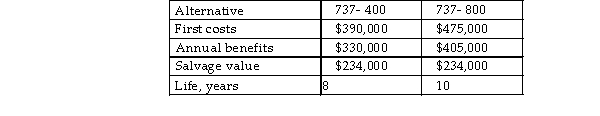

A low- cost airline operating in South Africa is considering adding either Boeing 737- 400 or Boeing 737- 800 to its fleet. The following information is prepared for the economic evaluation. Either aircraft is to be used for 5 years and sold for the estimated salvage value. Assume the double declining balance is used for tax purposes in this country and the airline's before- tax MARR is 6.00% per year and the effective tax rate is 35%. Select a machine on the basis of after- tax present worth analysis.

Free

(Essay)

4.9/5  (35)

(35)

Correct Answer:

PW400 4% = $805,391.27 PW800 4%) = $967,949.71

Select Boeing 737- 800.

A nuclear power plant is planning to replace the outdated equipment with more environmental- friendly equipment. The new equipment has an initial cost of $410,000. The equipment is expected to yield an annual savings of $190,000 each year for the first 4 years and $191,200 each year thereafter. The MACRS with a 15- year recovery period is to be used for tax purposes. Should the equipment be purchased if the equipment will be sold for $148,263.00 at the end of year 10? Assume an effective tax of 38% and a before- tax MARR of 16.13% per year.

(Essay)

4.8/5  (32)

(32)

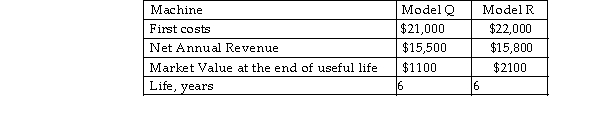

A logistics company is deciding between two models of semi- trailer trucks to add to its fleet. The manager has prepared the following information for the economic evaluation. The new trucks are to be used for 7 years and sold for the estimated salvage value. The before- tax MARR is 16.39% per year and the effective tax rate is 39%. Select a machine on the basis of after- tax annual worth analysis using MACRS with a 5- year recovery period.

(Essay)

4.8/5  (38)

(38)

For depreciation purposes, a 150% declining balance depreciation is used for a material handling lift truck with a cost basis of $23,000 and a salvage value of $6250 at the end of its useful life of 5 years. If the MACRS depreciation method with a 3- year recovery period is used for tax purposes, determine the difference between the annual depreciation after 2 years calculated from both depreciation methods.

(Essay)

4.8/5  (30)

(30)

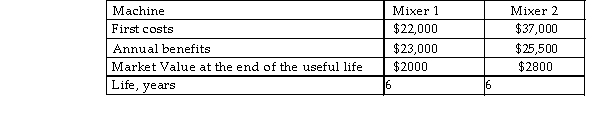

A construction company has an effective income tax rate of 39%. The company must purchase one of the following two cement mixers for its new project. The after- tax MARR is 10% per year. Select a cement mixer on the basis of after- tax present worth analysis using MACRS with a 5- year recovery period.

(Essay)

4.9/5  (37)

(37)

A plantation has purchased an automated propagation system for $26,000. The declining balance depreciation at a rate of 2 times the straight line rate and a $2022 salvage value are used to write off the capital investment. The company expects to realize net revenue of

$8000 each year for the next 5 years. Assume an effective federal tax of 39%, state income tax of 12.25% per year, and an after- tax MARR of 4% per year. Calculate the present worth of this investment.

(Short Answer)

4.8/5  (37)

(37)

A piece of liquid handling equipment that costs $10,000 has a $3000 salvage value. Using MACRS depreciation with a 3- year recovery period, calculate the accumulated annual depreciation at the end of year 3.

(Short Answer)

5.0/5  (34)

(34)

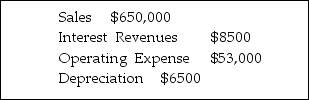

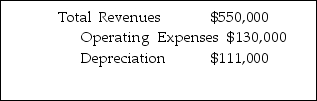

Seminole Lighting, a specialty lamps and specialty light sources manufacturer, had the following information on its annual tax returns. Determine Seminole's taxable income and calculate the federal income tax for the year.

(Short Answer)

4.9/5  (31)

(31)

A petroleum refining and recovery service company, Cowboy Enterprises, purchased

$13,000 worth of equipment for reconditioning fuels in its storage tanks. The equipment has a functional life of 14 years and a salvage value of 5% of the purchased price. Use MACRS depreciation with a 10- year recovery period to determine the book value after 4 years.

(Short Answer)

4.8/5  (38)

(38)

Aggie Research Laboratory purchased a new High Performance Liquid Chromatography HPLC) unit for $39,000. The unit has a functional life of 5 years and a salvage value of 10% of the purchased price. Using declining balance depreciation at a rate of 1.5 times the straight line rate, determine the annual depreciation at the end of year 2.

(Short Answer)

4.8/5  (30)

(30)

An piece of automated assembly equipment has an initial cost of $64,000 and generates net annual benefits of $150,000 per year. The equipment is expected to have zero salvage value at the end of its useful life of 5 years. Using straight- line depreciation, an after- tax MARR of 2%, a federal tax rate of 39%, and a state tax rate of 9%, determine if the investment in this equipment is economically justifiable on the basis of the present worth of the EVA estimates.

(Essay)

4.9/5  (37)

(37)

An engineer- to- order manufacturer is considering purchasing new equipment for its film adhesive assembly. The initial cost of the equipment is $12,100 and annual maintenance costs are estimated to be $185,000 per year. Annual operating costs will be in direct proportion to the hours of use at $12 per hour. The expected annual revenue is $220,000 per year. The equipment has a salvage value of $500 at the end of 5 years. What is the maximum annual hours of use for which the equipment is economically justified? Use straight- line depreciation, an effective tax rate of 39%, and an after- tax MARR of 16% per year.

(Short Answer)

4.8/5  (32)

(32)

A viscosity sensing instrument costs $46,000 and has a $5500 salvage value with a 7- year recovery period. The estimated annual operating cost is $3000 per year. Use classical straight line depreciation to calculate the cumulative depreciation and a book value at the end of year 6.

(Essay)

4.8/5  (47)

(47)

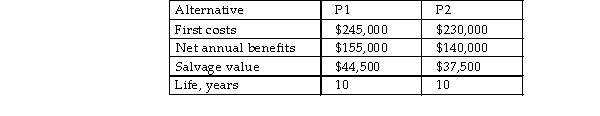

A construction company has an effective income tax rate of 38%. The company must purchase one of the following two models of tower cranes for its new project. The

after- tax MARR is 12% per year. Select a crane on the basis of present worth of the EVA estimates using MACRS with a 5- year recovery period.

(Essay)

4.9/5  (40)

(40)

New spray coating equipment costs $24,000 is to be used in an oversea shipyard. It has a 12- year life and an estimated salvage value of $4750. If the global naval shipbuilding company uses MACRS with an ADS recovery period to calculate the depreciation and book value for the new coating equipment, determine the annual depreciation and book value at the end of year 7.

(Short Answer)

4.8/5  (34)

(34)

Mountaineer Transportation, Inc. had the following information at the end of the year. For an effective federal tax of 38% and state income tax of 7.5% per year, determine the company's BTCF, ATCF, and NOPAT for the year.

(Essay)

4.8/5  (30)

(30)

A $22,000 flow measurement instrument was installed and depreciated for 9 years and was sold for $4500. If the double declining balance method of depreciation is used, determine the difference between the book value and the market value at the end of year 9.

(Short Answer)

4.9/5  (30)

(30)

ADD Systems Corp. reported a gross income of $590,000, and depreciation and expenses total $225,000 for the year. If the state income tax is 6% per year, determine the average federal tax rate and overall effective tax rate.

(Essay)

4.9/5  (32)

(32)

Showing 1 - 20 of 27

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)