Exam 2: Analyzing Transactions

Exam 1: Introduction to Accounting and Business243 Questions

Exam 2: Analyzing Transactions234 Questions

Exam 3: The Adjusting Process225 Questions

Exam 4: The Accounting Cycle211 Questions

Exam 5: Accounting for Retail Businesses273 Questions

Exam 6: Inventories236 Questions

Exam 7: Internal Control and Cash197 Questions

Exam 8: Receivables210 Questions

Exam 9: Long-Term Assets: Fixed and Intangible243 Questions

Exam 10: Liabilities: Current, Installment Notes, and Contingencies199 Questions

Exam 11: Liabilities: Bonds Payable172 Questions

Exam 12: Corporations: Organization, Stock Transactions, and Dividends221 Questions

Exam 13: Statement of Cash Flows193 Questions

Exam 14: Financial Statement Analysis206 Questions

Exam 15: Introduction to Managerial Accounting244 Questions

Exam 16: Job Order Costing212 Questions

Exam 17: Process Cost Systems196 Questions

Exam 18: Activity-Based Costing109 Questions

Exam 19: Support Department and Joint Cost Allocation172 Questions

Exam 20: Cost-Volume-Profit Analysis247 Questions

Exam 21: Variable Costing for Management Analysis136 Questions

Exam 22: Budgeting197 Questions

Exam 23: Evaluating Variances From Standard Costs172 Questions

Exam 24: Evaluating Decentralized Operations210 Questions

Exam 25: Differential Analysis and Product Pricing157 Questions

Exam 26: Capital Investment Analysis191 Questions

Exam 27: Lean Manufacturing and Activity Analysis134 Questions

Exam 28: The Balanced Scorecard and Corporate Social Responsibility170 Questions

Exam 29: Investments137 Questions

Select questions type

The erroneous arrangement of digits, such as writing $45 as $54, is called a slide.

(True/False)

4.9/5  (30)

(30)

On November 30, the company accountant discovers that $550 of a transaction recording the purchase of office supplies was really office equipment. Prepare the journal entry to correct this situation.

(Essay)

4.8/5  (30)

(30)

The process of transferring the data from the journal to the ledger accounts is called posting.

(True/False)

4.9/5  (32)

(32)

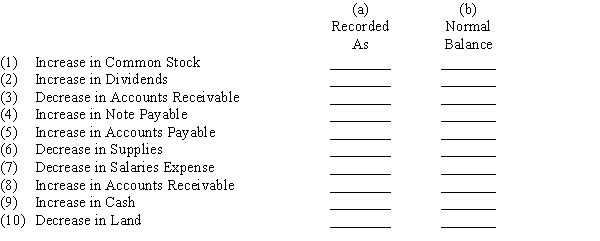

Increases and decreases in various types of accounts are listed below. In each case, indicate by "Dr." or "Cr." (a) whether the change in the account would be recorded as a debit or a credit and (b) whether the normal balance of the account is a debit or a credit.

(Essay)

4.9/5  (42)

(42)

Which of the following is not a correct rule of debits and credits?

(Multiple Choice)

4.9/5  (31)

(31)

For each of the following accounts, indicate whether its normal balance is on the credit side or the debit side of the T account.a.Credit side

b.Debit side

-Interest Revenue

(Short Answer)

5.0/5  (30)

(30)

A notation in the post reference column of the general journal indicates that the amount has been posted to the ledger.

(True/False)

4.8/5  (30)

(30)

The T account got its name because it resembles the letter "T."

(True/False)

4.8/5  (35)

(35)

The post reference notation used in the journal is the page number.

(True/False)

4.9/5  (30)

(30)

Answer the following questions for each of the errors listed below, considered individually:

(a)Did the error cause the trial balance totals to be unequal?

(b)What is the amount of the difference between the trial balance totals (where applicable)?

(c)Which of the trial balance totals, debit or credit, is the larger (where applicable)?

Present your answers in columnar form, using the following headings:

Error

Totals

Difference in Totals

Larger of Totals

(identifying number)(equal or unequal)(amount)(debit or credit)Errors:

(1)A dividend of $3,000 cash to shareholders was recorded by a debit of $3,000 to Salary Expense and a credit of $3,000 to Cash.(2)A $650 purchase of supplies on account was recorded as a debit of $1,650 to Equipment and a credit of $1,650 to Accounts Payable.(3)A purchase of equipment for $3,450 on account was not recorded.(4)A $870 receipt on account was recorded as a $870 debit to Cash and a $780 credit to Accounts Receivable.(5)A payment of $1,530 cash on account was recorded only as a credit to Cash.(6)Cash sales of $8,500 were recorded as a credit of $8,500 to Cash and a credit of $8,500 to Fees Earned.(7)The debit to record a $4,000 cash receipt on account was posted twice; the credit was posted once.(8)The credit to record a $300 cash payment on account was posted twice; the debit was posted once.(9)The debit balance of $7,400 in Accounts Receivable was recorded in the trial balance as a debit of $7,200.

(Essay)

4.8/5  (34)

(34)

Depending on the account title, the right side of the account is referred to as the credit side.

(True/False)

4.8/5  (32)

(32)

For each of the following accounts, indicate whether its normal balance is on the credit side or the debit side of the T account.a.Credit side

b.Debit side

-Accounts Receivable

(Short Answer)

4.8/5  (37)

(37)

Journal entries include both debit and credit accounts for each transaction.

(True/False)

4.8/5  (43)

(43)

The process of transferring the debits and credits from the journal entries to the accounts is called

(Multiple Choice)

4.7/5  (34)

(34)

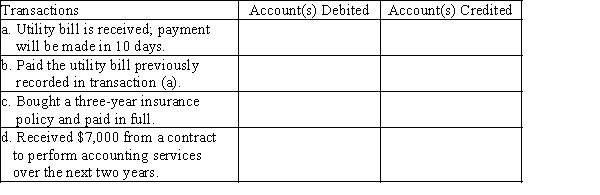

Listed below are accounts to use for transactions (a) through (d), each identified by a number. Following this list are the transactions. You are to indicate for each transaction the accounts that should be debited and credited by placing the account number(s) in the appropriate box.

1.Cash

2.Accounts Receivable

3.Office Supplies

4.Land

5.Interest Receivable

6.Building

7.Truck

8.Equipment

9.Accounts Payable

10.Interest Payable

11.Insurance Payable

12.Utilities Expense

13.Notes Payable

14.Prepaid Insurance

15.Service Revenue

16.Common Stock

17.Insurance Expense

18.Interest Expense

19.Office Supplies Expense

20.Unearned Service Revenue

21.Dividends

(Essay)

4.7/5  (42)

(42)

On January 12, JumpStart Co. purchased $870 in office supplies.

(a) Journalize this transaction as if JumpStart paid cash.

(b) (1) Journalize this transaction as if JumpStart purchased the supplies on account.

(b) (2) On January 18, JumpStart pays the amount due. Journalize this event.

(Essay)

4.8/5  (25)

(25)

Accounts payable are accounts that you expect will be paid to you.

(True/False)

4.8/5  (28)

(28)

Showing 201 - 220 of 234

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)