Exam 10: Reporting and Analyzing Liabilities

Exam 1: Introduction to Financial Statements218 Questions

Exam 2: A Further Look at Financial Statements238 Questions

Exam 3: The Accounting Information System275 Questions

Exam 4: Accrual Accounting Concepts310 Questions

Exam 5: Merchandising Operations and the Multiple-Step Income Statement261 Questions

Exam 6: Reporting and Analyzing Inventory250 Questions

Exam 7: Fraud, Internal Control, and Cash245 Questions

Exam 8: Reporting and Analyzing Receivables262 Questions

Exam 9: Reporting and Analyzing Long-Lived Assets276 Questions

Exam 10: Reporting and Analyzing Liabilities294 Questions

Exam 11: Reporting and Analyzing Stockholders Equity263 Questions

Exam 12: Statement of Cash Flows216 Questions

Exam 13: Financial Analysis: The Big Picture271 Questions

Exam 14: Time Value of Money295 Questions

Select questions type

Warner Company issued $4,000,000 of 6%, 10-year bonds on one of its interest dates for $3,454,800 to yield an effective annual rate of 8%. The effective-interest method of amortization is to be used. The journal entry on the first interest payment date, to record the payment of interest and amortization of discount will include a

Free

(Multiple Choice)

4.8/5  (34)

(34)

Correct Answer:

C

The higher the sales tax rate, the more profit a retailer can earn.

Free

(True/False)

4.8/5  (35)

(35)

Correct Answer:

False

The market rate of interest is often called the

Free

(Multiple Choice)

4.8/5  (45)

(45)

Correct Answer:

B

Discount on bonds payable may be amortized by the straight-line method if the results obtained by its use do not materially differ from the results obtained by use of the effective-interest method.

(True/False)

4.8/5  (32)

(32)

With an interest-bearing note, the amount of cash received upon issuance of the note generally exceeds the note's face value.

(True/False)

4.8/5  (44)

(44)

Mantle Publications publishes a golf magazine for women. The magazine sells for $4.00 a copy on the newsstand. Yearly subscriptions to the magazine cost $36 per year (12 issues). During December 2013, Expert Publications sells 4,000 copies of the golf magazine at newsstands and receives payment for 6,000 subscriptions for 2014. Financial statements are prepared monthly.

Instructions

(a) Prepare the December 2013 journal entries to record the newsstand sales and subscriptions received.

(b) Prepare the necessary adjusting entry on January 31, 2014. The January 2014 issue has been mailed to subscribers.

(Essay)

4.8/5  (37)

(37)

Material gains or losses on bond redemption are reported as an extraordinary item on the income statement.

(True/False)

4.7/5  (30)

(30)

The contractual interest rate is always equal to the market rate of interest on the date that bonds are issued.

(True/False)

4.8/5  (42)

(42)

The current market value of a bond is equal to the present value of all future cash payments promised by the bond.

(True/False)

4.7/5  (36)

(36)

Which of the following statements best describes the behavior over time of the components of equal mortgage payments?

(Multiple Choice)

4.9/5  (36)

(36)

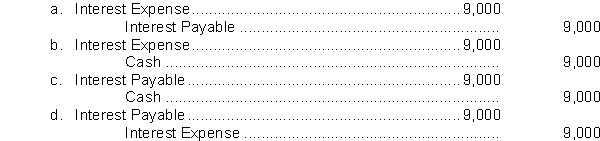

Moss County Bank agrees to lend the Sadowski Brick Company $300,000 on January 1. Sadowski Brick Company signs a $300,000, 6%, 9-month note. What is the adjusting entry required if Sadowski Brick Company prepares financial statements on June 30?

(Short Answer)

4.9/5  (40)

(40)

Grand Company issued $800,000, 10%, 20-year bonds on January 1, 2014, at 104. Interest is payable annually on January 1. Grand uses the straight-line method of amortization and has a calendar year end.

Instructions

Prepare all journal entries made in 2014 related to the bond issue.

(Essay)

4.8/5  (38)

(38)

The following partial amortization schedule is available for Courtney Company who sold $500,000, five-year, 10% bonds on January 1, 2014 for $520,000 and uses annual straight-line amortization.  Which of the following amounts should be shown in cell (i)?

Which of the following amounts should be shown in cell (i)?

(Multiple Choice)

4.7/5  (47)

(47)

When a business sells an item and collects a state sales tax on it, a current liability arises.

(True/False)

4.9/5  (34)

(34)

Interest expense on a note payable is only recorded at maturity.

(True/False)

5.0/5  (36)

(36)

Tina's Boutique has total receipts for the month of $24,255 including sales taxes. If the sales tax rate is 5%, what are Tina's sales for the month?

(Multiple Choice)

4.7/5  (39)

(39)

An installment note calling for equal total payments each period will result in an interest portion that decreases in each successive period.

(True/False)

4.8/5  (37)

(37)

Showing 1 - 20 of 294

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)