Exam 11: Long-Term Liabilities: Notes, Bonds, and Leases

Exam 1: Financial Accounting and Its Economic Context104 Questions

Exam 2: The Financial Statements93 Questions

Exam 3: The Measurement Fundamentals of Financial Accounting100 Questions

Exam 4: The Mechanics of Financial Accounting132 Questions

Exam 5: Using Financial Statement Information103 Questions

Exam 6: The Current Asset Classification, Cash, and Accounts Receivable103 Questions

Exam 7: Merchandise Inventory114 Questions

Exam 8: Investments in Equity Securities113 Questions

Exam 9: Long-Lived Assets122 Questions

Exam 10: Introduction to Liabilities: Economic Consequences, Current Liabilities, and Contingencies102 Questions

Exam 11: Long-Term Liabilities: Notes, Bonds, and Leases123 Questions

Exam 13: The Complete Income Statement85 Questions

Exam 14: The Statement of Cash Flows94 Questions

Exam 15: The Time Value of Money45 Questions

Exam 16: Quality of Earnings Cases: A Comprehensive Review15 Questions

Select questions type

On January 1, 2009, Luna Corporation issued a 5-year, 7%, $5,000 bond payable. Beginning in 2010, interest is payable every January 1 over the life of the bond. The market rate of interest on January 1, 2009 is 7%. Luna uses the effective interest method. Calculate the balance sheet value of the bond payable on January 1, 2010.

(Short Answer)

4.8/5  (33)

(33)

Interest expense recognized over the life of an obligation is the difference between cash received at the time of issuance and cash paid over the life of the obligation for

(Multiple Choice)

5.0/5  (35)

(35)

Branson Incorporated is considering leasing equipment. It can either lease the equipment for five or ten years. The five-year lease allows Branson to classify the lease as an operating lease. However, the ten-year lease requires Branson to classify the lease as a capital lease. Branson is operating under a debt covenant that sets a maximum on its debt/equity ratio. If Branson is close to violating this debt covenant, which lease contract would you advise Branson to sign? Why?

(Essay)

4.9/5  (42)

(42)

On January 1, a 6-year, $5,000, non-interest-bearing note payable was issued when the market rate of interest was 8%. The present value of the note is

a. $3,151.

b. $2,080.

c. $865.

d. $5,000.

(Short Answer)

4.9/5  (32)

(32)

Which one of the following is needed in order to find the present value of an obligation?

(Multiple Choice)

4.8/5  (35)

(35)

-On January 1, 2009, Justin Corp. leased equipment under a five-year lease with payments of $20,000 on each December 31 of the lease period. The present value of the lease payments is $77,800, using a market interest rate of 9%. Justin depreciates its equipment straight-line over 5 years with zero salvage value. The capital lease criteria are met. Calculate depreciation expense for 2009.

-On January 1, 2009, Justin Corp. leased equipment under a five-year lease with payments of $20,000 on each December 31 of the lease period. The present value of the lease payments is $77,800, using a market interest rate of 9%. Justin depreciates its equipment straight-line over 5 years with zero salvage value. The capital lease criteria are met. Calculate depreciation expense for 2009.

(Short Answer)

4.8/5  (39)

(39)

The difference in computing the effective interest rate for non-interest-bearing obligations as compared to installment obligations is

(Multiple Choice)

4.9/5  (32)

(32)

A call provision in a bond contract may specify that the issuing company

(Multiple Choice)

4.9/5  (46)

(46)

On January 1, 2009, Field Corporation issued a 3-year, 9%, $5,000 bond payable. Beginning in 2010, interest is payable every January 1 over the life of the bond. The market rate of interest on January 1, 2009 is 6%. What is the impact of the debt/equity ratio as a result of the issuance?

(Essay)

4.8/5  (32)

(32)

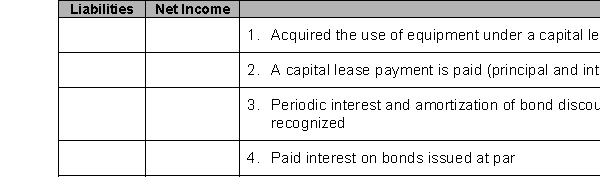

Identify the effect(s) as a result of each transaction listed as 1 through 4 below by placing the letter of the effect on total liabilities and the effect on net income in the two columns provided. Keep in mind that there are currently no accrued expenses recorded on the balance sheet as liabilities.

(Essay)

4.9/5  (40)

(40)

How does the balance between debt and equity in non-U.S. companies compare to the balance of debt and equity in U.S. companies?

(Essay)

4.9/5  (46)

(46)

Which one of the following is not one of the possible kinds of notes?

(Multiple Choice)

4.9/5  (39)

(39)

RJC Company issued $8,000 of 10% bonds on January 1, 2009. The bonds were issued at a premium. The cash payment for annual interest on the bonds

(Multiple Choice)

4.7/5  (43)

(43)

Duncan Industries sold $100,000 of 12 percent bonds on January 1, 2006, when the market interest rate was 10 percent and received $107,732 for them. The bonds mature on January 1, 2011 and pay interest on June 30 and December 31. Duncan uses the effective interest method of amortization. The June 30, 2006 entry will include:

(Multiple Choice)

4.9/5  (45)

(45)

Describe the relationship between the stated rate of interest and the effective rate of interest as it relates to bonds.

(Essay)

4.9/5  (41)

(41)

Showing 21 - 40 of 123

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)