Exam 10: Reporting and Analyzing Liabilities

Exam 1: Introduction to Financial Statements218 Questions

Exam 2: A Further Look at Financial Statements238 Questions

Exam 3: The Accounting Information System275 Questions

Exam 4: Accrual Accounting Concepts310 Questions

Exam 5: Merchandising Operations and the Multiple-Step Income Statement261 Questions

Exam 6: Reporting and Analyzing Inventory250 Questions

Exam 7: Fraud, Internal Control, and Cash245 Questions

Exam 8: Reporting and Analyzing Receivables262 Questions

Exam 9: Reporting and Analyzing Long-Lived Assets276 Questions

Exam 10: Reporting and Analyzing Liabilities294 Questions

Exam 11: Reporting and Analyzing Stockholders Equity263 Questions

Exam 12: Statement of Cash Flows216 Questions

Exam 13: Financial Analysis: The Big Picture271 Questions

Exam 14: Time Value of Money295 Questions

Select questions type

Ervay Company has $875,000 of bonds outstanding. The unamortized premium is $12,600. If the company redeemed the bonds at 101, what would be the gain or loss on the redemption?

(Multiple Choice)

4.8/5  (34)

(34)

The relationship between current assets and current liabilities is

(Multiple Choice)

4.9/5  (38)

(38)

Foley Company issued $800,000 of 6%, 5-year bonds at 98, which pays interest annually. Assuming straight-line amortization, what is the total interest cost of the bonds?

(Multiple Choice)

4.9/5  (35)

(35)

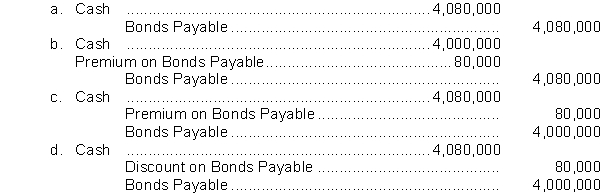

Four thousand bonds with a face value of $1,000 each, are sold at 102. The entry to record the issuance is

(Short Answer)

4.8/5  (40)

(40)

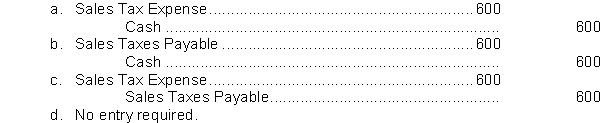

Don's Pharmacy has collected $600 in sales taxes during March. If sales taxes must be remitted to the state government monthly, what entry will Don's Pharmacy make to show the March remittance?

(Short Answer)

4.9/5  (32)

(32)

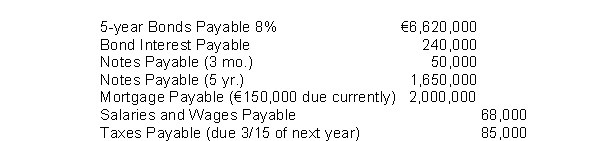

The adjusted trial balance for Beneteau Corporation at the end of the 2014 included the following accounts:  The total non-current liabilities reported on the statement of financial position at December 31, 2014 are

The total non-current liabilities reported on the statement of financial position at December 31, 2014 are

(Multiple Choice)

5.0/5  (41)

(41)

Bonds that are subject to retirement at a stated dollar amount prior to maturity at the option of the issuer are called

(Multiple Choice)

4.9/5  (38)

(38)

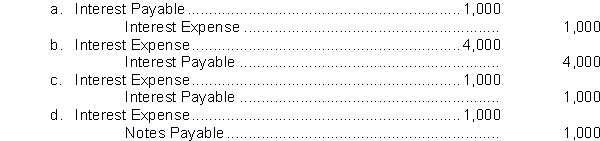

On October 1, Sam's Painting Service borrows $100,000 from National Bank on a 3-month, $100,000, 4% note. What entry must Sam's Painting Service make on December 31 before financial statements are prepared?

(Short Answer)

4.7/5  (39)

(39)

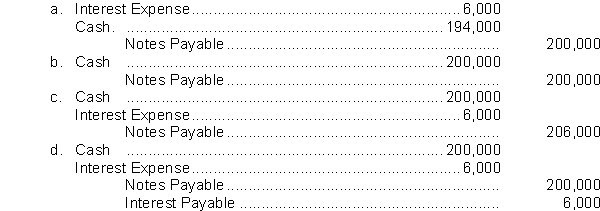

West County Bank agrees to lend Drake Builders Company $200,000 on January 1. Drake Builders Company signs a $200,000, 6%, 6-month note. The entry made by Drake Builders Company on January 1 to record the proceeds and issuance of the note is

(Short Answer)

4.9/5  (41)

(41)

If bonds have been issued at a discount, then over the life of the bonds the

(Multiple Choice)

4.7/5  (34)

(34)

If a retailer sells goods for a total price of $200, which includes a 5% sales tax, the amount of the sales tax is $9.52.

(True/False)

4.8/5  (40)

(40)

The debt to assets ratio measures the percentage of the total assets provided by creditors.

(True/False)

4.8/5  (29)

(29)

Neither corporate bond interest nor dividends are deductible for tax purposes.

(True/False)

4.8/5  (39)

(39)

Thayer Company purchased a building on January 2 by signing a long-term $2,520,000 mortgage with monthly payments of $23,100. The mortgage carries an interest rate of 10 percent. The entry to record the mortgage will include a

(Multiple Choice)

4.9/5  (35)

(35)

A company whose current liabilities exceed its current assets may have a liquidity problem.

(True/False)

4.9/5  (40)

(40)

(Communication)

Susan Jones works for Trend Press, a fairly large book publishing firm. Her best friend and rival, Diane Nilson, works for Lifeline Books, a smaller publisher. Both companies issue $100,000 in bonds on July 1. Trend's bonds were issued at a discount, while Lifeline's were issued at a premium. Diane sent Susan a fax the next day. She told Susan that it was obvious who the better publisher was and the market had shown its preference! She reminded Susan again of her recent increase in salary as further proof of the superiority of Lifeline Books.

Required:

Draft a short note for Susan to send to Diane. Explain how such a result could occur.

(Essay)

4.9/5  (42)

(42)

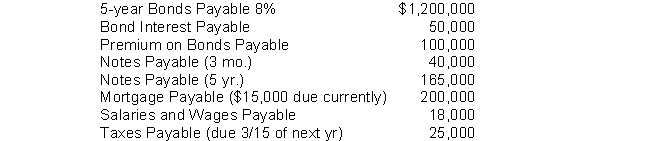

The adjusted trial balance for Hamilton Corp. at the end of the current year, 2014, contained the following accounts.  The total long-term liabilities reported on the balance sheet are

The total long-term liabilities reported on the balance sheet are

(Multiple Choice)

4.8/5  (37)

(37)

If bonds are originally sold at a discount using the straight-line amortization method

(Multiple Choice)

4.7/5  (37)

(37)

Showing 61 - 80 of 294

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)