Exam 5: Evaluating a Single Project

Exam 1: Introduction to Engineering Economy5 Questions

Exam 2: Cost Concepts and Design Economics14 Questions

Exam 3: Cost-Estimation Techniques14 Questions

Exam 4: The Time Value of Money30 Questions

Exam 5: Evaluating a Single Project30 Questions

Exam 6: Comparison and Selection Among Alternatives27 Questions

Exam 7: Depreciation and Income Taxes27 Questions

Exam 8: Price Changes and Exchange Rates15 Questions

Exam 9: Replacement Analysis8 Questions

Exam 10: Evaluating Projects With the Benefitcost Ratio Method10 Questions

Exam 11: Breakeven and Sensitivity Analysis10 Questions

Exam 12: Probabilistic Risk Analysis7 Questions

Exam 13: The Capital Budgeting Process5 Questions

Exam 14: Decision Making Considering Multiattributes5 Questions

Select questions type

The Bank of Tokyo- Mitsubishi issues 100,000 bonds as part of its liquidity and interest risk management instrument. The bonds have a face value of $36,000 each, a bond interest rate of 12% per year payable semiannually, and a maturity date of 16 years. The current price of the bond is $69,662. Write the correct equation to determine if this bond should be purchased using the IRR method, assuming an investor has a MARR of 4% per year, compounded quarterly.

Free

(Essay)

4.8/5  (39)

(39)

Correct Answer:

PW = 69,662 = 36,000 P/F, i*%, 32) + 2160 P/A, i*%, 32)

Shin Satellite Corp. issues 10,000 debenture bonds with a face value of $26,000 each and a bond interest rate of 18% per year payable semiannually. The bonds have a maturity date of 10 years. If the market interest rate is 14% per year, compounded semiannually, what is the present worth of one bond to a person who wants to purchase it and earn the market rate?

Free

(Short Answer)

4.9/5  (40)

(40)

Correct Answer:

$31,508.36

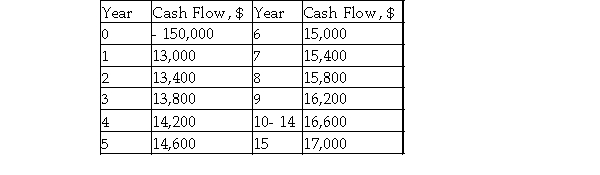

Determine the rate of return of the following cash flow using the ERR method and the reinvestment rate of 4% per year.

Free

(Short Answer)

4.8/5  (35)

(35)

Correct Answer:

i' = 14.77%

Orangemen Lofts plans to add 300 luxury apartments to its complex in Cohoes. The cost of the land now is $16 million including taxes and fees. The construction cost is expected to be $64 million including the cost of the central amenities. The annual maintenance and operating cost is expected to be $450,000. The company also estimates the market value of the property to be 72% of the construction price after 11 years. The average occupancy rate of 88% is expected each year. What is a minimum monthly rent required to make this investment economically acceptable if the company's minimum attractive rate of return is 6% per year, compounded monthly?

(Short Answer)

4.9/5  (36)

(36)

GoBulls Media is considering opening a new manufacturing facility to process and mail coupons to 660,000 households in the Tampa Bay area. The new facility will require an initial investment of $240,000 and an annual operating cost of $22,000. It will have a

$86,500 salvage value after 5 years. Calculate the net present worth of this investment if the company's minimum attractive rate of return is 5% per year, compounded monthly.

(Short Answer)

4.9/5  (31)

(31)

BioPharm Inc. recently acquired Cow Biopharmaceuticals Inc., a producer of antibodies and Cow- HB to prevent Hepatitis B re- infection in liver transplant patients. The company plans to invest $3.5 million in new manufacturing equipment. The Cow Biologics division is expected to generate revenue of $300,000 and operating cost of $330,000 each month.

The new equipment is estimated to have a $700,000 salvage value after 7 years. What is the future worth of this investment if the company's minimum attractive rate of return is 18% per year, compounded monthly.

(Short Answer)

4.9/5  (43)

(43)

Thai Savings Bank issues 100,000 bonds as a response to the Thai Central Bank's initiatives to increase domestic saving. The bonds have a face value of $40,000 each, a bond interest rate of 8% per year payable annually, and a maturity date of 14 years. What is the current price of a bond, if the market interest rate is 9% per year, compounded semiannually?

(Short Answer)

4.9/5  (35)

(35)

A textile manufacturer plans to improve revenue from its heating blankets, sold primarily in the northern areas of the United States by increasing its marketing activities. A total of

$170,000 spent now in marketing is expected to generate new revenue of $400,000 per year. The MARR is 6% per year and the evaluation period is 9 years. Use simple payback analysis to determine the acceptability of the marketing investment.

(Short Answer)

4.7/5  (27)

(27)

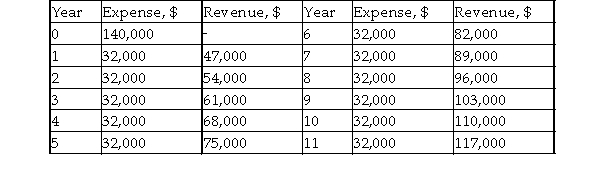

Consider the following cash flow. Determine the annual worth if the minimum attractive rate of return is 9% per year.

(Short Answer)

4.7/5  (33)

(33)

Husker Co., a major drug store chain, plans to spend $35 million in capital investments for its new inventory loss reduction initiative. By upgrading the current inventory tracking system using advanced RFID technology, the company estimates the annual maintenance cost of $210,000. The salvage value of the system at the end of year 13 is expected to be 0.4% of the original investment. What is the minimum annual inventory loss prevention required to make this investment economically acceptable if the company's minimum attractive rate of return is 8% per year.

(Short Answer)

4.9/5  (42)

(42)

Quinn purchases a bond for $29,000 when the market interest rate is 13% per year, compounded semiannually. The bond has an interest rate of 10% per year payable semiannually and a maturity date of 24 years. What is the face value of this bond?

(Short Answer)

5.0/5  (32)

(32)

Sony Corporation has invested $5.6 million in developing super- thin TVs based on new, organic light- emitting diode technology. The company plans to market the OLED TVs in an 11- inch size and produce 24,000 units for the first five years. The annual production and operating cost is estimated at $350 per unit and will be sold at $400 per unit. Determine the internal rate of return for this investment if the study period is five years.

(Short Answer)

4.8/5  (38)

(38)

Oregon Ducks, Inc. is considering buying licenses for 12 megahertz of wireless spectrum in the 700 MHz range, which is suitable for delivering television to mobile phones. The 700 MHz signals can travel long distances and more easily penetrate walls and other obstacles. The acquisition cost is $250 million. In addition, because networks that operate in the 700 MHz range are less expensive to build than those in other portions of the spectrum, Ducks estimates annual costs of $25 million over the next 7 years and no salvage value. During the same period, the company expects to generate annual revenue of $30 million by offering television and video to mobile- phone users. Calculate the net present worth of this investment, and determine the acceptability of the investment if the company's minimum attractive rate of return is 13% per year.

(Essay)

4.9/5  (33)

(33)

Sun Devil Inc. is building two small additions onto its corporate headquarters in Tempe in order to maximize its operating efficiency. The additions, which total 27,000 square feet, will attach to the east and south sides of its existing 66,000- square- foot headquarters. The construction costs are estimated to be $40 per square feet. The company estimates $60,000 per year in fixed costs e.g., maintenance and insurance, etc.) and $3 per square foot in variable costs e.g., utilities, etc.) for the additional facility. The market value of the additions is expected to be 33% of the construction costs at the end of 20 years. Determine the capital recovery cost and the EUAC of the two additions if the minimum attractive rate of return is 4% per year.

(Short Answer)

4.8/5  (34)

(34)

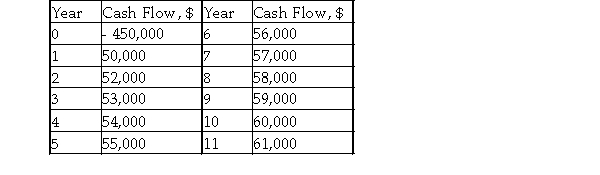

Determine the internal rate of return of the following cash flow.

(Short Answer)

4.8/5  (31)

(31)

Dean bought a $26,000 bond that has interest rate of 8% per year payable semiannually, 3 years ago. The bond has a maturity date of 12 years from the date it was issued. How much should he be able to sell the bond for today, if the current market interest rate is 9% per year, compounded semiannually?

(Short Answer)

4.7/5  (40)

(40)

AmeriTextile Co. is considering opening a production and shipping facility in Dallas to keep up with demand for its pillows. The 105,000- square- foot facility will require an initial investment of $280,000, and an annual operating cost of $26,000. It will have a

$74,500 salvage value after 9 years. Calculate the net present worth of this investment if the company's minimum attractive rate of return is 5% per year.

(Short Answer)

4.8/5  (39)

(39)

Lane College in Jackson, Tennessee, is considering the conversion of an abandoned church pew manufacturing plant adjacent to the school's campus into a 34,000- square- foot building to house the campus bookstore, a conference center, a small business incubator, and a community computer lab. The project requires $30 million for renovation costs, additional annual fixed operating and maintenance expenses of $100,000, and variable expenses of 190 per square- foot over a 10- year period. The college expects to generate an annual revenue of $7,810,000 over a 10- year period. The college uses a MARR of 7 percent per year in its economic evaluations of the new project. The market value of the building will be $2 million at the end of 10 years. Write the correct equation to determine if this building should be renovated using the IRR method.

(Essay)

4.8/5  (29)

(29)

Longhorn Energy is planning a $340 million expansion of two major pipelines in Texas. The Austin- based pipeline company will add 56 miles of 36- inch pipeline and 20,000 horsepower of compression. The expansion will increase the capacity of the Katy pipeline in southeast Texas to more than 1.1 billion cubic feet per day from 700,000 million cubic feet per day. Net revenue per cubic foot is $1.25 and the pipeline is expected to have a resale value of 28 million at the end of year 38. Determine the capital recovery cost of this investment if the minimum attractive rate of return is 14% per year.

(Short Answer)

4.7/5  (41)

(41)

Kenny Pipe & Supply Inc., a wholesale distributor of plumbing supplies, pipe, valves, and fittings, plans to remodel its existing facility in the Birmingham, Alabama, location. The facility will require an initial remodeling cost of $370,000 and a monthly operating and maintenance cost of $30,000. It will have a $66,500 salvage value after 7 years. What is the net present worth of this investment if the company's minimum attractive rate of return is 6% per year, compounded monthly?

(Short Answer)

4.9/5  (30)

(30)

Showing 1 - 20 of 30

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)