Exam 4: Revenue Recognition and the Statement of Income

Exam 1: Overview of Corporate Financial Reporting101 Questions

Exam 2: Analyzing Transaction and Their Effect on Financial Statement74 Questions

Exam 3: Double-Entry Accounting and the Accounting Cycle84 Questions

Exam 4: Revenue Recognition and the Statement of Income78 Questions

Exam 5: The Statement of Cash Flows112 Questions

Exam 6: Cash and Accounts130 Questions

Exam 7: Inventory96 Questions

Exam 8: Long-Term Assets95 Questions

Exam 9: Current Liabilities65 Questions

Exam 10: Long-Term Liabilities100 Questions

Exam 12: Financial Statement Analysis120 Questions

Select questions type

At the time of sale, the selling price does not have to be determined in order for the selling company to quantify the economic benefits of the transactions.

(True/False)

4.8/5  (49)

(49)

In which of the following businesses would the delivery of the product and the collection of cash occur at the same time?

(Multiple Choice)

4.9/5  (33)

(33)

On September 25, Olive Oil Distributors receives an order from DeNarda Italian Supermarkets for 125 cases of extra virgin olive oil. Olive Oil accepts the order, which needs to be delivered to DeNarda's warehouse and DeNarda agrees to pay within 30 days of the receipt of the product. Each case of extra virgin olive oil contains 12 bottles at a selling price of $7.50 each. Olive Oil's cost is $3 / bottle. The shipment is received at DeNarda's warehouse on Oct 2 and DeNarda mails a cheque to Olive Oil at the end of the agreed upon payment terms. Olive Oil Distributors used a contact based approach to revenue recognition.

Instructions

a) Determine if there is a contract between Olive Oil Distributors and DeNarda Italian Supermarkets.

b) If there is a contract, record Olive Oil's entries related to these transactions.

(Essay)

4.9/5  (38)

(38)

Oceans Limited sold $1,750,000 worth of goods during the current year. The cost of goods sold is $1,050,000. Credit sales were $1,575,000, of which 40% were still outstanding. How much cash was collected by Oceans Ltd.?

(Multiple Choice)

5.0/5  (29)

(29)

In retail stores, revenue is normally recognized at the time of sale.

(True/False)

4.9/5  (40)

(40)

For a contract to exist all of the following criteria must be met, except for

(Multiple Choice)

4.8/5  (30)

(30)

How should Magic Mountain account for the corporate tickets not redeemed?

(Multiple Choice)

4.8/5  (46)

(46)

Indicators that control has been transferred to a customer under the contract-based approach include all of the following, except for

(Multiple Choice)

4.8/5  (36)

(36)

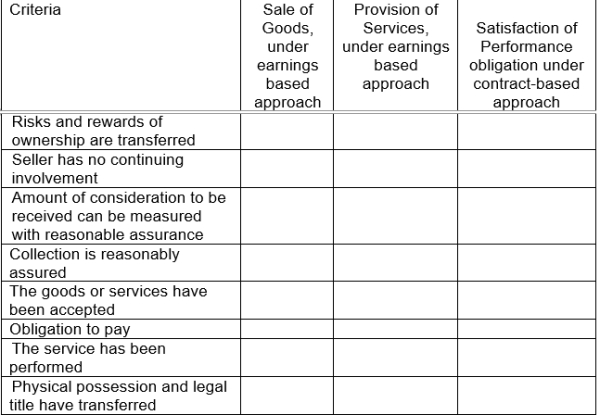

Place an X for each criterion that must be met in order to recognize revenue in each category.

(Short Answer)

4.9/5  (40)

(40)

Under IFRS the contract-based approach must be used for revenue recognition. Identify and describe the five-step model of revenue recognition that must be used.

(Essay)

4.8/5  (42)

(42)

With consignment sales, at the time of the sale to a third party:

(Multiple Choice)

4.7/5  (33)

(33)

All of the following are examples of service revenues except

(Multiple Choice)

4.8/5  (31)

(31)

Buff it Up, a privately held corporation using ASPE, successfully operates two high-end fitness centres in the same town. Members pay a $150 non-refundable initiation fee, and then a one-year membership for unlimited access to the facilities costs an additional $900. They have 3,200 active members. Memberships are required to be paid in full, in three equal monthly instalments over the first 3 months of a membership year. Partial refunds of the annual fees are only given if a member moves more than 50 kilometres away. In addition to the facilities, there is a juice bar that sells fruit smoothies and healthy snacks. Members can sign for their purchases at the juice bar and then they are billed at the end of the month.

Instructions

Discuss when all revenues should be recognized at Buff it Up. Support your discussion with reference to the specific revenue recognition criteria.

(Essay)

4.9/5  (34)

(34)

Which of the following would indicate high quality earnings for a company?

(Multiple Choice)

4.9/5  (40)

(40)

When following ASPE, part of the revenue recognition criteria includes reasonable assurance of collectability of at least some portion of the amount earned.

(True/False)

4.9/5  (32)

(32)

Private companies must report comprehensive income in their financial statements.

(True/False)

5.0/5  (39)

(39)

Showing 41 - 60 of 78

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)