Exam 1: Introduction to Financial Statements

Exam 1: Introduction to Financial Statements218 Questions

Exam 2: A Further Look at Financial Statements238 Questions

Exam 3: The Accounting Information System275 Questions

Exam 4: Accrual Accounting Concepts310 Questions

Exam 5: Merchandising Operations and the Multiple-Step Income Statement261 Questions

Exam 6: Reporting and Analyzing Inventory250 Questions

Exam 7: Fraud, Internal Control, and Cash245 Questions

Exam 8: Reporting and Analyzing Receivables262 Questions

Exam 9: Reporting and Analyzing Long-Lived Assets276 Questions

Exam 10: Reporting and Analyzing Liabilities294 Questions

Exam 11: Reporting and Analyzing Stockholders Equity263 Questions

Exam 12: Statement of Cash Flows216 Questions

Exam 13: Financial Analysis: The Big Picture271 Questions

Exam 14: Time Value of Money295 Questions

Select questions type

(Ethics)

Joe Laramie owns and operates Joe's Burgers, a small fast food store, located at the edge of City College campus in Newton, Ohio. After several very profitable years, Joe's Burgers began to have problems. Most of the problems were related to Joe's expansion of the eating area in the restaurant without corresponding increases in the food preparation area. Joe does not have the cash or financial backing to expand further. He has therefore decided to sell his business.

William Sheets is interested in purchasing the business. However, he is located in another city and is unfamiliar with Newton. He has asked Joe why he is selling Joe's Burgers. Joe replies that his elderly mother requires extra care, and that his brother needs help in his manufacturing business. Both are true, but neither is his primary reason for selling. Joe reasons that William should not have asked him anyway, since profitable businesses don't come up for sale.

Required:

1. Identify the stakeholders in this situation.

2. Did Joe act ethically in not revealing fully his reasons for selling the business? Why or why not?

(Short Answer)

4.8/5  (42)

(42)

The information needs of a specific user of financial accounting information depends upon the kinds of decisions that user makes. Identify the major users of accounting information and discuss what questions financial accounting information answers for each group of users.

(Short Answer)

4.9/5  (37)

(37)

Why would it be safer for a wealthy individual to set up his or her business as a corporation rather than as a proprietorship or partnership?

(Essay)

4.8/5  (35)

(35)

The heading on the statement of cash flows identifies all of the following except

(Multiple Choice)

4.9/5  (33)

(33)

At September 1, the balance sheet accounts for Kiner's Restaurant were as follows:  The following transactions occurred during the next two days:

Stockholders invested an additional $20,000 cash in the business. The accounts payable were paid in full. (No payment was made on the notes payable.)

Instructions

Prepare a balance sheet at September 3, 2014.

The following transactions occurred during the next two days:

Stockholders invested an additional $20,000 cash in the business. The accounts payable were paid in full. (No payment was made on the notes payable.)

Instructions

Prepare a balance sheet at September 3, 2014.

(Essay)

4.9/5  (40)

(40)

Use the following information to calculate for the year ended December 31, 2014 (a) net income (net loss), (b) ending retained earnings, and (c) total assets.  LO: 4,5, Bloom: AP, Difficulty: Medium, Min: 5, AACSB: Analytic, AICPA BB: Legal/Regulatory Perspective, AICPA FN: Reporting, AICPA PC: Problem Solving, IMA: Reporting

Solution 178 (5 min.)

(a) $6,000 (b) $10,000 (c) $32,000

-Listed below in alphabetical order are the balance sheet items of Nolan Company at December 31, 2014. Prepare a balance sheet and include a complete heading.

LO: 4,5, Bloom: AP, Difficulty: Medium, Min: 5, AACSB: Analytic, AICPA BB: Legal/Regulatory Perspective, AICPA FN: Reporting, AICPA PC: Problem Solving, IMA: Reporting

Solution 178 (5 min.)

(a) $6,000 (b) $10,000 (c) $32,000

-Listed below in alphabetical order are the balance sheet items of Nolan Company at December 31, 2014. Prepare a balance sheet and include a complete heading.

(Essay)

4.8/5  (35)

(35)

What are the advantages to a business of being formed as a corporation? What are the disadvantages?

(Essay)

4.8/5  (33)

(33)

If the retained earnings account increases from the beginning of the year to the end of the year, then

(Multiple Choice)

4.8/5  (41)

(41)

Which of the following is not an advantage of the corporate form of business organization?

(Multiple Choice)

5.0/5  (46)

(46)

The accounting equation can be expressed as Assets - Stockholders' Equity = Liabilities.

(True/False)

4.9/5  (33)

(33)

Elston Company compiled the following financial information as of December 31, 2014:  Elston's assets on December 31, 2014 are

Elston's assets on December 31, 2014 are

(Multiple Choice)

4.9/5  (39)

(39)

Elston Company compiled the following financial information as of December 31, 2014:  Elston's retained earnings on December 31, 2014 are

Elston's retained earnings on December 31, 2014 are

(Multiple Choice)

4.8/5  (36)

(36)

Indicate in the space provided by each item whether it would appear on the income statement (IS), balance sheet (BS), or retained earnings statement (RE):

(Essay)

4.9/5  (35)

(35)

Jackson Company recorded the following cash transactions for the year: Paid $135,000 for salaries.

Paid $60,000 to purchase office equipment.

Paid $15,000 for utilities.

Paid $6,000 in dividends.

Collected $245,000 from customers.

What was Jackson's net cash provided by operating activities?

(Multiple Choice)

4.8/5  (35)

(35)

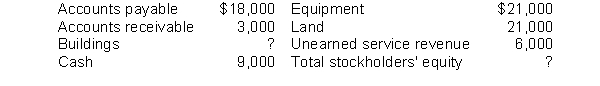

Marvin Services Corporation had the following accounts and balances:  If total stockholder's equity was $57,000, what would be the balance of the Buildings Account?

If total stockholder's equity was $57,000, what would be the balance of the Buildings Account?

(Multiple Choice)

4.9/5  (40)

(40)

One way of stating the accounting equation is: Assets + Liabilities = Stockholders' Equity.

(True/False)

4.7/5  (34)

(34)

A business organized as a separate legal entity owned by stockholders is a partnership.

(True/False)

4.9/5  (35)

(35)

Showing 181 - 200 of 218

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)