Exam 4: Time Value of Money

Exam 1: An Overview of Financial Management and the Financial Environment46 Questions

Exam 2: Financial Statements, Cash Flow, and Taxes74 Questions

Exam 3: Analysis of Financial Statements103 Questions

Exam 4: Time Value of Money159 Questions

Exam 5: Bonds, Bond Valuation, and Interest Rates100 Questions

Exam 6: Risk, Return, and the Capital Asset Pricing Model137 Questions

Exam 7: Stocks, Stock Valuation, and Stock Market Equilibrium66 Questions

Exam 8: Financial Options and Applications in Corporate Finance26 Questions

Exam 9: The Cost of Capital90 Questions

Exam 10: The Basics of Capital Budgeting: Evaluating Cash Flows104 Questions

Exam 11: Cash Flow Estimation and Risk Analysis70 Questions

Exam 12: Financial Planning and Forecasting Financial Statements47 Questions

Exam 13: Corporate Valuation, Value-Based Management and Corporate Governance24 Questions

Exam 15: Capital Structure Decisions70 Questions

Exam 16: Working Capital Management128 Questions

Exam 17: Multinational Financial Management47 Questions

Exam 18: Lease Financing22 Questions

Exam 19: Hybrid Financing: Preferred Stock, Warrants, and Convertibles30 Questions

Exam 20: Initial Public Offerings, Investment Banking, and Financial Restructuring25 Questions

Exam 21: Mergers, Lbos, Divestitures, and Holding Companies48 Questions

Exam 22: Bankruptcy, Reorganization, and Liquidation10 Questions

Exam 23: Derivatives and Risk Management14 Questions

Exam 24: Portfolio Theory, Asset Pricing Models, and Behavioral Finance31 Questions

Exam 25: Real Options19 Questions

Exam 26: Analysis of Capital Structure Theory31 Questions

Exam 27: Providing and Obtaining Credit35 Questions

Exam 28: Advanced Issues in Cash Management and Inventory Control24 Questions

Exam 29: Pension Plan Management10 Questions

Exam 30: Financial Management in Not-For-Profit Businesses10 Questions

Select questions type

As a result of compounding, the effective annual rate on a bank deposit (or a loan) is always equal to or less than the nominal rate on the deposit (or loan).

(True/False)

4.8/5  (43)

(43)

Suppose United Bank offers to lend you $10,000 for one year at a nominal annual rate of 8.00%, but you must make interest payments at the end of each quarter and then pay off the $10,000 principal amount at the end of the year. What is the effective annual rate on the loan?

(Multiple Choice)

4.8/5  (40)

(40)

You are considering an investment in a Third World bank account that pays a nominal annual rate of 18%, compounded monthly. If you invest $5,000 at the beginning of each month, how many months would it take for your account to grow to $250,000? Round fractional months up.

(Multiple Choice)

4.8/5  (32)

(32)

Starting to invest early for retirement increases the benefits of compound interest.

(True/False)

4.9/5  (29)

(29)

Some of the cash flows shown on a time line can be in the form of annuity payments while others can be uneven amounts.

(True/False)

4.8/5  (43)

(43)

You have a chance to buy an annuity that pays $2,500 at the end of each year for 3 years. You could earn 5.5% on your money in other investments with equal risk. What is the most you should pay for the annuity?

(Multiple Choice)

4.9/5  (37)

(37)

Your aunt is about to retire, and she wants to sell some of her stock and buy an annuity that will provide her with income of $50,000 per year for 30 years, beginning a year from today. The going rate on such annuities is 7.25%. How much would it cost her to buy such an annuity today?

(Multiple Choice)

4.7/5  (39)

(39)

Suppose you are buying your first condo for $145,000, and you will make a $15,000 down payment. You have arranged to finance the remainder with a 30-year, monthly payment, amortized mortgage at a 6.5% nominal interest rate, with the first payment due in one month. What will your monthly payments be?

(Multiple Choice)

4.9/5  (46)

(46)

The greater the number of compounding periods within a year, then (1) the greater the future value of a lump sum investment at Time 0 and (2) the smaller the present value of a given lump sum to be received at some future date.

(True/False)

4.9/5  (45)

(45)

Your child's orthodontist offers you two alternative payment plans. The first plan requires a $4,000 immediate up-front payment. The second plan requires you to make monthly payments of $137.41, payable at the end of each month for 3 years. What nominal annual interest rate is built into the monthly payment plan?

(Multiple Choice)

4.9/5  (41)

(41)

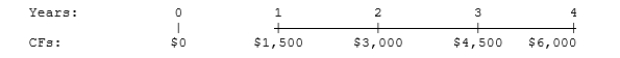

What is the present value of the following cash flow stream at a rate of 12.0%?

(Multiple Choice)

4.7/5  (32)

(32)

As a result of compounding, the effective annual rate on a bank deposit (or a loan) is always equal to or greater than the nominal rate on the deposit (or loan).

(True/False)

4.8/5  (40)

(40)

What's the present value of a 4-year ordinary annuity of $2,250 per year plus an additional $3,000 at the end of Year 4 if the interest rate is 5%?

(Multiple Choice)

4.8/5  (42)

(42)

Your 75-year-old grandmother expects to live for another 15 years. She currently has $1,000,000 of savings, which is invested to earn a guaranteed 5% rate of return. If inflation averages 2% per year, how much can she withdraw (to the nearest dollar) at the beginning of each year and keep the withdrawals constant in real terms, i.e., growing at the same rate as inflation and thus enabling her to maintain a constant standard of living?

(Multiple Choice)

4.7/5  (36)

(36)

How much would $5,000 due in 25 years be worth today if the discount rate were 5.5%?

(Multiple Choice)

4.9/5  (40)

(40)

You just inherited some money, and a broker offers to sell you an annuity that pays $5,000 at the end of each year for 20 years. You could earn 5% on your money in other investments with equal risk. What is the most you should pay for the annuity?

(Multiple Choice)

4.7/5  (26)

(26)

The present value of a future sum increases as either the discount rate or the number of periods per year increases, other things held constant.

(True/False)

4.7/5  (37)

(37)

You want to quit your job and return to school for an MBA degree 3 years from now, and you plan to save $7,000 per year, beginning immediately. You will make 3 deposits in an account that pays 5.2% interest. Under these assumptions, how much will you have 3 years from today?

(Multiple Choice)

4.7/5  (36)

(36)

Showing 121 - 140 of 159

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)