Exam 5: Using Financial Statement Information

Exam 1: Financial Accounting and Its Economic Context104 Questions

Exam 2: The Financial Statements93 Questions

Exam 3: The Measurement Fundamentals of Financial Accounting100 Questions

Exam 4: The Mechanics of Financial Accounting132 Questions

Exam 5: Using Financial Statement Information103 Questions

Exam 6: The Current Asset Classification, Cash, and Accounts Receivable103 Questions

Exam 7: Merchandise Inventory114 Questions

Exam 8: Investments in Equity Securities113 Questions

Exam 9: Long-Lived Assets122 Questions

Exam 10: Introduction to Liabilities: Economic Consequences, Current Liabilities, and Contingencies102 Questions

Exam 11: Long-Term Liabilities: Notes, Bonds, and Leases123 Questions

Exam 13: The Complete Income Statement85 Questions

Exam 14: The Statement of Cash Flows94 Questions

Exam 15: The Time Value of Money45 Questions

Exam 16: Quality of Earnings Cases: A Comprehensive Review15 Questions

Select questions type

Which of the following ratios would be of primary importance to a supplier in deciding to extend credit for goods delivered?

(Multiple Choice)

5.0/5  (29)

(29)

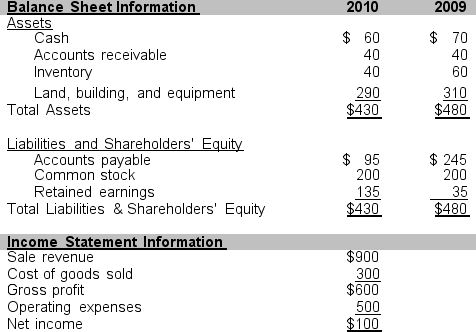

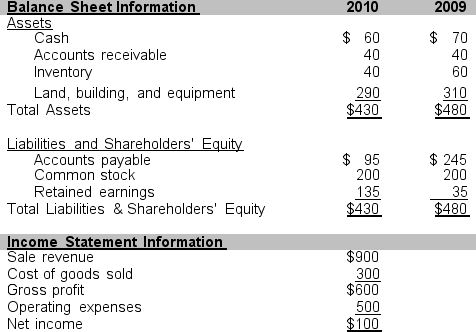

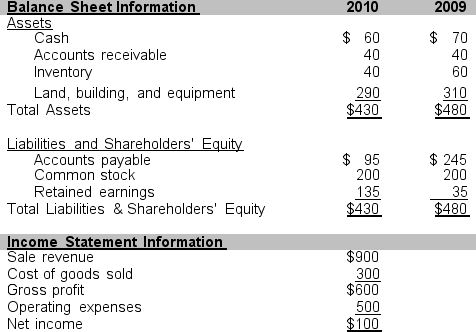

Use the information that follows taken from Carter Company's financial statements for the years ending December 31, 2010 and 2009 to answer problems 3 through 9.

-Washington Company has current assets, current liabilities, and long-term liabilities of $8,000, $2,000, and $5,000, respectively at the end of 2010. How much cash can Washington use to acquire equipment and retain a current ratio of at least 2.0?

-Washington Company has current assets, current liabilities, and long-term liabilities of $8,000, $2,000, and $5,000, respectively at the end of 2010. How much cash can Washington use to acquire equipment and retain a current ratio of at least 2.0?

(Essay)

4.9/5  (35)

(35)

What must an analyst learn first prior to assessing a particular business environment?

(Essay)

4.8/5  (42)

(42)

How does off-balance sheet financing make a company appear less risky?

(Essay)

4.8/5  (39)

(39)

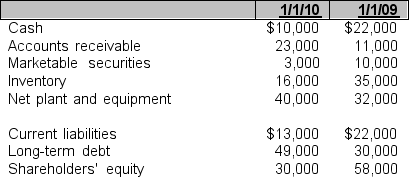

Taylor Company has the following financial data on January 1, 2010 and January 1, 2009.

A. In terms of the quick and current ratio, has the short-term solvency position of Taylor improved, remained the same, or declined?

B. If you were a potential short-term creditor to Taylor, would you be more willing to extend credit on either January 1, 2009 or 2010? Explain.

A. In terms of the quick and current ratio, has the short-term solvency position of Taylor improved, remained the same, or declined?

B. If you were a potential short-term creditor to Taylor, would you be more willing to extend credit on either January 1, 2009 or 2010? Explain.

(Essay)

4.8/5  (28)

(28)

The two fundamental ways in which financial accounting numbers are useful are

(Multiple Choice)

4.9/5  (34)

(34)

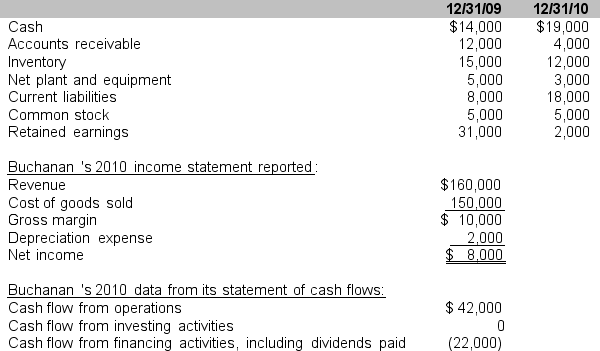

Buchanan Company has the following financial data on December 31, 2010 and 2009:

Required: Using appropriate ratios, comment on the change in Buchanan's solvency position and assess the probable cause of the change from 2009 to 2010.

Required: Using appropriate ratios, comment on the change in Buchanan's solvency position and assess the probable cause of the change from 2009 to 2010.

(Essay)

4.8/5  (28)

(28)

Monroe Company has total assets, liabilities, and shareholders' equity of $30,000, $23,000, and $7,000, respectively. Assume no material change occurred during the year to totals on the balance sheet. What amount of long-term debt must Monroe exchange for new shares of common stock issued in order to decrease its debt/equity ratio to 1.0?

(Essay)

5.0/5  (37)

(37)

Which of the following may be a limitation of financial statements?

(Multiple Choice)

4.8/5  (37)

(37)

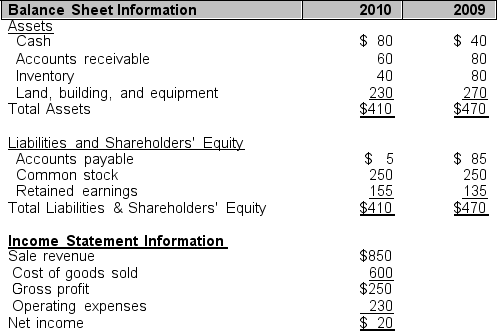

Use the information that follows taken from Tyler Company's financial statements for the years ending December 31, 2010 and 2009 to answer problems 13 through 19.

-The industry in which Tyler is a member has an average accounts receivable turnover of 10 times. How does Tyler compare in 2010? Comment on what information is provided with this calculation and how credit managers might use it to make decisions. Assume all sales were credit sales.

-The industry in which Tyler is a member has an average accounts receivable turnover of 10 times. How does Tyler compare in 2010? Comment on what information is provided with this calculation and how credit managers might use it to make decisions. Assume all sales were credit sales.

(Essay)

4.9/5  (39)

(39)

Devin Inc. has an inventory turnover ratio of 30. Devin's average number of day's inventory is:

(Multiple Choice)

4.8/5  (39)

(39)

Monroe Company has current assets, current liabilities, and long-term liabilities of $12,000, $3,000, and $9,000, respectively. Within these amounts, $1,000 is accounts payable, and $1,500 is accounts receivable. What effect will the payment of the accounts payable have on the current ratio? Should Monroe pay the accounts payable on the last day of the year? Explain.

(Essay)

4.9/5  (32)

(32)

Use the information that follows taken from Carter Company's financial statements for the years ending December 31, 2010 and 2009 to answer problems 3 through 9.

-If the industry in which Carter is a member has an average current ratio of 1.9, determine if, on December 31, 2010, Carter is more or less solvent than the average firm in its industry as measured by its current ratio.

-If the industry in which Carter is a member has an average current ratio of 1.9, determine if, on December 31, 2010, Carter is more or less solvent than the average firm in its industry as measured by its current ratio.

(Essay)

4.8/5  (43)

(43)

Rudy Company has total assets, liabilities, and shareholders' equity of $35,000, $28,000, and $7,000, respectively. Assume no material change occurred during the year to totals on the balance sheet. What amount of long-term debt must Rudy exchange for new shares of common stock issued in order to decrease its debt/equity ratio to 1.0?

a. $17,500

b. $10,500

c. $14,000

d. $21,000

(Essay)

5.0/5  (32)

(32)

Use the information that follows taken from Carter Company's financial statements for the years ending December 31, 2010 and 2009 to answer problems 3 through 9.

-If the industry in which Carter is a member has an inventory turnover of 11 times, determine if in 2010, Carter is more or less efficient at converting inventory into sold units than the average firm in its industry. Explain what information this ratio provides you.

-If the industry in which Carter is a member has an inventory turnover of 11 times, determine if in 2010, Carter is more or less efficient at converting inventory into sold units than the average firm in its industry. Explain what information this ratio provides you.

(Essay)

4.9/5  (40)

(40)

Comment on the following news headline: "Van Buren, Inc. Takes a Bath in Current Year."

(Essay)

4.9/5  (32)

(32)

Showing 21 - 40 of 103

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)