Exam 18: Activity-Based Costing

Exam 1: Introduction to Accounting and Business243 Questions

Exam 2: Analyzing Transactions234 Questions

Exam 3: The Adjusting Process225 Questions

Exam 4: The Accounting Cycle211 Questions

Exam 5: Accounting for Retail Businesses273 Questions

Exam 6: Inventories236 Questions

Exam 7: Internal Control and Cash197 Questions

Exam 8: Receivables210 Questions

Exam 9: Long-Term Assets: Fixed and Intangible243 Questions

Exam 10: Liabilities: Current, Installment Notes, and Contingencies199 Questions

Exam 11: Liabilities: Bonds Payable172 Questions

Exam 12: Corporations: Organization, Stock Transactions, and Dividends221 Questions

Exam 13: Statement of Cash Flows193 Questions

Exam 14: Financial Statement Analysis206 Questions

Exam 15: Introduction to Managerial Accounting244 Questions

Exam 16: Job Order Costing212 Questions

Exam 17: Process Cost Systems196 Questions

Exam 18: Activity-Based Costing109 Questions

Exam 19: Support Department and Joint Cost Allocation172 Questions

Exam 20: Cost-Volume-Profit Analysis247 Questions

Exam 21: Variable Costing for Management Analysis136 Questions

Exam 22: Budgeting197 Questions

Exam 23: Evaluating Variances From Standard Costs172 Questions

Exam 24: Evaluating Decentralized Operations210 Questions

Exam 25: Differential Analysis and Product Pricing157 Questions

Exam 26: Capital Investment Analysis191 Questions

Exam 27: Lean Manufacturing and Activity Analysis134 Questions

Exam 28: The Balanced Scorecard and Corporate Social Responsibility170 Questions

Exam 29: Investments137 Questions

Select questions type

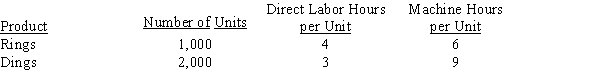

Aleutian Company produces two products: Rings and Dings. They are manufactured in two departments: Fabrication and Assembly. Data for the products and departments are listed below.  All of the machine hours take place in the Fabrication Department, which has estimated total factory overhead of $90,000. All of the labor hours take place in the Assembly Department, which has estimated total factory overhead of $105,000.Aleutian Company uses the multiple production department factory overhead rate method. The Fabrication Department uses machine hours as an allocation base, and the Assembly Department uses direct labor hours.

-All of the following can be used as an allocation base for calculating factory overhead rates except

All of the machine hours take place in the Fabrication Department, which has estimated total factory overhead of $90,000. All of the labor hours take place in the Assembly Department, which has estimated total factory overhead of $105,000.Aleutian Company uses the multiple production department factory overhead rate method. The Fabrication Department uses machine hours as an allocation base, and the Assembly Department uses direct labor hours.

-All of the following can be used as an allocation base for calculating factory overhead rates except

(Multiple Choice)

4.9/5  (36)

(36)

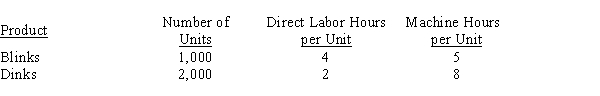

Ramapo Company produces two products, Blinks and Dinks. They are manufactured in two departments, Fabrication and Assembly. Data for the products and departments are listed below.  All of the machine hours take place in the Fabrication Department, which has an estimated overhead of $84,000. All of the labor hours take place in the Assembly Department, which has an estimated total overhead of $72,000.

-Ramapo Company uses a single plantwide overhead rate to apply all factory overhead costs based on direct labor hours. The factory overhead allocated per unit of Blinks is

All of the machine hours take place in the Fabrication Department, which has an estimated overhead of $84,000. All of the labor hours take place in the Assembly Department, which has an estimated total overhead of $72,000.

-Ramapo Company uses a single plantwide overhead rate to apply all factory overhead costs based on direct labor hours. The factory overhead allocated per unit of Blinks is

(Multiple Choice)

4.9/5  (40)

(40)

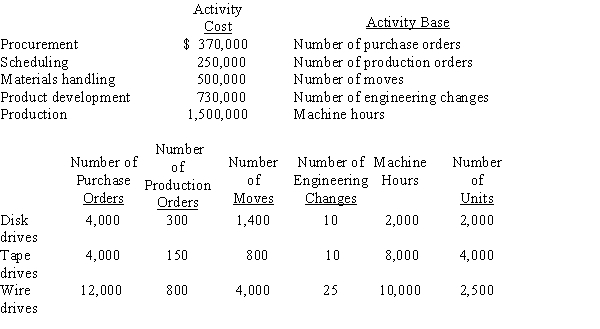

Panamint Systems Corporation is estimating activity costs associated with producing disk drives, tapes drives, and wire drives. The indirect labor can be traced to five separate activity pools. The budgeted activity cost and activity base data by product are provided below.

-The activity rate for the production cost pool is

-The activity rate for the production cost pool is

(Multiple Choice)

4.8/5  (41)

(41)

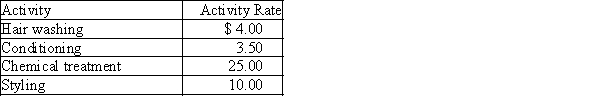

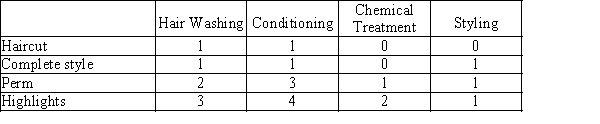

Beauty Beyond Words Salon uses an activity-based costing system to determine the cost of services. The salon has determined the costs of services by activity and activity usage as follows:

-Which of the following is not a way to accomplish an activity cost reduction?

-Which of the following is not a way to accomplish an activity cost reduction?

(Multiple Choice)

4.9/5  (49)

(49)

The single plantwide overhead rate method is very expensive to apply.

(True/False)

4.8/5  (38)

(38)

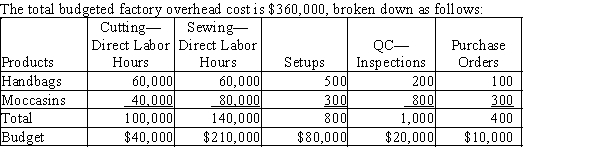

Pikes Peak Leather Company manufactures leather handbags and moccasins. The company has been using the single plantwide factory overhead rate method but has decided to evaluate the activity-based costing method to allocate factory overhead. The factory overhead estimated per unit together with direct materials and direct labor will help determine selling prices.  Determine the amount of factory overhead to be allocated to each unit using activity-based costing. The company plans to produce 60,000 handbags and 40,000 moccasins.

Determine the amount of factory overhead to be allocated to each unit using activity-based costing. The company plans to produce 60,000 handbags and 40,000 moccasins.

(Essay)

4.9/5  (34)

(34)

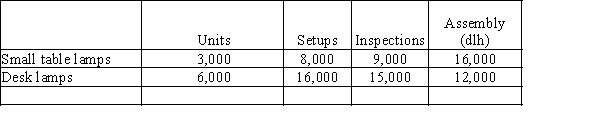

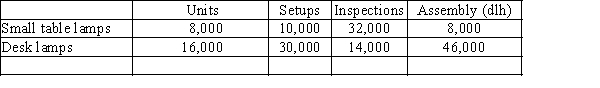

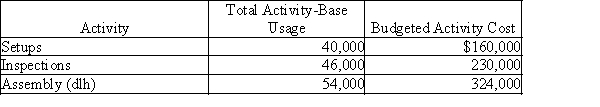

Dawson Company manufactures small table lamps and desk lamps. The following shows the activities per product and the total overhead information:

-The total factory overhead to be allocated to each unit of small table lamps is

-The total factory overhead to be allocated to each unit of small table lamps is

(Multiple Choice)

4.8/5  (42)

(42)

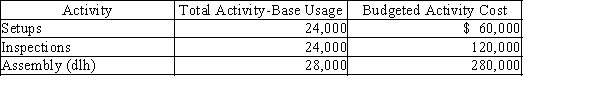

Valhalla Company manufactures small table lamps and desk lamps. The following shows the activities per product:  Using the following information prepared by Valhalla Company, determine (a) the activity rates for each activity and (b) the activity-based factory overhead per unit for each product.

Using the following information prepared by Valhalla Company, determine (a) the activity rates for each activity and (b) the activity-based factory overhead per unit for each product.

(Essay)

4.7/5  (30)

(30)

Use of a plantwide factory overhead rate does not distort product costs when there are differences in the factory overhead rates across different production departments.

(True/False)

5.0/5  (29)

(29)

Showing 101 - 109 of 109

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)